Federal Reserve Chairman Jerome Powell on Thursday in a speech at a meeting Jackson Hole Annual Economic Symposium, announced significant changes in the Fed's inflation strategy, saying it is willing to allow a higher-than-normal rate to support the labor market and the economy in general.

Under this new approach, the Fed will be less inclined to act, even if inflation exceeds 2%, to keep the interest rate at current levels, close to 0% a.a. The increase in interest rates is generally the mechanism that the EDF uses to prevent the inflation rises, and an increase or any signalling in this indentation is all that the market least wants at that time, due to the level of indebtedness of the government and companies.

However, this more relaxed approach to managing price pressure is considered by many to be a dangerous measure, which could mean a stronger increase in US inflation in the long run, penalizing the poorest.

Essentially, the FED is now further increasing the same policies that created today's zombie economy and its distortions.

Although it is a far cry from the type of hyperinflation seen in nations like Venezuela and Lebanon, it does trigger a warning increasing number of investors, making the perception that assets such as Bitcoin and Gold are two of the biggest hedges and reserves of value for that moment.

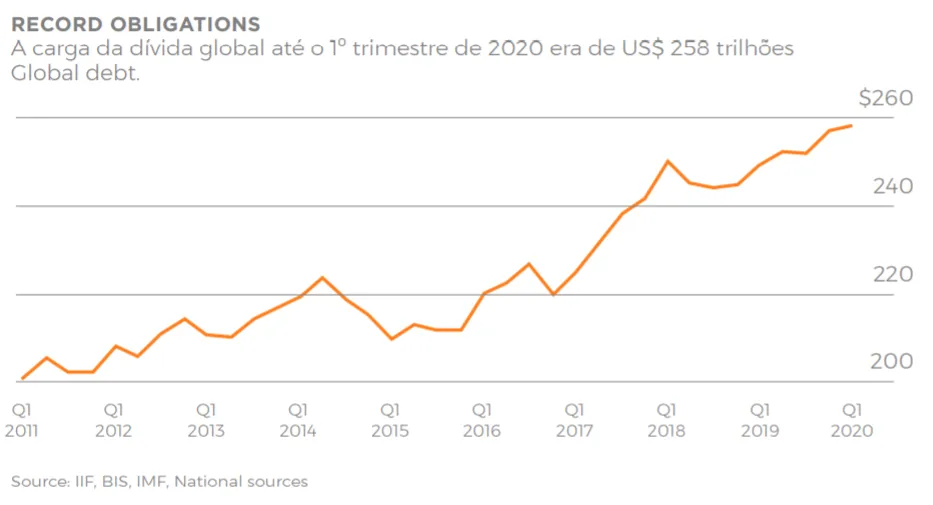

With record amounts in debts and deficits and the number of stimuli seen, what would be the value of money since trillions can be created without a limit? There are indications that much more is yet to come.

Let's analyze the data to understand the current situation.

The latest budget deficit figures for the United States in the second quarter of 2020 have been released and do not look good.

Federal government spending (annual fee) skyrocketed to $9 trillion, while revenues fell to $ 3.5 trillion.

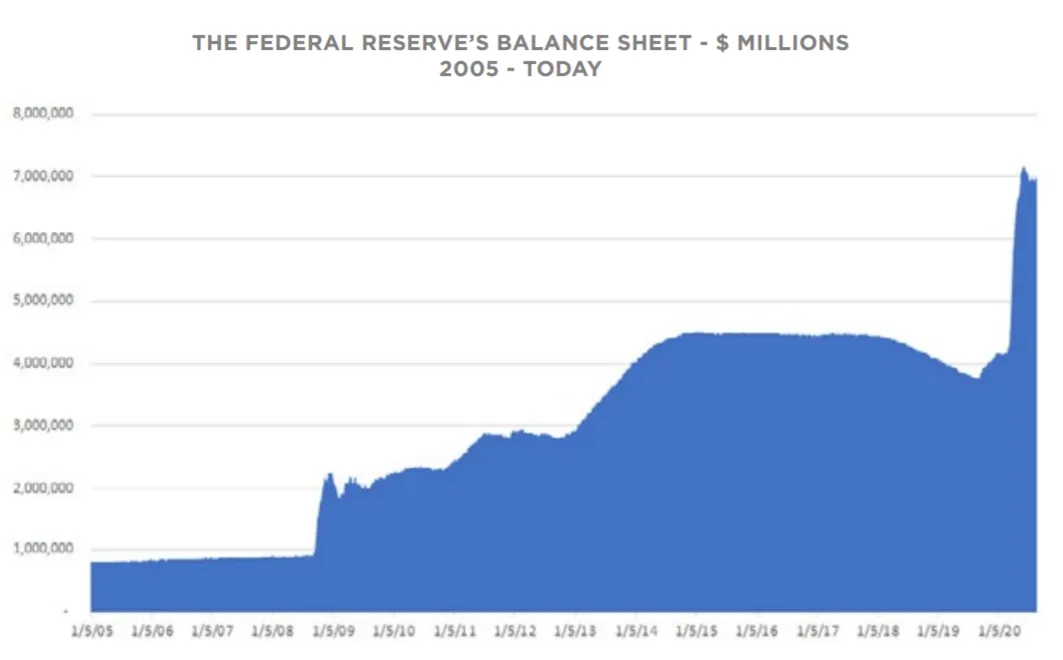

The Federal Reserve's balance sheet is exploding, growing by about $ 3 trillion since mid-March and now totalling more than $ 7 trillion.

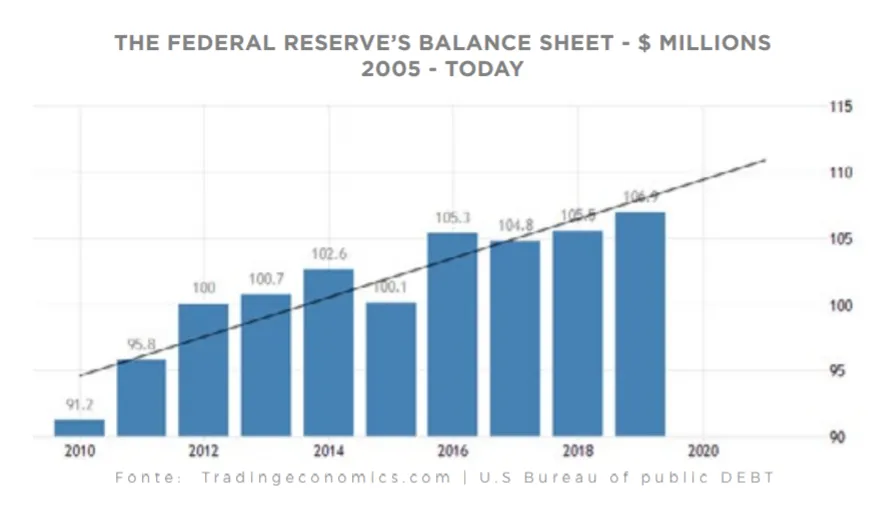

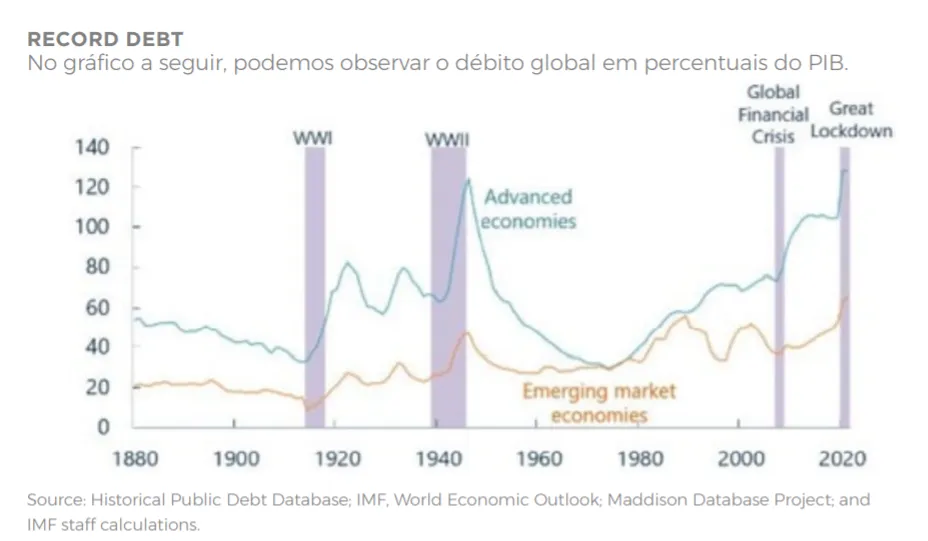

The U.S. government debt recorded the equivalent of 106.90% of the country's Gross Domestic Product in 2019.

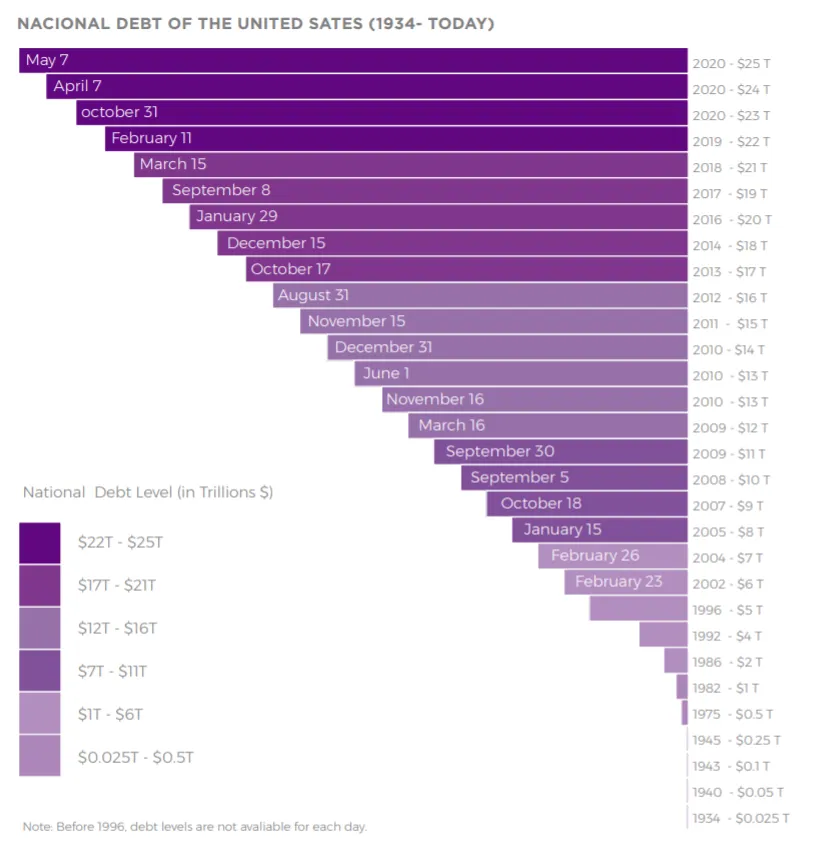

We take this graph to illustrate the current amount of US debt.

The table shows the data for the month of May. Each square represents 1 trillion dollars.

Updating for August, you can add 1 square to the image, since the debt today is $26 trillion.

The United States is not alone in this. Notice how the largest central banks are also expanding their balance sheets and thus increasing their monetary base.

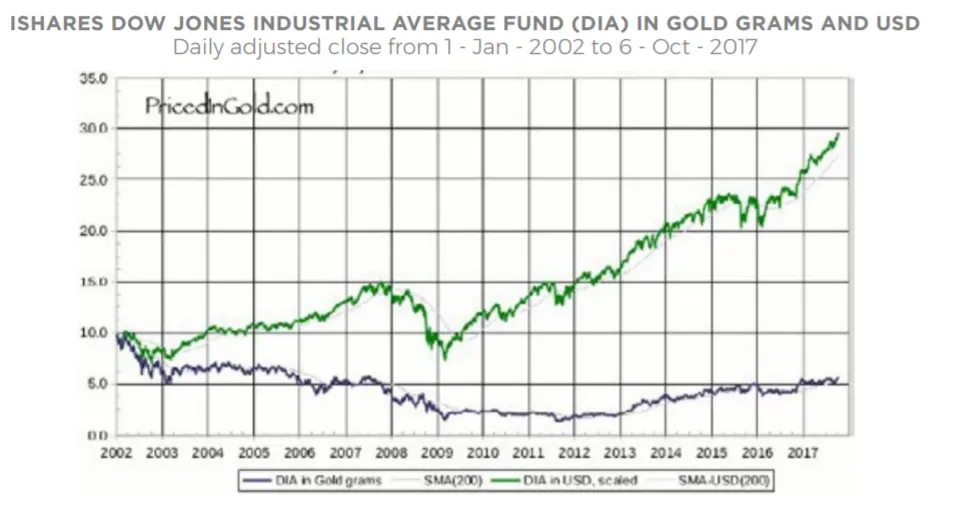

Here is the stock market quoted in dollars versus the quoted in gold. Since rock bottom in March 2009, prices have risen sharply when measured in dollars, seen by many as proof that the recession is over and the recovery has begun to take hold.

However, when priced in gold, we see that the entire "robust recovery" was the result of further depreciation of the dollar, as trillions of dollars created by Quantitative Easing (QE) and bailout programs flooded the market. There is a strong argument that the stock market has not increased in value, but the dollar has depreciated.

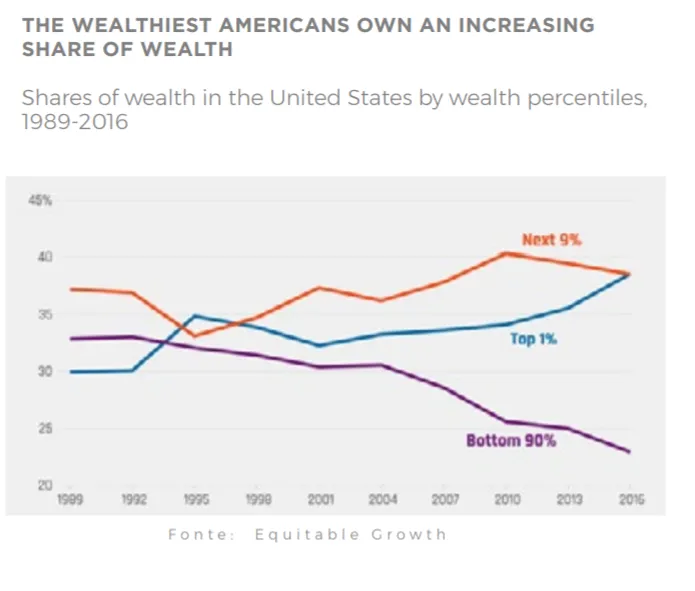

Disparities in wealth have been increasing over time. In 1989, the poorest 90% of the US population held 33% of all wealth.

In 2016, the poorest 90% of the population had only 23% of wealth.

The richest 1% share of wealth has increased from around 30% to about 40% in the same period.

The concentration of political and economic power is enormous, huge companies with a data monopoly and interventionist governments.

The stimulus with floods of liquidity took place in such a magnitude that it astonished even market veterans, such as billionaire investor Paul Tudor Jones.

"We are witnessing the Great Monetary Inflation - an unprecedented expansion of all forms of money, unlike anything the developed world has ever seen."

By his calculations, $ 3.9 trillion in cash, equivalent to 6.6% of global economic output, has been in print since February.

As a macro investor, in doing his analysis of hedge assets against inflation, Jones recognized an important role for Bitcoin.

Billionaire investor Paul Tudor Jones said that Bitcoin resembles gold in the 1970s and may be the best protection against inflation in the coronavirus era.

While people see their money devaluing, without knowing the alternatives to fiat money, Bitcoin is scarce and has great advantages, among which it cannot be printed and manipulated by government policies.

The solution to this is to seek to educate people about how money and the economic system work, as anyone who is aware of concepts such as inflation, scarcity and value reserves will be one step ahead and will benefit from the economic scenarios that arise.

The scenario seems to be becoming more and more prone to Bitcoin and its proposal.