We must consider how only a tiny fraction of the world's population currently uses smart contract platforms. Just because Ethereum has the network effect now, doesn't mean it can't lose it to a more user-friendly and efficient competitor in the future.

Ethereum has a problem with scalability. It had originally planned to implement sharding to facilitate on-chain scaling, but has since transitioned to focusing on patching in L2 sidechains instead. The main problem with these sidechains is that they are complicated for non-technical people to use, and therefore hinder mass-adoption.

There's a lot of capital tied up in Ethereum and its sidechains, and therefore there's a lot of vested interest in making the entire ecosystem succeed. However, from an objective standpoint, we must consider that redesigning the system from scratch will likely have a better long-term outcome.

Aside from native scalability, Ethereum also lacks on-chain governance. Meaning there's no way to transparently poll the stakeholders (token holders) when a big decision needs to be made in regards to the protocol, such as reversing a hack or adjusting the block size.

Several smart people have recognized these limitations and have came up with a variety of "Ethereum killers" - blockchains that supposedly scale well, have built-in governance, and offer other features.

Given the incentives of successfully engineering the next generation of money, there are countless teams building alternative solutions in a fiercely competitive market. They must prove themselves over many years to be just as secure and censorship-resistant as Bitcoin and Ethereum, in order to overtake them.

In this post, I'd like to write about one of these projects, MultiversX (EGLD). What are its pros and cons, and how its scaling technology and leadership set it apart from the pack.

When I first heard of "Elrond", as MultiversX was called in its early days, I was very skeptical considering the number of disingenuous competitors in the space. However, over time, I've come to believe that it's one of the projects that wants to be here for the long-haul.

Scalability

MultiversX uses a technology called Adaptive State Sharding to achieve native scalability.

Basically, the validators (block producers) on the network are split into multiple shards, and each validator only validates transactions within its own shard, preventing one popular dapp from slowing down the entire system.

Currently there are three execution shards on the network, and one coordinator shard. However, it will be possible to add more shards to the network as demand increases.

This is true on-chain scaling, as opposed to the sidechains like Optimism and Arbitrum that are being patched onto Ethereum as an afterthought.

The intricacies of this scaling technique are complicated, and I encourage you to read more about it on Binance Research if you're interested.

Token Distribution

One thing that I love about Bitcoin is its fair distribution of tokens. From day one, anybody in the world with a computer and an internet connection was able to participate in mining. Nobody was allocated any Bitcoins when the chain launched.

In more recent years though, a lot of blockchain projects have launched with a large portion of the tokens allocated to the founders and advisors, right from the outset.

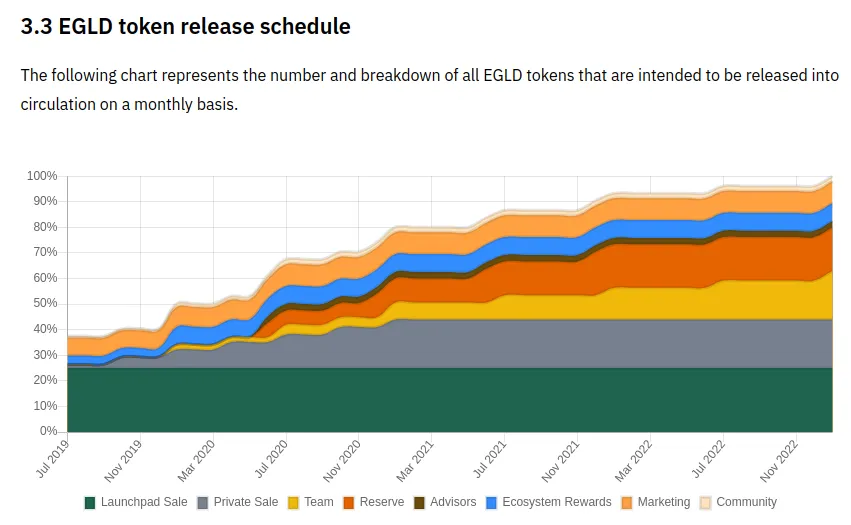

In the case of MultiversX, the team allocated 19% of the tokens to themselves, 17% to a "reserve" fund, and 8% to marketing, among other recipients. A significant amount, but at least the team's tokens were vested over a period of four years, as illustrated in this chart from Binance Research:

One would think that the team members who didn't truly believe in the project would have sold off in the bull run of 2021 when each EGLD token reached ~$500 USD. If so, the tokens would now be in the hands of new owners who are actually optimistic about the project's future.

At the end of the day, was this a fair token distribution? Personally, I would have preferred to see a smaller allocation of the total supply up front. With the remaining tokens being distributed to stakers over a longer period of time.

As per Coinmarketcap, the current supply is ~25.5 million with a maximum supply of ~31.5 million. However, the supply won't reach that limit, as a small portion of EGLD is burned as transactions occur.

Governance

We must also consider the impact this token allocation could have on decision making as the project moves forward. MultiversX could be considered centralized if only a few founding members are able to veto any governance proposal from community members.

The team has stated on their roadmap that they plan to enable governance in the first quarter of 2023. It has been enabled in a subsection of xExchange, however it doesn't seem very active yet.

So far there has only been one proposal to transform Maiar DEX into xExchange, which the voting is now closed on. This pales in comparison to the number of proposals on Hive, or within the Cosmos ecosystem.

Node Distribution

Not only is token distribution important when it comes to decentralization, but also node distribution. Anyone should be able to participate in the network without asking for permission.

As per the MultiversX docs, one would need to stake 2500 EGLD (roughly $95,000 at today's prices) in order to host a node, which puts it out of the reach of most indivudals, but a possibility for a medium-sized business.

Leadership

The leadership behind MultiversX is impressive. I always want to make sure that the team behind a project is genuinely interested in making a difference with the technology, and not just in it for a quick buck.

You can get a feel for what the team is like by watching some of them interviewed in the following video:

Beniamin Mincu, the founder and CEO, is very active on Twitter and constantly posting updates about the project. The sentiment in the comments is upbeat and positive, which is always a good sign.

In 2022, a hacker exploited a vulnerability in one of the Maiar DEX smart contracts and drained over 100 million dollars worth of EGLD from the exchange. The team responded quickly and had a patch ready in short time, and was able to cover the majority of the losses.

Dapp Development

There are many interesting projects building atop the MultiversX platform. Projects like UTrust, ZoidPay, xExchange, and Bhat are all making progress and have market caps under 50 million.

The xExchange DEX is easy to use, and you can trade your EGLD there to obtain a small share in all of these projects if you wish to support them. Additionally, they have a metastaking program, where these tokens can be staked to earn more of the same token.

Conclusion

In the end, the free market will decide whether or not MultiversX will be one of the leading third generation blockchains of the future, or fall by the wayside with many others who tried and failed.

They have certainly developed some superior scaling technology, proven themselves to be capable in emergency situations, and have built a strong community.

From an investing perspective, I think it would be worth adding a little bit of EGLD, and it's early project tokens into a well-diversified portfolio.

Are you optimistic or pessimistic about MultiversX's future?