source

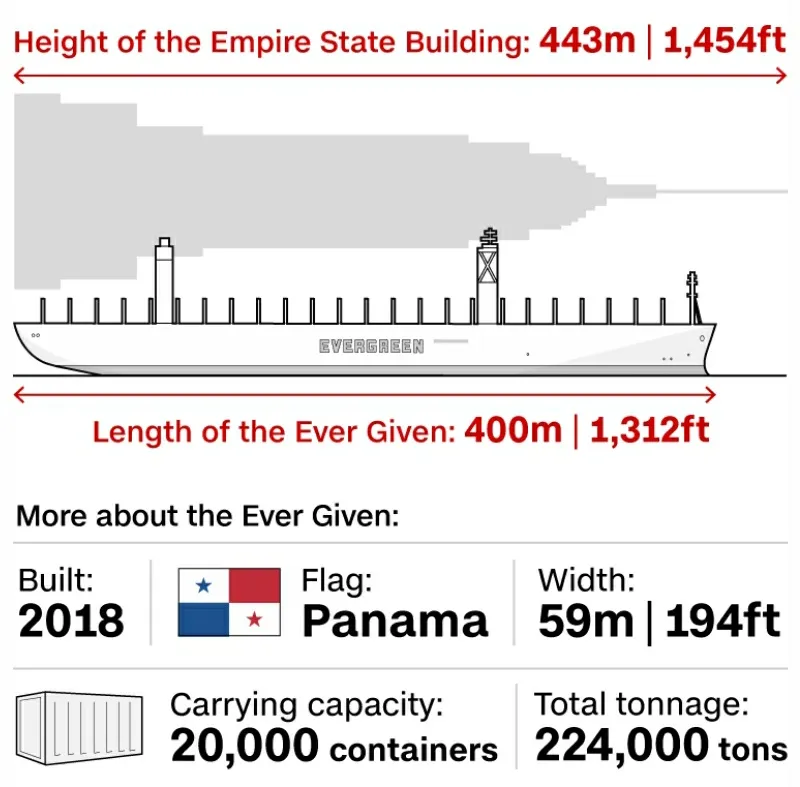

20 000 containers on board that may need to be off loaded.

source

Don't laugh as this is genuinely what is going on.

In the last half hour salvagers gave up for the day as hopes of budging the vessel even a fraction disappeared. The vessel is too heavy and if we compare to something similar played out in Hamburg 5 years ago that vessel took a week to dislodge and they had floating cranes nearby from Rotterdam to assist. Not only that they had a spring tide plus 12 tugs and that vessel was 20 percent smaller than the Ever Given. It also wasn't wedged on both sides and was easier to get to.

Lloyds of London which is the top insurer for vessels in the world put a figure on the catastrophic scenes playing out in the Suez Canal. With ships passing both ways with an average of $9.6 Billion a day in value this puts a total on things and how much is at stake each day that passes. This is going to have a massive knock on effect as each day passes as we move into day 5 tomorrow.

source

Sounds simple enough, but beneath that sand they are dredging and digging is rock. The picture above doesn't tell the full story and why I added the one below. This baby is really and truly beached and reality has to have kicked in that it has to be off loaded.

What is interesting is to look a little deeper on how bad things could become as I think the reality of how bad this is has started to sink in. The 2 days to 1 week thoughts are slowly disappearing as this is no easy fix. The Suez canal may be 300 meters wide but the channel that is used to navigate is not that wide. Why are shipping companies sending ships the long route already if this is only going to be a few days? Surely even if they waited another week it would still be quicker unless they don't believe it will only be 1 week to fix.

source

There is a chain reaction and economic fallout which we are slowly starting to see play out already. Things are serious enough for the US Navy to send out a fleet to see if they can assist as it is looking more and more like a salvage job as every day passes.

source

Firstly concerns over containers running out in the East (China) has resurfaced like it did for two months at the end and beginning of this year. Too many containers on vessels tied up and not enough in ports is the new problem. Every day we can add another 200 vessels joining this ever increasing queue. Less ships being available as longer routes are now being taken sending backlogs at ports from weeks into months.

Things we don't even think about with manufacturers like CAT discussing today that they may have to fly orders out or risk closing down production lines due to too much inventory just sitting creating backlogs. Crazy as it sounds as this company is booming right now but can't get the orders out and is creating one big bottleneck at their factory. Caterpillars share price has seen an upward trend lately and is up 23%.

The longer this goes on the sooner we will start noticing the impact and one fortunate thing is oil consumption has been a lot less during the pandemic so demand is not at it's normal rate as otherwise this would have created price increases. Asia receives roughly 20% of it's supply from the Suez region and lets hope this is resolved very soon.