In previous articles we discussed some up-and-coming DePIN projects that have the potential to disrupt major market incumbents like Facebook, Amazon, and Google. To summarize, DePIN stands for Decentralized Physical Infrastructure Network, and it essentially means using token economics on trustless blockchains to incentivize the rollout of physical infrastructure in a decentralized way.

Solana vs. Polygon vs. Dedicated Blockchain

While some DePIN projects have chosen to launch on their own dedicated blockchain (Akash, Flux, Filecoin, etc.), others have mostly opted to mint their token on one of two popular blockchains, namely Solana and Polygon. Solana is a high-performance, stand-alone blockchain, while Polygon was created as a sidechain to Ethereum, to offload transactions from the mainnet.

Polygon was originally created as a simple and fast Proof of Stake (PoS) blockchain. However, the team has since launched a beta Polygon zkEVM, which harnesses the power of zero knowledge proofs to take performance to the next level. While the tech is incredibly promising, zkEVM is still in its experimental phase, so this guide will stick to the original PoS chain.

Some interesting DePIN projects that chose to mint their token on Polygon include DIMO, Wifi Map, Geodnet, Xnet and Streamr. We can make the educated guess that some of them chose Polygon over Solana because Solana had been experiencing severe performance issues throughout 2022 and 2023. Now that the Solana appears to have stabilized, we have established DePIN projects like Helium and Render migrating their tokens over to it.

Keep in mind that just because a DePIN project has their token on Polygon, Solana, or some other blockchain today, doesn't mean they won't migrate their token to another blockchain some day in the future. Normally when this happens, the community publishes a guide showing token holders how to move their tokens.

How To Get Polygon DePIN Tokens

In order to obtain these DePIN tokens you will first need to get some MATIC, which is the native token of the Polygon blockchain. MATIC is used to pay for transaction fees on the Polygon network, as well as for delegate to validators (staking), and vote on governance proposals.

The MATIC token can be purchased on major exchanges like Coinbase and Binance, or you can obtain it via smaller crypto-to-crypto exchanges like simpleswap or changenow.

One of the most common wallets people use to hold MATIC these days is Metamask, which was originally designed only for Ethereum, but now supports a variety of blockchains. You can install Metamask as a mobile app on your phone, or as a browser extension in Chrome or Firefox.

Once you have Metamask installed, you will need to add the custom Polygon network in order to interact with the Polygon blockchain. Afterwards, you can use a new Metamask wallet address to receive MATIC tokens from an exchange. Remember that a Polygon address has the same format as an Ethereum address.

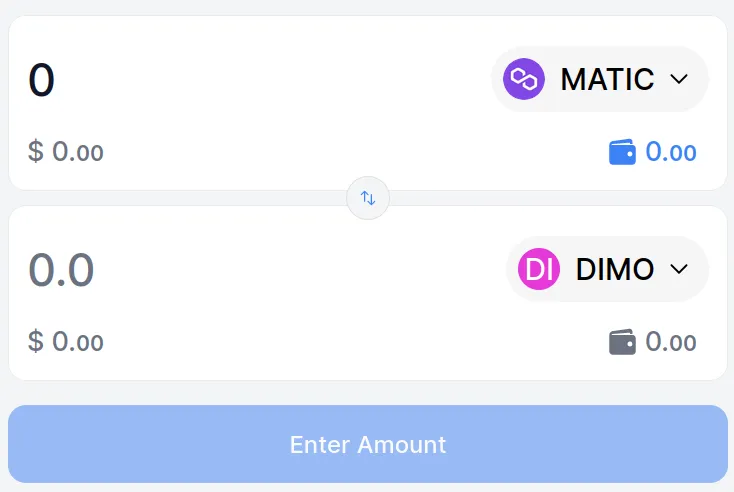

The next step is to use a decentralized exchange (DEX) on Polygon to swap the MATIC in your wallet to the tokens of these DePIN projects. A couple of well-known DEXs on Polygon are Quickswap and Sushi Swap. In this guide we will cover how swap tokens using Sushi Swap. 🍣

From the Sushi Swap web interface you will first need to connect your Metamask wallet. Make sure that your Metamask wallet is connected to the Polygon network, and not the Ethereum mainnet or some other blockchain.

Your MATIC balance should appear on Sushi Swap's web interface, and you can now swap it for DePIN tokens after finding them in the list. Some of these DePIN projects are still relatively new, so they may listed as "unverified" or "not on the default token list", but you can confirm their contract address yourself by cross-checking with a website like CoinGecko.

After swapping, you can verify your token balances by checking your Polygon address on a public block explorer like Polygonscan.

Watch Out For Potential Hype and Speculation

In every bull cycle run we have some hot topics that attract a lot of speculation. For example, in the bull run of 2021 "NFTs" were a popular term that led to a lot of gambling on "metaverse" projects and the like.

"DePIN" could very be a hot topic in the next bull run, as well as "web3 gaming" and "RWA" (Real World Assets). Due to a build-up of hype, we could see these projects increase in value rapidly.

We must be careful though, because as the bull run picks up steam, new projects will come out of the woodwork, trying to ride the coat tails of teams that have been burning the midnight oil throughout the bear market.

By focusing on the crypto space during the bear market, we can identify better which projects are here for the long haul and which ones have arrived just want to make a quick buck.

Conclusion

Trustless blockchains present a paradigm shift in the way we build out physical infrastructure. DePIN projects that have been building throughout the bear market have the potential to grow exponentially into the future.

Some DePIN projects have decided to launch their own dedicated blockchain, while others have minted their tokens on well-known blockchains like Solana and Polygon. Wherever the project's token may lie today doesn't prevent the community from migrating the token to another blockchain in the future.

The tokens for DePIN projects on Polygon can be acquired by using a wallet like Metamask and DEXs such as Sushi Swap. Remember that none of this is financial advice and all these projects are risky investments.

Follow Me

If you learned something from this guide, be sure to check out my other articles about finance and crypto here on the HIVE blockhain, and follow me on InLeo for more frequent updates.

Until next time...