As a passive income earner this could be a winner as being rewarded in their gas tokens daily VTHO could actually have some true value.

I like to think I have researched my portfolio to the best of my ability but I do still have a wild card that is there as I am just not certain either way. #VET or Ve Chain is my odd one out or the gamble if you look at it that way.

The Ve Chain is designed to support the supply chain and is taking a rather long time to get thigs moving. In 2018 they moved onto their mainnet or VE Chain Thor as it is now known by. In the process they changed thier tokens from the VEN token to the VET token diluting the value by 10x. 1 VEN had the value of 10 VET nd why VET took a tumble in value as basically the number of tokens did a 10 x overnight.

This is the total opposite way of thinking to other crypto projects as they would rather decrease the supply through burns and thus creating value artificially. This is kind of what got me more interested in the project as no one does this unless they are expecting far more partnerships. This is the gamble as what kind of value could be generated?

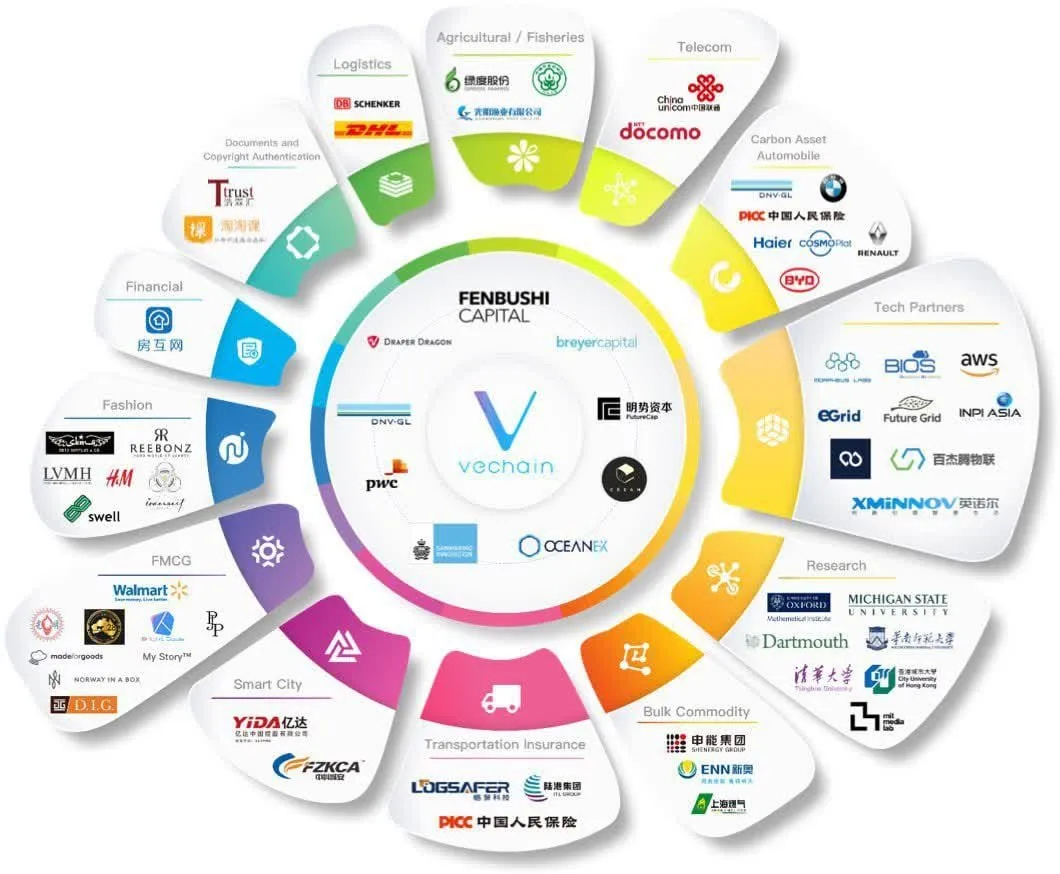

When you look at this list of who is involved it is seriously impressive and one to definitely keep an eye on.

BMW uses the VE Chain to track odometer readings in car sales to prevent odometer fraud. Walmart uses the chain to track the food provenance so they know it's origins. LVMH uses it to track luxury leather goods so there are no imitations or fakes sneaking into the supply chain. These are just a few examples of where and how the Ve Chain can be used and all so different in their uses.

I mentioned before in a previous post where the value will eventually come from and that is the gas token VTHO which is used to pay for the transactions. One has to be holding VET in order to obtain VTHO which is earned every day as a reward for staking. The value comes into effect when more VTHO is burnt than is supplied daily as this is what happens when the gas token is used in transactions. A genuine use case however which is what is the important factor here.

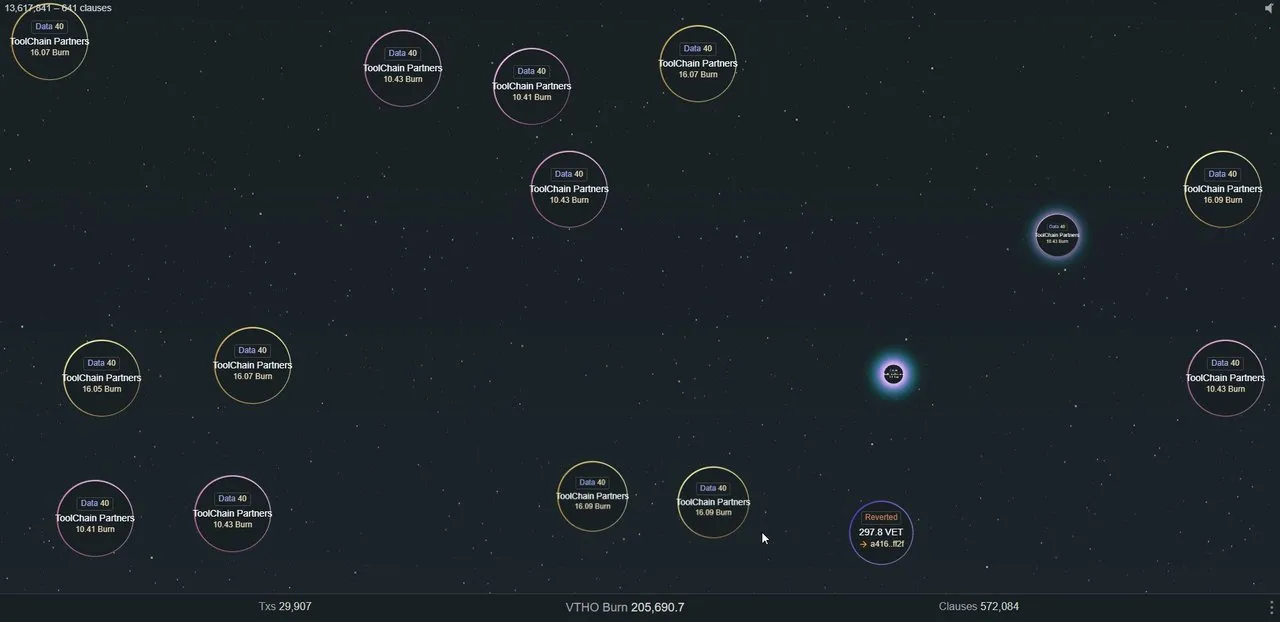

A prime example is how many VTHO tokens Walmart is burning every single day by the number of transactions being processed. In this case they burned 205K for doing just under 30K transactions. This is only one company and there are others like the Norwegian company called DNV. This is a classification company providing services for over 13 000 vessels. There are many we don't even know about who have come on board and partnered with VET.

I was doing some research for my VET investment as have been hunting down the precise figure of how many VTHO are produced daily. This is the important figure and what will eventually increase the value of VET long term.

“VTHO is generated by holding the VET token. There is a fixed number of 87 billion VET tokens which generate VTHO daily at a rate of 0.000432 per VET token. This results in a fixed number of 37,584,000 VTHO tokens generated daily.”

That is a big number of VTHO generated daily as the problem is the 87 billion VET generating the VTHO. This wont be a major factor once companies start adopting the VE Chain as 37 million will be consumed. This has proven VE Chain has a daily use case which is the important factor here and nothing else. Value will be added but the gamble is how long will this take as this I do think is a sure bet for a long term hold. This could easily out do all my other investments as buying VET now whilst it is cheap should pay off within the next 10 years.