A couple of days ago the Bitcoin network experienced its fourth halving, causing the block subsidy to drop from 6.25 Bitcoin to 3.125 Bitcoin. As a result, Bitcoin miners have been essentially generating half the revenue they were earning before the halving.

Luckily for the miners however, they also earn transaction fees, which must be paid by users whenever they send Bitcoin. And since the halving occurred, the fees have been more than making up for the miners' lost rewards, to the point where many users actually took to Twitter to complain.

https://x.com/edward_farina/status/1782144491278778795

A lot of people have been wondering, why did the Bitcoin transaction fees skyrocket immediately after the halving?

It's all due to a new protocol on the Bitcoin network called "Runes", which was activated right when the halving occurred at block 840,000. Since then, degens have been battling each other and paying top dollar to mint rare tokens on the Bitcoin blockchain.

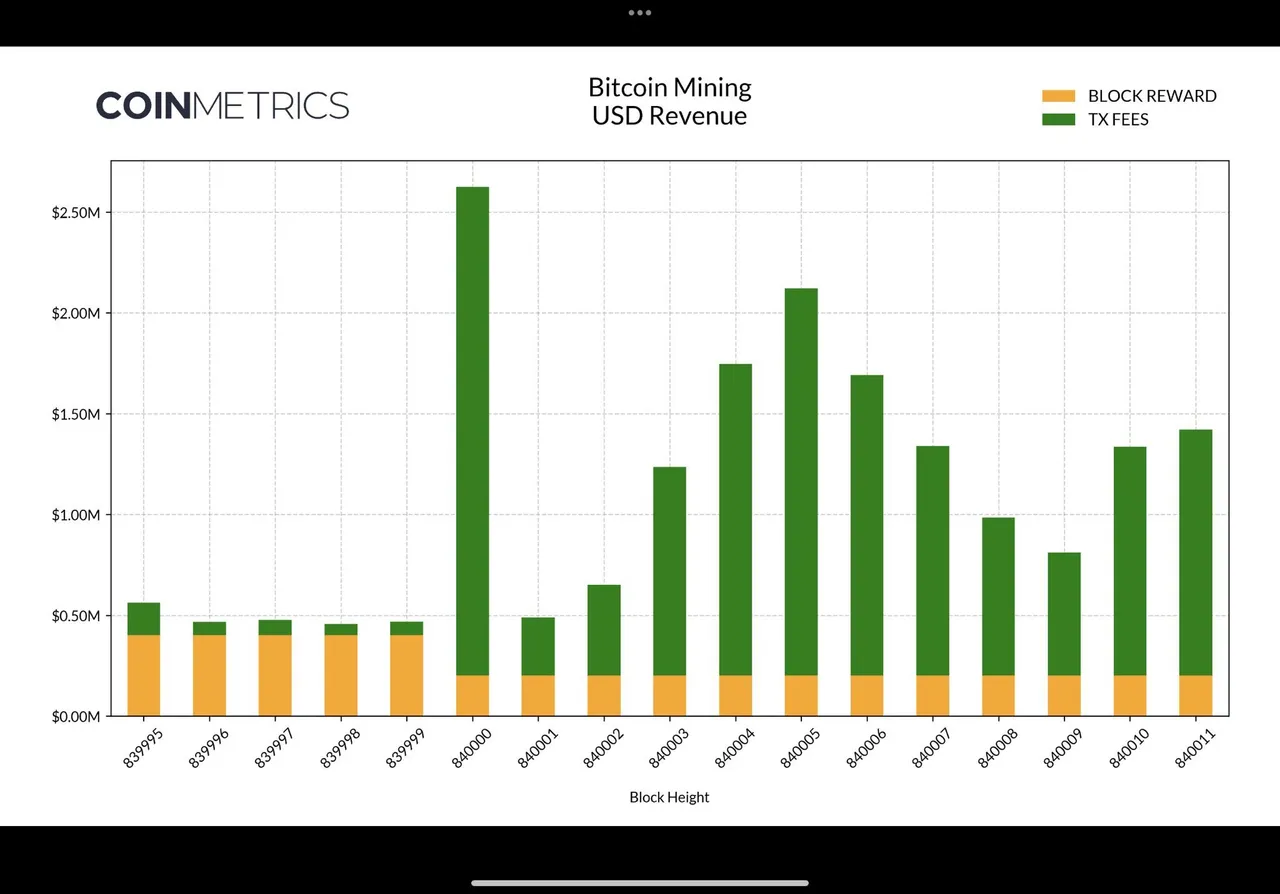

In fact, a new record was broken for the number of dollars spent on transaction fees in block 840,000. Users (including degens) spent a total of 37 BTC (or $2.4 million) to mint tokens in this block.

The Runes protocol is similar to the BRC-20 standard, which also clogged up the Bitcoin network back in early 2023 as users rushed to mint and trade rare "ordinals". In essence, these protocols allow people to create NFTs on Bitcoin.

As you can see from the chart above, rewards from transaction fees far exceeded the block subsidy immediately after the halving occurred. Instead of miners losing revenue from a lower subsidy as expected, they ended up earning far more from transaction fees alone.

How can you avoid these insane fees?

Many Bitcoin proponents will recommend using the Lightning network as solution to these high fees. And Lightning works relatively well if you already have your Bitcoin over there. However, if you need to move some of your Bitcoin to the Lightning network, you will have to pay these excessive fees to transfer it.

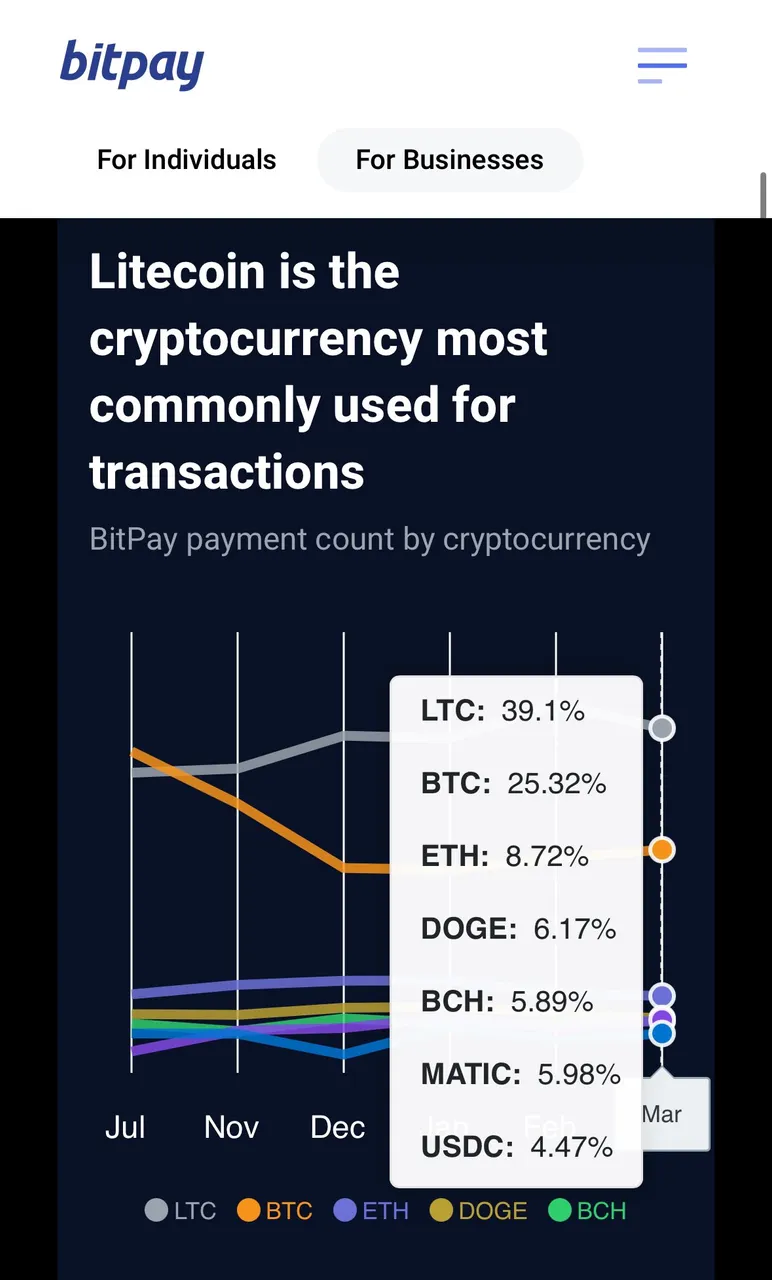

The other option is to use an alternative cryptocurrency with much lower fees. For example, Bitcoin Cash, Litecoin, or Dash are currently much cheaper to use. They have plenty of block space to spare, allowing you to spend your money whilst paying minimal fees. In fact, when it comes to Bitpay, most users have been using Litecoin these days.

Over the coming days and weeks, we can expect the Bitcoin network to calm down, and for the network fees to decrease as the Runes hype dies dissipates.

In fact, just a couple of hundred blocks later, users are now spending a total of about ~1 BTC on transaction fees, which is great relief from the 37 BTC that was paid in block 840,000.

Both the Runes and Ordinal ordeals demonstrates that Bitcoin has become a cryptocurrency for the rich, leaving the market wide open for cheaper alternatives to spread as cryptocurrencies continue to gain worldwide adoption.

If you learned something from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me in InLeo for more frequent updates.

Until next time...

Resources

Block reward vs. transaction fees chart [1]

Bitpay and Litecoin chart [2]

Bitcoin high fees tweet [3]