A couple of days ago, the 365-day SPS airdrop to Splinterlands asset owners came to an end. This was the main reason why SPT did a 50x at some point and went back down -94% since. So right now, the token is back to mainly offering some use-case inside the splintertalk.io ecosystem and it is also used to buy "Jpeg NFTs" which both are way less valuable to the fact that it provided aidrop points. I would argue that there is also some speculative value again at this point as nothing prevents the devs from giving SPT a more real usecase again that is directly linked to playing the game giving benefits there.

There seem to be quite some buy orders from players that want to pick it up cheap again most likely for the speculative aspect I assume.

SPT Market Caps & Inflation

This is the overall evolution of SPT so far since I started tracking it.

| Date | Price | Market Cap | Supply |

|---|---|---|---|

| 10/02/2021 | 0.00028$ (-) | 19,318 $ | 68,905,727 SPT |

| 22/04/2021 | 0.00031$ (+10.7%) | 23,123 $ | 75,621,474 SPT (+9.74%) |

| 04/08/2021 | 0.00619$ (+2000%) | 460,895 $ | 85,561,680 SPT (+13.14%) |

| 05/09/2021 | 0.01593$ (+257%) | 1,425,000 $ | 89,454,000 SPT (+4.55%) |

| 18/02/2022 | 0.00311$ (-80.5%) | 387,350 $ | 124,550,000 SPT (+39.2%) |

| 28/07/2022 | 0.0010$ (-67.8%) | 152,244 $ | 153,782,658 SPT (+23.5%) |

The overall inflation is still quite big but it is for sure slowing down in percentage as more SPS gets in circulation. I'm not quite sure how much has been burned with the NFT stuff.

Personal Approach

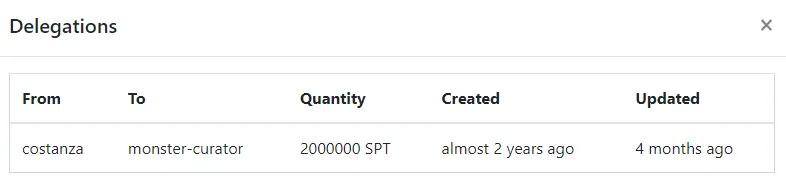

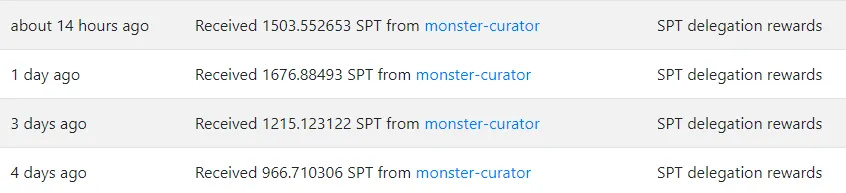

I managed to stack up while SPS was cheap before the Airdrop, got quite some SPS each day thanks to it which most was staked now earning both Vouchers and SPS Rewards. While for sure it would have been better to dump all my SPT at the top (instead of just taking some healthy profit), I don't really mind all too much my overall approach to getting the SPS instead which I'm quite bullish on long-term. As for the SPT itself, I continue holding 2 Million having it delegated to @monster-curator for some passive curation earnings which continue to come in consistently.

Whenever I need some funds for cards or packs, I tend to 'redistribute' (sell) some SPT earnings while keeping my original stack which is diluting my overall holdings due to inflation. I see it as cost-average taking some profit along the way and I intend to keep this approach going forward.

Conclusion

SPT right now seems to have gone back to mostly having speculative Value after a -94% Value drop compared to when the hype was big with the SPS airdrop. I'm happy to hold on to my original rather big stack not expecting anything even though I'm hoping for new real use-cases in the future that will take us for a big ride up again. I would argue that the price now is held up by speculators and my guess would be that it continues trending down slowly the coming months. At some point when SPT feels like it's completely dead and useless, it might become a good enough risk/reward ratio to throw in a couple more 100$ to get my stack back to a higher % of the overall supply in circulation.

Play2Earn Games I'm Playing...

|  |  |

|---|

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using as they allow anonymous betting with no KYC or personal restrictions...

|  |  |  |  |

|---|

|

|

|