Rocky week for markets which get rattled by the new Covid variant - I smell a rat there - was a week for some early bottom fishing and then for staying away. Hive motors ahead with increase in the price making up for paper losses on markets

Portfolio News

In a week where S&P 500 dropped 2.21%, my pension portfolio dropped 3.55%. Selling was broad based but bigger drops in solar power, Japan and Europe, especially financials, than seen in US market index.

News of a new covid variant found in South Africa spooked markets big time. It never helps when news like this hits over the Thanksgiving Day holiday. Those Wall Street desks are manned by inexperienced traders on Friday morning - they panic. The conspiracist in me suggests WHO chose the timing very deliberately.

Futures markets are suggesting there may be a bounce when trading resumes fully on Monday - and that is indeed what happened.

Big movers of the week were Telecom Italia (TIT.MI) (+38.7%), Yooma Wellness (YOOM.CN) (+37.7%), Harvest One Cannabis (HVT.V) (+21.4%). Star Bulk Carriers (SBLK) (+11%)

Telecom Italia

Big move in share price as KKR makes a non-binding bid to take Telecom Italia private.

CEO, Luigi Gubitosi, reigned on Friday to make way for the bid to progress. Indicative bid price is €0.505 which is below my entry point but a whole lot better than things have been looking.

Crypto booms

Bitcoin price tried to consolidate all week but got caught in the selling on Friday finishing the week 8% lower than the open.

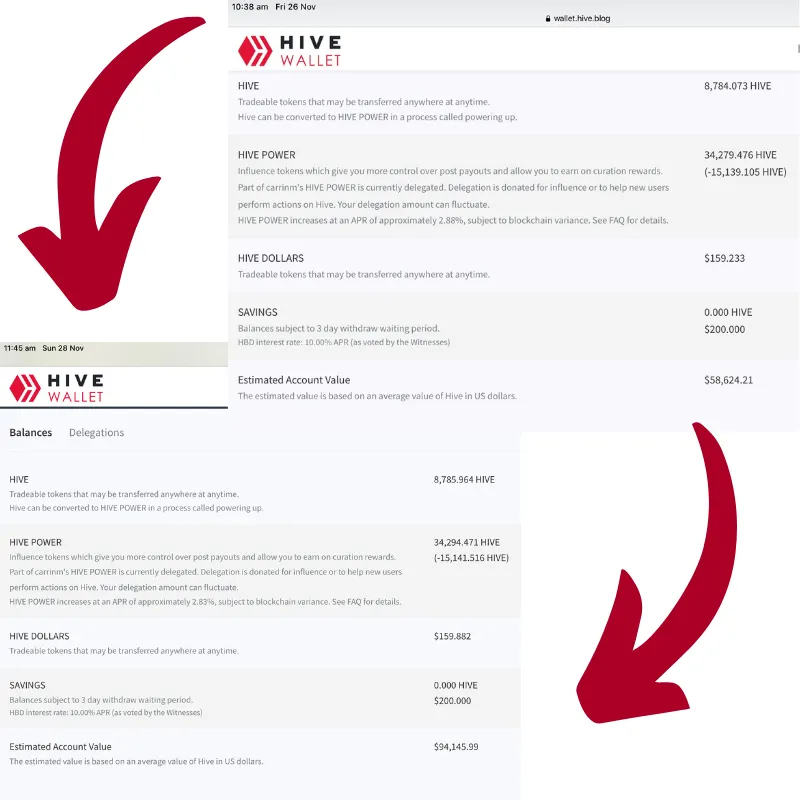

Move of the week was in HIVE racing from $1 through $2 with trough to peak move of 174%

Two snapshots of my HIVE wallet (this info is in the public domain) show that pay to blog works - dates and values highlighted by the arrows

STEEM was not left out - I am still holding some STEEM in an exchange wallet and on Steemit.com.

I have put in a pending order to sell for BTC at the last high - that has not been hit as at the time of writing. This will leave a small parcel on Steemit.com and I will leave that there to collect some curation rewards for Actifit posts.

Bought

Centrica plc (CNA.L): UK Utility. Replaced stock assigned on covered call at 9.5% premium to assigned price. British Gas is well placed to prosper with rising gas prices. I must say stamp duty costs (0.5% on purchases) are turning me off investing in London listed stocks. Sold covered call at 1.9% premium with 6.5% price coverage.

Electricité de France S.A. (EDF.PA): French Utility. Replaced some stock assigned on October covered call at 9% premium to assigned price. I chose to replace ENGIE stock assigned with EDF - change of scene. Sold covered call at 1.0% premium with 4.5% price coverage.

Used a selloff to average down on a few entry prices or to replace stocks assigned in my pension portfolio. With the number of stocks assigned last options expiry, I am holding a fairly large cash pile

Alerian MLP ETF (AMLP): US Oil. Replacing stock assigned at 4.4% discount to price assigned in October

Hecla Mining Company (HL): Silver Mining. Replacing stock assigned at 4.4% discount to price assigned in November

Centrus Corp (LEU): Uranium. Averaging down on last purchase by 10.4%

ETFMG Alternative Harvest ETF (MJ): Marijuana. Averaging down on last purchase by 22.3%

NOV Inc was National Oilwell Varco (NOV): Oil Services. Averaging down on last purchase by 19.3%

Sunrun Inc (RUN): Solar Power. Averaging down on average cost by 2.4% - this purchase was higher than previous one.

iShares Silver Trust (SLV): Silver. Replacing stock assigned at 5% discount to price assigned in November

Sunpower (SPWR): Solar Power. Replacing stock assigned at 19% premium to price assigned in October

United States Natural Gas (UNG): US Natural Gas. Averaging down on last purchase by 1.3% and scaled position size up 3 times.

Unum Group (UNM): US Health Insurance. Replacing stock assigned at 3.1% premium to price assigned in October

Commerzbank AG (CBK.DE): German Bank. Took the chance on Friday 5% selloff to replace stock assigned last month. Sold covered call at 1.4% premium with 7.4% price coverage.

Blue Star Helium (BNL.AX): Helium Exploration. Followed the trade signal on Global Helium Corp (HECOF) discussed in TIB571 and added to my holding in this explorer to average down my entry price on the back of a new helium discovery.

This represents a similar gas composition to the historic Model Dome analogue production and one of the highest in-situ helium concentrations both in the U.S. and globally.<

Sold

No stock sales

Shorts

No trades

Cryptocurrency

Used selloff days on Bitcoin and Ethereum to take up one new position in new rising 10 altcoin portfolio and to scale in to another

Worldwide Asset Exchange (WAXPETH). Price pulled back off the highs relative to Bitcoin and Ethereum - chose to sell Ethereum as I have larger holdings than Bitcoin. Patient investor would have waited for a confirmed reversal. WAX facilitates the buying and selling of assets used in games.

Velas (VXPBTC): Scaled in my holding to average $200 in the new portfolio this time selling Bitcoin - last time USDT. Time will tell on this entry - it looks like a pennant forming.

Income Trades

A slower start to income trades with 41 covered calls written in pension portfolio ((UK 2, Switzerland 1, Europe 12, US 26) and 28 naked puts (Switzerland 1, Europe 3, US 24). This portfolio is holding enough cash to over those naked puts but it does feel a bit heavy. In my other portfolios 28 covered calls (US 23, Europe 5) and 11 naked puts (all US)

Naked Puts

A number of naked puts written rather than buying stock

ABB Ltd (ABBN.SW): Europe Industrials - a re-entry idea.

CVS Health Corporation (CVS): US Retail. Same strike as stock assigned in November. CVS is actively repositioning from being a pharmacy retailer to being a healthcare service provider. It is showing well in the share price

Chevron Corporation (CVX): US Oil. Ramping up a call spread risk reversal. Sold same strike (100) as the naked put that expired in November and reduced net premium on the trade to $0.23

Price has broken above the consolidation zone from early 2021 and is holding above the bought call (100). The covid news may dent this if lockdowns drop demand for oil again.

Decarbonization Plus Acquisition Corporation III (DCRC): Alternate Energy

ETFMG Prime Cyber Security ETF (HACK): Cybersecurity.

Honeywell International Inc (HON): US Industrials.

Nucor Corporation (NUE): US Steel.

iShares MSCI India ETF (INDA): India Index. Ramping up a call spread risk reversal. Sold higher strike (145) as the naked put that expired in November and reduced net premium on the trade to $1.40 which takes maximum profit potential up from 506% to 614%

The updated chart shows price breaking through the $45 level and consolidating for a while above $47.50 - Friday selloff has dented that but stayed above the new sold put level (45)

Currency Trades

None

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

November 22-26, 2021