In a week where the markets wanted to go higher, the trade action was about picking a few laggards wanting to go higher with the flow

Portfolio News

In a week where S&P 500 rose 2.02% to make 7 consecutive highs, my pension portfolio rose only 0.56%. Biggest drags were De Grey Mining (DEG.AX) and a few other Australian resource stocks. US stocks contributing to the drag were solar and shipping. My other portfolio did a lot better up 2.2% as it is more highly geared through options trades to the reopening (e.g. AAL and ABNB).

The jobs report said it all - this market wants to get better. Never mind the doomsayers

Big movers of the week were Bed Bath & Beyond (BBBY) (+60.7%), Airbnb (ABNB) (+18.1%), NVIDIA (NVDA) (+16.4%), Honey Badger Silver (TUF.V) (+15.4%), 3D Systems (DDD) (+14.8%), American Airlines (AAL) (+13.6%), Centrus Corp (LEU) (+13.3%), Delta Airlines (DAL) (+13.2%), Ford Motor (+12.9%), American Eagle Outfitters (AEO) (+12.0%), Livent (LTHM) (+11%), Telecom Italia (TIT.MI) (+10.7%), Helmerich & Payne (HP) (+10.5%) Jyske Bank (JYSK.COM) (+10.4%), Xilinx (XLNX) (+10.3%). The big theme is the reopening trade, deal activity at American Eagle and BBBY (and a massive short squeeze). Alternate energy is moving in there with new Ford EV announcements plus uranium. Nice to see one oil services company the week after I put it in.

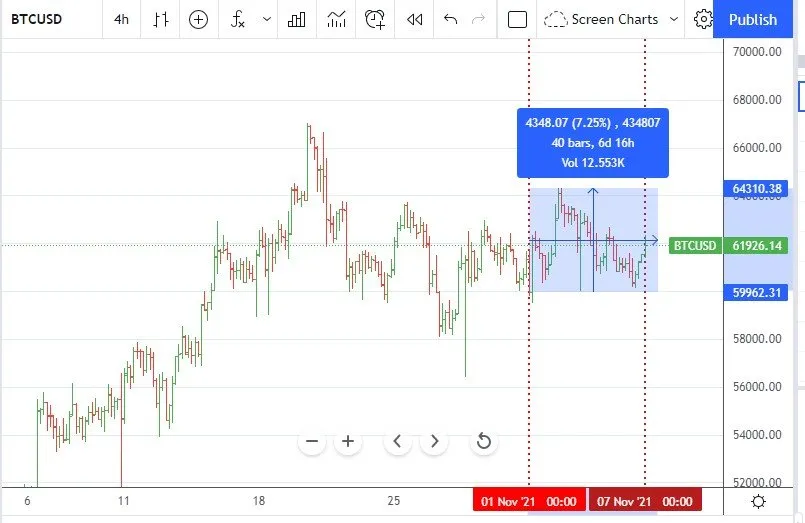

Crypto booms

Bitcoin price pushed higher as much as 7% and finishing the week just 4% higher than the open.

This looks like a classic base formation before the next push begins off the $60k base.

Altcoins caught a bid - biggest pump in my portfolios was HIVE clearing $1 for the first time but settling back only 5% up on the week.

There were a few altcoins that jumped over 30%, like Polkadot and New Economy Movement, but the leader was Solana which held onto the gains

Bought

VanEck Vectors Steel ETF (SLX): Steel. I am working with a friend building out an ETF based investing service. The concept is to deliver returns to a target percentage capital return by tilting the portfolio with growth ETFs. One idea is to add ETF's based on the biggest movers in my portfolios. Last week, US Steel (X) was in the big movers, so I added the Steel ETF (SLX) Yield 1.34%.

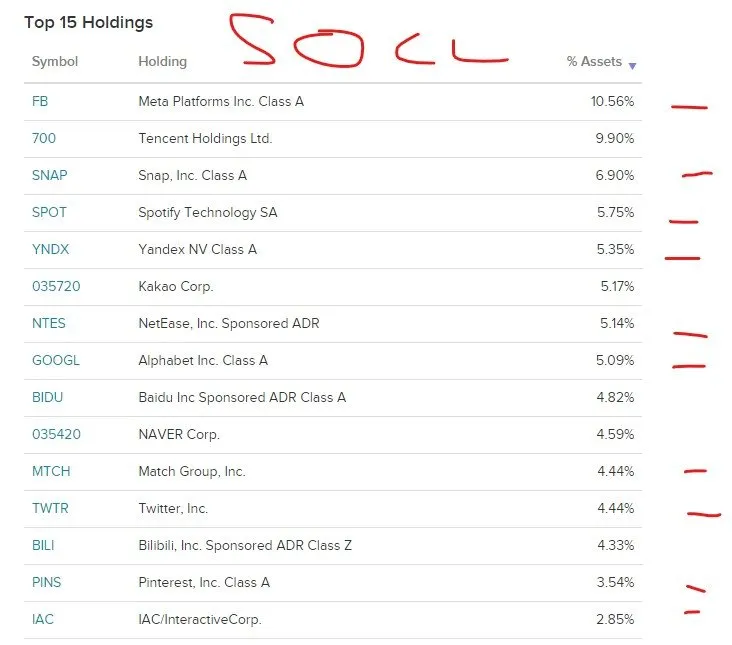

Global X Social Media ETF (SOCL): Social Media. While I was looking at Steel, I saw the chart for this Social Media ETF - it looks like there is a big support area that it is trading off and there is scope for a 10 to 15% run up in each cycle. What is disappointing is the cycle highs are progressively lower than the previous ones.

Now this demands a little digging as to what are the drags - China stocks, Tencent and Baidu make up 15% of the ETF holdings. The comparative chart shows that they are the drags.

There are two ways to invest this - skip the ETF and follow the leaders (say the ones between 4 and 6%) or follow the laggards. I have added in two China technology ETFs to the chart - I am pretty sure they will close the gaps once the crackdown ends - I am already invested in KWEB.

Deere & Company (DE): Farm/Construction Equipment. AAP Plus added this to their portfolios. I added a small parcel of stock and wrote a December expiry naked put at 1.2% premium with 12% price coverage. Dividend Yield 1.18%

The Walt Disney Company (DIS): US Media. AAP Plus added this to their portfolios. I added a small parcel of stock and wrote a December expiry naked put at 1.6% premium with 6.3% price coverage.

Fiverr International Ltd (FVRR): Internet Services. I read an article on Motley Fool with a 3 Stocks to Double Your Money headline. I steer away from these articles as they are normally front-running an offer to subscribe to the Motley Fool. I read it because one of the 3 stocks was on the buy list from AAP team, namely Disney. The top line of the article was the potential for vaccine mandates to drive a lot of workers into the gig economy - i.e., to start freelancing. This is a long run view which could well be valid - I know for sure that is what I would be doing if I was still in the workforce.

As I looked at the chart, I can see that Fiverr has already seen a massive move up following the pandemic selloff in March 2020. It has also given a lot of those gains away and is now consolidating in a range. I bought small parcels of stock in two portfolios. I also added a 175/250/150 call spread risk reversal.

To do this I bought a January 2023 175/250 call spread with a net premium of $22.80 which offers maximum profit potential on its own of 329% for a price move of 48% from $168.58 trade price. I funded the net premium partly by selling a June 2022 150 strike put option which reduced the net premium to $2.75 and ramps up maximum profit potential to 2627% with 12.4% price coverage.

Let's look at the chart which shows the bought call (175) as a blue ray and the sold call (250) as a red ray and the sold put (150) as a dotted red ray with the expiry date the dotted green lines on the right margin. I have added in a blue ray to show the profit potential if price gets halfway to target. Key features of the chart is the size of move needed is no more than we saw in May/June 2021 and is only halfway back to the highs (the small stock holdings can do the work for those). The sold put (150) is below the levels that have been tested twice in 2021 and are under test now. With earnings set for November 10, management guidance will be closely watched to see if that support level holds.

https://www.fool.com/investing/2021/11/01/got-5000-buy-these-3-stocks-to-double-your-money/

I did find another article on the overall Gig Economy stocks - an ETF for these would be nice.

https://finance.yahoo.com/news/7-gig-economy-stocks-buy-180116296.html

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Rounded up holding in a DRP to be able to write covered calls. Price was 6% higher than the last assignment. Wrote same covered call as other holding

iShares Russell 2000 ETF (IWM): US Index. I watched market reaction to the jobs report numbers. The major indices have all made higher highs this week and Russell 2000 has not. One of the signal services I use had talked last week about the potential that a good jobs report could be the catalyst for small caps to follow the big end of town. I bought a small parcel in one portfolio - too small to write covered calls. I matched that with an equivalent size holding in Global X Russell 2000 Covered Call ETF (RYLD) - someone else can write the covered calls. I also wrote a December expiry naked put for 0.53% premium with 11% price coverage.

Starbucks Corporation (SBUX): US Restaurants. AAP Plus idea to add following the earnings related pullback. I did initially buy a small parcel and then scaled it up to write a covered call. Wrote a December 10 (i.e., just 4 weeks) expiry covered call for 0.89% premium with 3.9% price coverage. That premium is lower than I like but is better than half the full year dividend yield. Dividend Yield 1.68%

Skyworks Solutions, Inc (SWKS): US Semiconductors. AAP Plus idea to drive off supply chains easing and 5G rollouts. I bought a small parcel. I also sold a December expiry naked put for 1.8% premium with 8.45% price coverage.

Sold

No sales

Shorts

Invesco QQQ Trust (QQQ): Nasdaq Index. With price opening at $400.04, I was hit on a November expiry 356/340 ratio put spread. Whoever took up that offer was looking for price to drop between 12 and 17% in two weeks. Just WOW!!

Cryptocurrency

ShibaInu (SHIBUSDT): Well I bought into the hype and bought Shiba on a pull back looking to bounce back to the previous high at 0.00008800 - still waiting

Ethereum Cash (ETCUSDT): Sold a small parcel of ETC in one portfolio to clear away some rats and mice - can only think it was mined ETC as I do not recall buying any.

Income Trades

Global X NASDAQ 100 Covered Call ETF (QYLD): Nasdaq Index. As you know, I have been driving a lot of income using covered calls across all my portfolios. I stumbled on this ETF which basically does the work for you. It invests in the Nasdaq 100 and writes covered calls and distributes the income as dividends. Annual distribution is in the order of 10.5% which is in line with what I target writing covered calls (1% per month). While the market is rising there should be capital growth in the underlying. The amount will depend on how wide the writers make the price coverage. The fund was started quite recently during a market run up - so there is not any data to show how it will perform when prices are falling. The big question is how does the fund stack up against other income funds - here is a comparative chart going back to the March 2020 lows (fund started a little before that)

The closest performer was WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) some 3 percentage points behind. This ETF has a distribution yield of 4.2% = which brings the gap to 9 percentage points

Changing the comparison times to when Nasdaq was consolidating - say April 2021 - tightens the performance clustering to a band that is only two percentage points wide. The journey is a lot more volatile than one sees in any of the bond funds.

Now there are some taxation considerations depending a little on how your tax authorities deal with writing covered calls. In Australia, my gains from writing covered calls are treated as capital gains. As the contracts are only held for one month, there is no CGT discount. Capital gains tax rate is the same as income tax rate. In other jurisdictions capital gains are taxed at a lower rate. The distributions from this fund would however be taxed as normal income.

Global X Russell 2000 Covered Call ETF (RYLD): US Index. See above.

Covered Calls

Bed Bath & Beyond Inc. (BBBY): US Retail. Stock was caught in a massive short squeeze during the week which saw the price jump 50%. Implied volatility also spiked. My holding was looking really sick before this happened (down 50%). I figured I would grab some of the capital losses back through writing covered calls. I wrote a November expiry for 5% premium (to opening price) with 10% coverage - that might do it. Price closes at $22.57 = above the sold strike and up 11.9% on the day.

Naked Puts

A quiet week for naked puts but did add this one when AAP Plus team revised price target upwards. Costco Wholesale Corporation (COST) US Retail

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

November 1-5, 2021