Earnings are driving the market. Inflation is lurking. Trade action was all about some careful picks to replace stocks assigned last week - without going overboard as I preserve capital for the next pullback

Portfolio News

In a week where S&P 500 rose 1.63% to touch an all time high, my pension portfolio rose only 0.15% dragged down by De Grey Mining (DEG.AX) down over 10% and Japan stocks

Big movers of the week were Blue Star Helium Limited (BNL.AX) (+13.8%), Castillo Copper (CCZ.AX) (+13.5%), Starr Peak Mining (STE.V) (+10.3%). Just bubbling under were JinkoSolar (JKS) and Capital Product Partners (CPLP). So alternate energy remains a theme and one oil shipper in the mix.

Inflation Expectations

It is becoming clear that inflation is not as transitory as Jerome Powell would like to think - in US and in Europe.

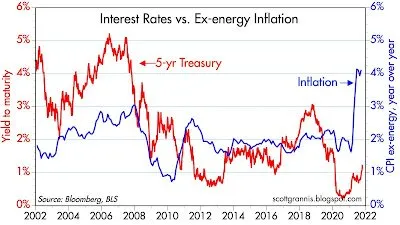

Is it the time to panc? The stock markets think not with solid earnings pushing out new highs. I borrowed a chart which shows US inflation excluding energy compared with 5 year Treasury yields - the yields are showing an uptick that is more than noise on the chart.

Borrowing words from Scott Grannis - Calafia Beach Pundit

That the stock market is taking this in stride—so far—suggests that higher interest rates are not necessarily bad for the economy. I think we are still in the early innings of the adjustment to higher interest rates. There's a lot more to this story that will play out soon.

Eventually, rising yields and rising inflation expectations will prod the Fed to ignore the supposed weakness of the economy and begin the long process of normalizing interest rates.

https://scottgrannis.blogspot.com/2021/10/the-bond-market-is-waking-up.html

Crypto booms

Bitcoin price pushed higher to an all time high before drifting and finishing the week 4.5% lower than the open.

With the launch of the Proshares BTC ETF, this headline caught my eye.

There is a huge risk here that the futures market becomes disconnected with the underlying market as the institutions can only follow the futures market and not the underlying

https://forkast.news/headlines/proshares-seeks-alter-btc-etf-after-week/

Biggest mover of the week in my portfolios was Solana ending 25% up - Solana is proving to be one of the go to platforms for NFT's.

Bought

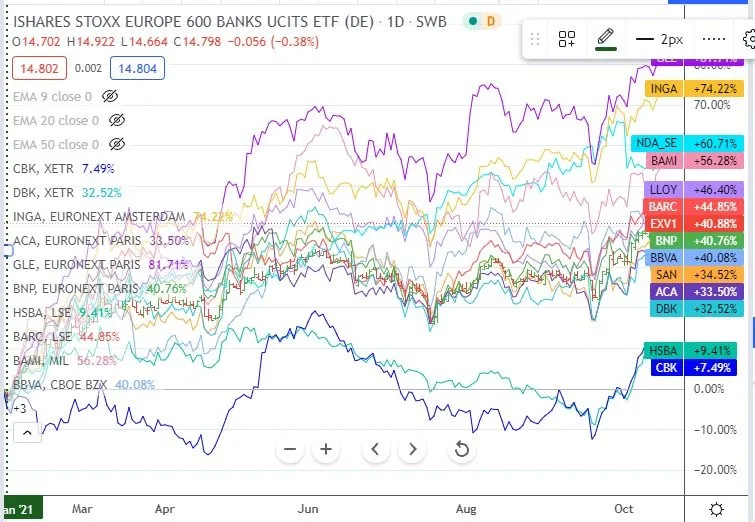

I ran some price relative charts against the iShares Europe Banks ETF (EXV1.DE) to decide which of the assigned bank stocks to replace. The chart shows prices going back to the September 2020 lows. EXV1 is he red tag in the middle at 40.88% - idea is to invest in the laggards below - this suggests HSBC Holdings, the two major German Banks and Credit Agricole - this is where I focused.

Changing the timeline to the January 2021 reversal pushed Nordea Bank above the line - so I ignored that one.

HSBC Holdings (HSBA.L): Global Bank. Replaced at 5.5% premium to assigned price

Credit Agricole (ACA.PA): French Bank. Added a small holding based on the price relatives analysis - not held this stock in this portfolio since February 2021.

Centrica plc (CNA.L): UK Utility. Replaced at 6.3% premium to assigned price

Danone SA (BN.PA): Europe Consumer. Replaced at 8% discount to price when assigned in August - price has taken a dip and I feel confident consumer spending will grow well enough to recover the dip. Dividend yield 3.45%

Deutsche Bank AG (DBK.DE): German Bank. In one portfolio, I replaced stock assigned at 1.9% premium to assigned price. In another portfolio I decided to go the options route looking for rising yields to lift banking stocks in the next 6 to 9 months. To do this I added a March 2022 11.6/14/11 call spread risk reversal with a full cash neutral trade.

Let's look at the chart which shows the bought call (11.6) as a blue ray and the sold call (14) as a red ray and the sold put (11) as a dotted red ray with the expiry date the dotted green line on the right margin. The trade parameters do not look quite right with the sold call (14) possibly too far away to make the maximum. Equally the sold put (11) is really close to trade entry price with only 5% leeway. This is however the level stock was assigned in this portfolio in May 2021 - so I am happy to own it at €11. A better trade structure looks like sold call at 13 and sold put at say 10.

Enel SpA (ENL.MI): Europe Utility. Averaged down entry price in one portfolio. Dividend yield 5.14%

Centrus Corp (LEU): Uranium. With the big move in uranium stocks I dug into the holdings of the Global X Uranium ETF (URA) and picked Centrus which has dipped in recent weeks while everything was rising.

Shipping Did some averaging down bottom fishing on a range of shipping stocks.

Nordic American Tankers Limited (NAT): Oil Shipping. Dividend yield 3.61%

Safe Bulkers Inc (SB): Bulk Shipping.

Teekay Corporation (TK): Oil/LNG Shipping.

Ford Motor Company (F): US Automotive. Replaced portion of stock assigned at 3.7% premium to higher of prices stock was assigned at. Ford feels like a rocket ship with the truck EV plans.

United States Steel Corporation (X): US Steel. Averaged down entry price in one portfolio.

Commerzbank AG (CBK.DE): German Bank. I put in pending orders to replace stock assigned in October expiries at prices around the recent lows - I am thinking/(hoping) we will see a pullback. With rising yields I looked at options to remain invested with lower capital commitment. With price opening at €6.29 (Oct 21), I set up a June 2022 6.4/7.6/5.6 call spread risk reversal. This is one strike out-the-money and looking for price to rise 20% in 9 months and willing to buy the stock 12% lower than current prices. The net premium on the call spread was €0.39 which offers maximum profit potential of 208% on its own. The sold put fully funds the premium though it does not cover trading costs - €11 per leg is expensive compared to US trades.

Let's look at the chart which shows the bought call (6.4) as a blue ray and the sold call (7.6) as a red ray and the sold put (5.6) as a dotted red ray with the expiry date the dotted green line on the right margin. Price is cycling along a trend line in a tidy parallel channel. The top of the channel projects past the level of the sold call before expiry. I have cloned in some price scenarios based on the first cycle from the 2020 lows. The lengths of the cycles are similar and I have used that to place the potential price scenario - if that starts a little higher than the last cycle down, the trade will win. The sold put (5.6) is not below the previous higher low but it is 12% away from current price.

In my other portfolio, I did March 2022 expiry with a tighter call spread (6.4/7.2) and sold the same put (5.6) - trade was also not quite cash neutral and did not cover trading costs.

Sold

Barclays PLC (BARC.L): UK Bank. With price opening at £1.99 (Oct 21) pending order to close out a January 2022 1.80/1.95 bull call spread was hit for 82% profit since August 2021 - too bad I only made a small trade. The profit was not as high as projected because there is still quite a lot of time value.

I replaced the trade with a June 2022 2.0/2.2/1.8 call spread risk reversal. The new trade is shown on the chart with green rays working to the vertical dotted expiry line on the right margin.

I have modelled a price scenario from the last cycle up (it was a little smaller than the first cycle) - get a repeat of that and this trade will win comfortably maybe even well before June 2022 expiry. Barclays results announcement last week was very positive too with strong trading income. Net premium on the call spread was £0.07 giving maximum profit potential of 185% for a price move of 10%. Premium of the sold put was 50% bigger than the spread premium with 10% price leeway too. I did make trade size bigger.

VanEck Vectors Russia Small-Cap ETF (RSXJ): Russia Index. Pending order hit at 52 week high for 7.5% blended profit since August 2017/June 2018. This has been a long slow recovery from China trade war hit on oil prices. This ETF has relatively low exposure to energy stocks but has still not grown as strongly as other markets. The initial trade idea was to invest in Russia as it was trading at Price to Book ratio of less than 1.

Shorts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. I am now short positions in two portfolios. I am wrestling with ways to manage the short positions and do not want to land up with a long position. Normally what I do is sell a put option at a strike price below the current price - that closes out the short if price falls further. With price opening at $144.66 (Oct 19) I sold a 146 strike put option (November 19) in a late night trading session - that has me on the wrong side of the trade and would have me exiting well above the current market. I closed that out next day giving away some profits and sold a put below the market at 142.

Cryptocurrency

BitTorrent (BTTUSDT): Sold a small parcel of BitTorrent that I had received in airdrop sometime back - feels like free money.

Income Trades

Income trades have started off a little slower. I have reduced the number of naked puts as I am keen to preserve some of the cash raised in the last cycle of expiries. The inflation data is becoming bothersome. In the pension portfolio, 56 covered calls (US 41, Europe 10, Canada 3, UK 2) and 13 naked puts (US 12, Europe 1) written. In the other portfolio, 33 covered calls (US 28, Europe 5) and 5 naked puts (all US) written.

Naked Puts

I do use stock picks as a way to write naked puts rather than buying stock especially where the stock price is a bit high for buying enough shares to write covered calls. - I typically write one month away at about 10% below current price. This is the current list of major items:

AbbVie Inc. (ABBV) - US Pharmaceuticals

Honeywell International Inc. (HON) - US Industrials

Mastercard Incorporated (MA) - Payment Services

Tesla, Inc. (TSLA) - US Automotive

Morgan Stanley (MS) - US Bank

NVIDIA Corporation (NVDA) - US Semiconductors.

Currency Trades

Sold USD to raised AUD to pay a deposit on a retirement house on the South Coast of NSW.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

October 18-22, 2021