Is DAI not the censorship-resistant stablecoin we thought it to be?

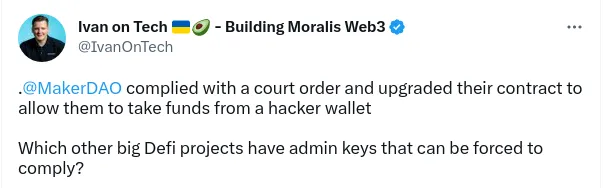

Earlier today, I noticed a tweet from Ivan on Tech that MakerDAO had supposedly rewritten its smart contracts to recover millions of dollars worth of crypto stolen by a hacker:

This raised a couple of important questions...

Does this mean that DAI is not the decentralized, censorship-resistant stablecoin we thought it was?

How decentralized is DeFi if project owners can simply upgrade their smart contracts to confiscate user funds?

Background

Back in February of 2022, a hacker managed to steal over 300 million dollars worth of wrapped ETH from the Wormhole bridge. Since then, the unscrupulous individual has transferred the stolen funds to various DeFi protocols, including one called Oasis.

Oasis has since been issued a court order from the High Court of England to retrieve the funds by any means necessary. In response, they upgraded their smart contracts to confiscate the hacker's tokens, including a MakerDAO vault containing 78 million worth of DAI stablecoins.

DeFi protocols such as MakerDAO and Oasis are essentially a collection of smart contracts on a particular blockchain, in this case Ethereum. These smart contracts are usually controlled by a private key, or multiple private keys (if a multisig has been setup), and can be upgraded at any time by the owner(s).

Implications

Unlike USDC, which has been known to freeze accounts, a lot of people were under the impression that DAI is a decentralized, censorship-resistant stablecoin. Has this incident revealed that MakerDAO can in fact censor any account holding DAI if they receive a court order from a government?

First, in order to find out what actually happened here, we need to distinguish between the back-end (MakerDAO) and the front-end interface (Oasis).

A statement from MakerDAO made shortly after Ivan's tweet clarified that they were not involved with this incident. They reiterated that they are not in control of front-end interfaces such as Oasis that interact with MakerDAO vaults.

They stated that none of their own smart contracts were modified, and that they made no directives to confiscate the hacker's funds. In other words, it was the Oasis team who modified their smart contracts to retrieve the funds, and take ownership of the MakerDAO vault.

That being the case, how can we actually consider Oasis "decentralized finance"?

If a court can compel them to upgrade their smart contracts and take ownership of user funds, how are they any different from a traditional bank that can be ordered to suspend an account?

I'd argue the only difference here is that at least with Oasis, the entire process is transparent. Using a block explorer, anyone can see that the funds have been transferred to a new address. And at least we can then have an open discussion about it on Twitter... Or HIVE ;)

Fallout

On Twitter, some people didn't seem to have a problem with the protocol upgrade to confiscate the hacker's funds:

On the one hand, it's convenient to have these backdoors to recover funds from malicious hackers, but it also means that the account of an organization the government deems unsavory (Canadian truckers, maybe?) could be confiscated on a whim. It sort of defeats the purpose of crypto, if you think about it.

Of course, many Bitcoin maxis were out on Twitter celebrating this, as it demonstrates the not-so-decentralized nature of many DeFi smart contracts.

And it's a good point. If you keep your wealth in a self-custodied BTC wallet, no court order can be issued to confiscate it, as Bitcoin has no built-in smart contract capability.

This also applies to storing your wealth in any blockchain's native token, like ETH or HIVE, rather than depositing it into a smart contract that may be controlled by a centralized party.

Conclusion

While the headline was alarming, it would seem that DAI still remains a censorship-resistant stablecoin so long as you keep it out of centralized smart contracts. For 100% censorship-resistance, keep your wealth in a blockchain's native token.

What implications do you think this most recent incident with Oasis will have on users who have a large percentage of their wealth locked into centralized smart contracts?

Follow Me

If you found this article informative, please consider giving it a thumbs up and following me here on HIVE to catch my future articles. Thanks!

Sources

Image source: 1

Cointelegraph article: 1

Source Tweet: 1