Hi friends,

Over the past decade or so, Bitcoin has transitioned from a niche hobby to a globally chased new-age investment product, while simultaneously challenging the concepts and status of traditional currencies. It's offered us a whole new way of thinking about wealth, value storage, and transactions. At the heart of Bitcoin lies a unique and crucial mechanism: the Bitcoin halving. This event, where the rewards for mining new blocks on the Bitcoin network are halved every four years, has been coded into Bitcoin's design from the beginning. Each Bitcoin halving has been accompanied by dramatic market fluctuations and sparked extensive discussions and predictions about Bitcoin's future price trends among crypto enthusiasts.

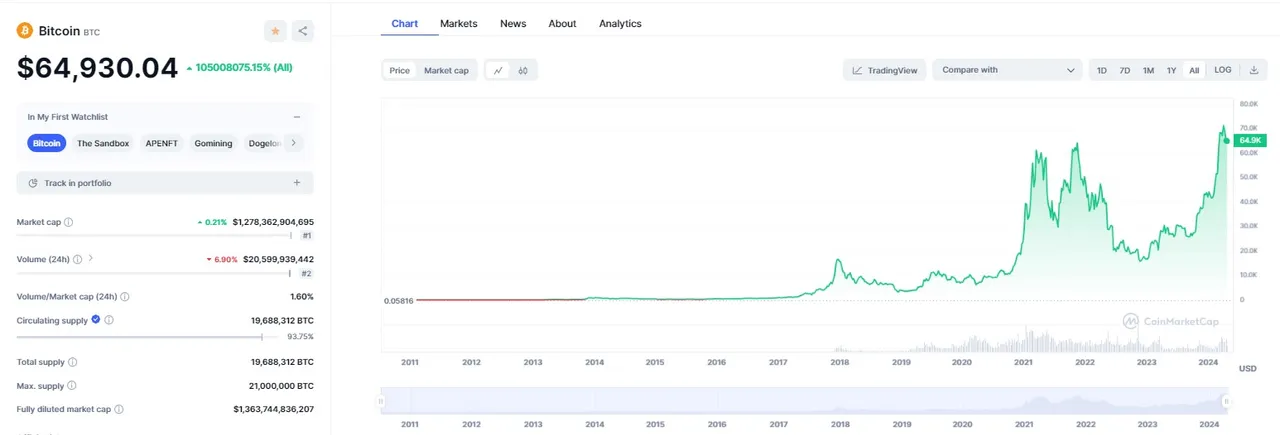

After the fourth Bitcoin halving, miner rewards, i.e., token rewards, will decrease from 6.25 bitcoins per block to 3.125 bitcoins. The halving doesn't change transaction fees, which are determined by users themselves. Bitcoin is currently trading around $65,000, with a recent high of around $73,000. Historically, there's often been a significant price correction before previous halvings, but it hasn't affected the subsequent upward trend in prices. Market expectations for Bitcoin's price in 2025 range from $150,000 to $200,000, as optimism towards the cryptocurrency market prevails. Analyst reports from Bernstein and other institutions further support this optimistic outlook.

Especially since the introduction of Bitcoin ETFs earlier this year, smart money has been entering this market. I'm somewhat skeptical about whether there will be a significant price correction recently. The likelihood of Bitcoin miners selling off due to reduced mining rewards and rising costs has decreased. Everyone expects a wave of price corrections, but with miners holding onto their Bitcoin, and traditional financial institutions waiting to buy at lower prices, the possibility of people selling off Bitcoin seems relatively low. So, the market's potential trajectory is either a steady rise or a substantial increase, with the possibility of occasional declines, perhaps due to regional conflicts or turbulence in traditional financial markets.