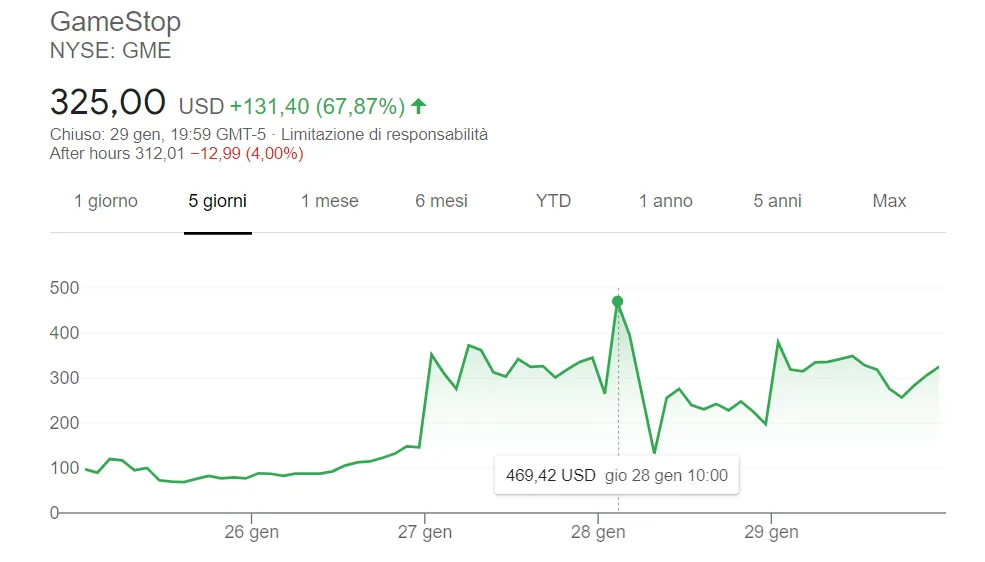

On January 27, a very rare phenomenon occurred on the American stock exchange, namely the incredibly high volatility for a listed title, namely the titles of Game Stop (GME), a well-known video game distribution chain, on the verge of bankruptcy mainly due to the effects negative of the pandemic, suddenly saw frightening swings upwards. The stock had touched a low below $ 70 and the hedge fund had bet on sales, abandoning a declining and no longer profitable stock but here the unthinkable happened.

A popular group on Reddit called WallStreetBets, which has thousands of small private investors, has attempted a real riot by buying GME shares in bulk and causing the price to skyrocket to just below the $ 500 mark, creating a pump of over. 600% in a few hours, a reaction never seen on Wall Street. The price today settles at $ 325, saving the Game Stop company from probable bankruptcy.

Bankruptcy that has affected the Hudge Fund very closely, which has seen profits vanish in this way and has found itself suffering a loss of its investment fund. A financial giant knocked out by a group of young and free investors. How did all this happen in a practical way?

The WSB organized themselves on the Reddit group intent on opposing the guided failure of GameStop and above all intent on giving a moral slap to the financial giants, so cynical about judging companies like GME that has thousands of employees around the world bankruptcy. The action was collective and performed by thousands of users who purchased through the RobinHood platform, a very popular APP in the United States, especially among kids. The platform taught them to enter the financial markets, on their own, without the need for brokers or intermediaries. Accused of making trading a game, Robinhood actually had the merit of expanding a sector that seemed reserved only for professionals.

So with RobinHood, a name that has a non-accidental meaning, the boys bought the shares listed on the Wall Street stock exchange, without being a specialized financial company, but almost for fun it could be said for some special cases. However, in the face of this important movement, the platform had to limit the amount of tradable securities, restricting the trading that it had facilitated so much. He did so with a post on his blog to announce that the changes would be applied to American Airlines, AMC, GameStop and other volatility-prone stocks.

The effect was an inevitable fall in prices but nevertheless closed the week above any higher rosy vision, compared to the opening on Monday 25 January. An example of the struggle for the power of centralization that is slowly spreading to all sectors, such as the social one of Twitter and the Trump case. All this is an optimal terrain for the Hive ecosystem that has always been fighting centralization and free speech and I am sure that in the coming months it will become a great reference point for all those who will be dissatisfied with the increasingly stringent censorship.