A quiet week focused on replacing uranium stocks assigned the week before and loading up on relatively under-valued ASX uranium stocks. Am staying out of markets (mostly) until US Election is resolved.

Portfolio News

In a week where S&P 500 dropped 0.95% and Europe dropped 2.07%, my pension portfolio dropped 1.03% - in line with US and not as bad as Europe. Progressively reducing exposure to Europe is working. Positives were ASX stocks other than uranium. Biggest drag there was accounting scandal hit Mineral Resources (MIN.AX) down 25.6%. Europe portfolio was positive helped by a rise in Volkswagen (VOW.DE)

Big movers of the week were Honey Badger Silver (TUF.V) (72.7%), Euro Manganese (EMN.AX) (35.3%), Blue Star Helium (BNL.AX) (33.3%), Lanthanein Resources (LNR.AX) (33.3%), DGL Group (DGL.AX) (27%), HelloFresh (HFG.DE) (24.7%), Canopy Growth Corporation (WEED.TO) (23.9%), Panther Metals (PNT.AX) (19.4%), Stroud Resources (SDR.V) (18.7%), QuantumScape Corporation (QS) (17.2%), JinkoSolar Holding Co (JKS) (15.5%), AML3D (AL3.AX) (15.2%), Société BIC (BB.PA) (14.8%), Titan Minerals (TTM.AX) (14.3%), Mithril Silver and Gold (MTH.AX) (14.1%), JDE Peet's (JDEP.AS) (13.8%), Kairos Minerals (KAI.AX) (13.3%), Sun Silver (SS1.AX) (12.6%), EML Payments (EML.AX) (10.7%), CGN Mining Company (1164.HK) (10%)

A short list of only 20 stocks in the big movers list. From the top, the themes are silver/gold mining (6 stocks), battery materials (3 stocks), rare earths (1 stock), cannabis (1 stock), alternate energy (2 stocks), uranium (only 1 this week)

Jump in Honey Badger Silver (TUF.V) on the back of news extending Nanisivik project.

US markets news shifted to earnings season mood - a lot of nerves and bouncy days around guidance - down days and record days mixed in between. The end of the week high for Nasdaq is an indicator that technology stocks are coming back to the fore.

Crypto Bumbles

Bitcoin price did not have the conviction to follow last week and drifted ending 1.1% lower on the week with a peak to trough range of 6.7%. Note the two low tests on the 4 hour chart - maybe they were telling us about the days in the new week

Ethereum chart is altogether different with the high from the week before a point too far and price fell over ending the week 8% lower with a peak to trough range of 13.2%

Helium (HNTBTC) tried to make a run with a pop of 17% before giving it all away

Litecoin (LTCETH) keeps cycling upwards along the moving averages - news of a potential ETF bought in the buyers.

Nuclear Energy Holdings

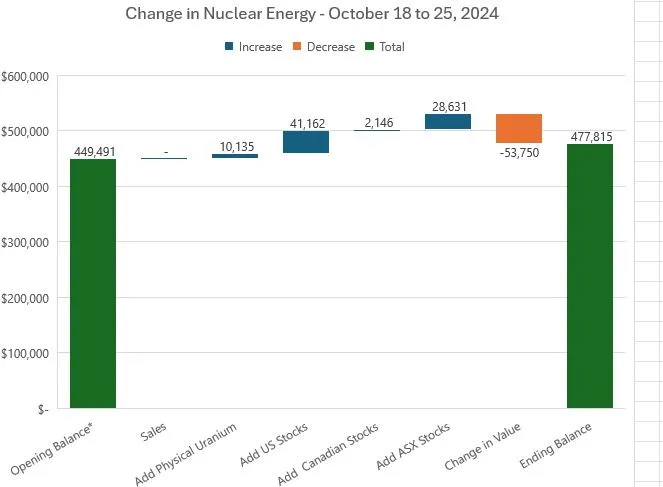

Decided to change the reporting for uranium to include nuclear technology stocks. This matches more closely with the holdings of the Global X Uranium ETF (URA). The opening balance of the sources of change chart has been modified from the week before to include nuclear tech stocks that were held the prior week. One other small change is BHP Group (BHP.AX) is reported now at full value - not just the share of revenues coming from uranium to match URA. Adding in the nuclear technology stocks requires a new target holding percentage - say 20%

Was a busy week for replacing uranium holdings assigned the week before - market pullback made that a good opportunity. The pullback was strong with 12% decline in value - a lot of that came from nuclear technology stocks which were on a tear the week before

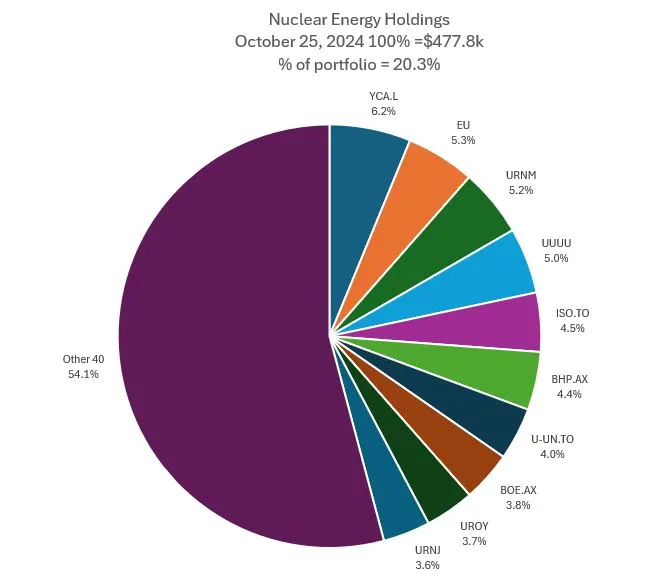

The mix of holdings sees quite a few changes from the additions made last week and the inclusion of BHP at slot 6. Top two stay the same. Addition back of the Sprott Mining ETF (URNM) brings it in at slot 3. Additions to Boss Energy (BOE.AX) and Uranium Royalty Corp (UROY) brings them in at slots 8 and 9. Dropping out of the Top 10 are Denison Mines (DML.TO), Global Atomic (GLO.TO) and NexGen (NXE). Others now totals 40 stocks and are more than half the value.

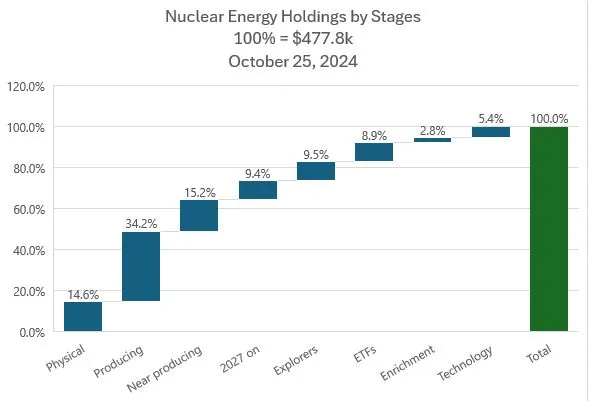

Holdings by stage chart sees a few changes with the addition of nuclear technology at 5.4 percentage points. The additions in the week were focused on producing (up near 5 points) and 2027 on up 2 points. The additions in ETF's was not enough to cover the drop in valuation. Biggest drop in valuation was in near producing down 4.1 percentage points.

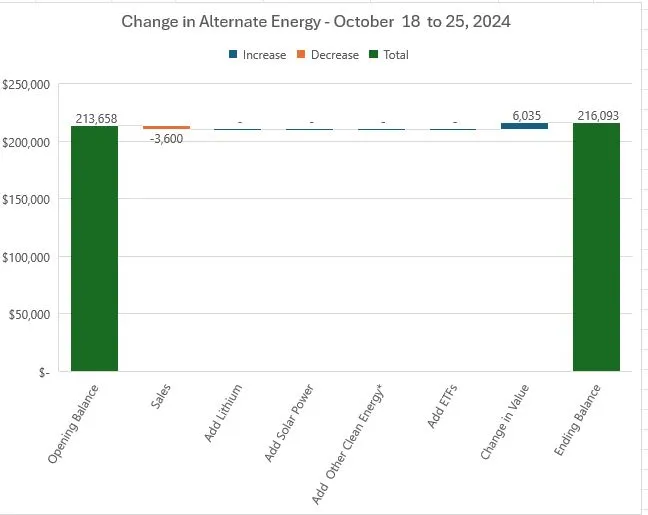

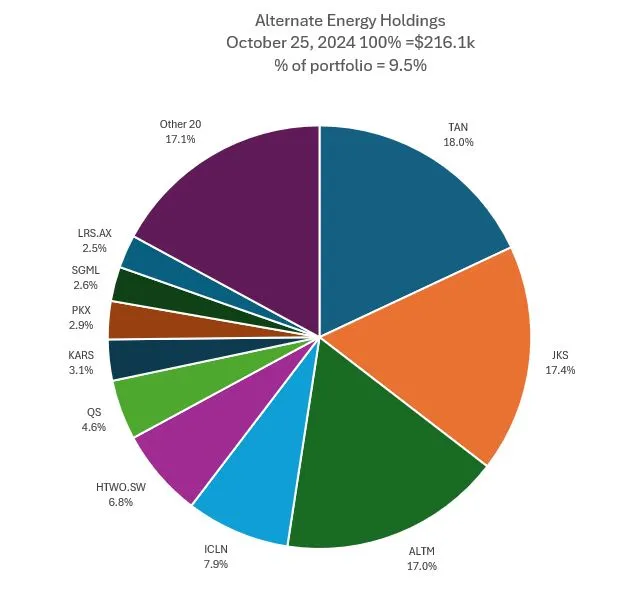

Alternate Energy Holdings

Only one change in alternate energy stocks with a sale on an assigned covered call.

Share of portfolio value moves up a smidge to 9.5% - that leaves total portfolio in energy at 30% (a few oil and gas holdings rounds it up). Mix of holdings sees JinkSolar moving up one place into slot 2. Krane Electric Vehicles ETF (KARS) moves up one place to slot 7 on the back of rise in Tesla (TSLA) value.

Bought

ASX listed uranium stocks tend to lag US and Canada stocks. Did an analysis of all stocks against Sprott Physical Trust (U-UN.TO - the bars - green box 2nd from top on right hand scale) and added to holdings from the most lagging right up to the least of the under-performers. Rather than try to second guess the winners, invested amounts to make holdings equal sizes

The chart includes one stock which is not ASX listed - Forsys Metals Corp (FSY.TO). Included it as it has large tenements in Namibia like quite a few of the others.

Aura Energy Limited (AEE.AX): Uranium. Developing Tris mine in Mauritania

Bannerman Resources (BMN.AX): Uranium. Developing Etango mine in Namibia.

Boss Energy (BOE.AX): Uranium. Producing at Honeymoon in South Australia

Lotus Resources Limited (LOT.AX): Uranium. Reopening Kayelekera mine in Malawi.

Paladin Resources (PDN.AX): Uranium. Restarting and producing at Langer Heinrich mine in Namibia and exploring in Athabasca and Western Australia

Peninsula Energy Limited (PEN.AX): Uranium. Restarting Lance project in US

Elevate Uranium Ltd (EL8.AX): Uranium. Exploring in Koppies in Namibia.

Forsys Metals Corp (FSY.TO): Uranium. Its flagship project is the Norasa uranium project, which includes the Valencia and Namibplaas uranium projects located in the Namibia.

enCore Energy Corp (EU): Uranium. Added to small managed portfolio to replace Uranium Energy Corp (UEC) assigned last week. Producing in Alta mesa in Texas with two other restarts scheduled for 2026.

ASP Isotopes Inc (ASPI): Nuclear Technology. Added a first holding after the pullback from the prior week surge. Could be a key player in enrichment.

Kaiser Reef Limited (KAU.AX): Gold Mining. Next investors idea - consolidating gold mining holdings in New South Wales. New addition in personal portfolio.

Lightbridge Corporation (LTBR): Nuclear Technology. After racing past covered call strike at options expiry, price did pull back a little, enough to get below the next options strike level (7.5). Keen to remain invested beyond the November expiry sold puts (5) - so set up a December expiry 7.5/10/5 call spread risk reversal. With net premium of $0.62, the 7.5/10 call spread offers maximum profit potential of 303% for a 47.5% move in price from $6.78 open (Oct 24). The sold put (5) premium fully funds the call spread and brings breakeven to $4.70 with 26.3% price protection.

Let's look at the chart which shows the bought call (7.5) as a blue ray and the sold call (10) as a red ray and the sold put (5) as a dotted red ray with the expiry date the dotted green line on the right margin. Breakeven is the green ray. This might look like a blue skty trade with the bought call (7.5) above the 2023 highs. The big blue line is a price scenario borrowed from the 2007 nuclear cycle - it ends somewere around $400 and was that steep. This is a stock to own if this is the start of the next cycle. Tomorrow I am going to plunk down some of the stock profits and just buy a call option to keep this open ended.

Price pulled back on Friday open to $5.90 (Oct 25). Took the chance to buy back some stock in 3 portfolios. That blue arrow on the chart above tells me to be open ended. Also added a December expiry 7.5/5 risk reversal. With net premium of $0.58 beakeven is at $8.08. Challenge is to see if stock can move up 32% and not fall 22% in 10 weeks - the blue arrow says it could move up like that. Not fussed if it drops below the sold put (5) as that is 22% lower entry than the stock just bought. Easy to adjust the trade - sell a call option above the bought strike or turn the sold put into a ratio spread.

[Means: Risk reversal - buy a call option and fund with a sold put]

Uranium stocks all pulled back in the week on a slow to move spot price. Added parcels to several portfolios as reinvestments of stock assigned last week.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Added to managed portfolio to average down entry price from last two entries - price is lagging as it tends to move with spot price. Am fully expecting a spike when spot moves.

Cameco Corporation (CCJ): Uranium. Replaced stock in pension portfolio and managed portfolion at 3.2% discount to assigned price. Wrote covered call for 1.18% premium with 13.7% price coverage.

Uranium Royalty Corp (UROY): Uranium. Added to managed portfolio to scale in holding. UROY is leveraged to rising spot price and market capitalisation is about the same as value of uranium holdings and cash making the 9 royalty projects essentially free. There is some X (formerly Twitter) noise that there may be a capital raise in the wings - no news though. = ignoring it. News this week is they added another royalty from Cameco (CCJ)

Yellow Cake plc (YCA.L): Uranium. Scaled in to managed portfolio. Yellow Cake trades persistently at a wider discount to net asset value than Sprott Physical Uranium Trust Fund (U-UN.TO).

Thinking is that this gap will begin to close when spot price starts moving

Ur-Energy Inc (URG): Uranium. Scaling into holding in managed portfolio and added for first time in pension portfolio. Producing from Lost Creek project.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Replaced stock in pension portfolio at 3.3% premium to assigned price.

Sprott Uranium Miners ETF (URNM): Uranium. Added to pension portfolio for first time. Wrote covered call for 0.96% premium with 12.2% price coverage.

Cauldron Energy Limited (CXU.AX): Uranium. Rights offer taken up in personal portfolio including December 2025 options at $0.015 strike - currently price is below that. Explorer at Manyngie in Western Australia - some risk as there is a uranium mining ban in place in the state. Good news is Australian Labor Party lost the state election in Queensland this weekend - this could be the start of a switch over to more favourable state view on uranium mining. .

Northern Minerals Limited (NTU.AX): Rare Earths. Added to holding in pension portfolio through share purchase plan placement.

Sold

QuantumScape Corporation (QS): Battery Technology. Assigned on covered call for 9.1% profit in one week. Still have a holding for the long haul.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots (upped lst week as portfolio has strong cash position)

New Buys

Mayne Pharma Group Ltd (MYX.AX): Pharmaceuticals. Dividend yield 4.35% - 2023 - no dividend paid 2024. 2nd time holding this stock.

Chart shows price well beaten down after last exit and has had one solid go at breaking the downtrend and settled into a sideways pattern. Profit target is below the previous highs.

Income Trades

Modest start to covered calls cycle with 40 covered calls written across 4 portfolios (UK 3 US 27 Europe 8 US Canada 2)

Naked Puts

Sold puts on stocks happy to enter at lower prices

- American Airlines Group (AAL): US Airline. Return 3.5% Coverage 8%

- Commerzbank AG (CBK.DE): German Bank. Return 2.2% Coverage 4.5% - similar in 3 portfolios

- Deutsche Bank AG (DBK.DE): German Bank. Return 2% Coverage 4% - similar in 3 portfolios

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 1.25% Coverage 4.8%

- Engie SA (ENGI.PA): French Utility. Return 1.3% Coverage 3.2%

- QuantumScape Corporation (QS): Battery Technology. Return 5.4% Coverage 5.4%

- Uranium Royalty Corp. (UROY): Uranium. Return 2% Coverage 23.6%

- L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Return 1.04% Coverage 2%

- HelloFresh SE (HFG.DE): Europe Restaurants. Return 2.67% Coverage 16.8%

Credit Spreads

None in place

With large assignment profile last week - plenty cash to cover exercise risk. No table this week.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

October 21-25, 2024