Today we celebrate Leo Power Up Day or #LPUD in short. The idea is to power up, or stake, your liquid $LEO on the INLEO platform. Besides growing your influence and earning more LEO by simply upvoting, you also participate in LEO delegation raffles in which you can win some huge monthly delegations.

Today my power-up was 343 LEO which increased my total stake to 3,744 LEO. I'm still very far away from the 6k yearly LEO goal but if keep pushing really hard these final 1.5 months I believe I could make it 5k and achieve the Cub status.

HIVE

Besides powering up LEO, I also decided to stake some HIVE too. Just the other day I made an alarming discovery when I noticed the amount of my RC(resource credits) had drastically dropped from the usual 80-90% to as low as 37%! The main reason for this to happen was probably this delegation frenzy I have slipped into.

One of the cool things about Hive is the possibility of taking part in interesting upcoming projects by delegating Hive Power to certain accounts. In my opinion, this is the safest way to start earning the project's native assets while your delegated HP is growing.

For example, #holozing is an upcoming game on Hive which is currently distributing $ZING tokens in a couple of different ways. One of them is to simply own #posh tokens which would earn you ZING at an APR of 282%. I have to admit I was very tempted to buy a huge pile of POSH but instead chose the safer way to take part by delegating Hive Power to @zingtoken. So there it is, earning both interests on HIVE and ZING tokens.

I've also been delegating HP to a couple of other gaming projects, @wrestorgonline and @cryptocompany while earning $WOO and $CCD. If that wasn't enough, my largest HP delegation is @leo.voter. When we add all of these up, the total amount makes the most of my staked HIVE leaving me bleeding Resource Credits.

If I understood correctly, RC is for my activity on the chain and if it's delegated, it's for someone else to use. So, the lesson learned from the sudden RC drop is not to go totally crazy with delegating but also, to understand the importance of HIVE as an asset and why I should have it and get it more.

LEO

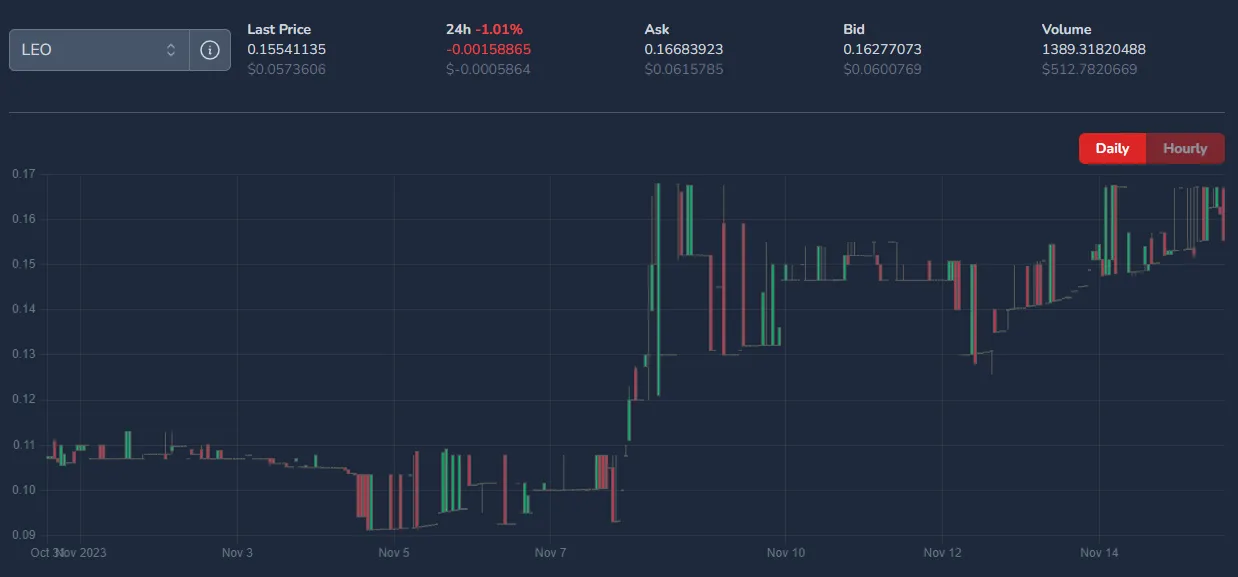

Almost from the very beginning of November, $LEO has drawn a good-looking chart and making long, green candles. From the monthly low of 0.0912 HIVE, the price of LEO has climbed to the current level of 0.155 HIVE.

This kind of positive price development is probably the sum of many things but there are a couple of ones worth mentioning that might have something to do with it.

- The hive backed dollar ($HBD) earned from Premium subscriptions is used to buy HIVE and LEO

- Ad revenue is used to buy LEO

Also, I feel the general vibe on INLEO is getting more and more vibrant and even though I haven't seen the stats of the monthly user base growing, I can see and feel positive buzzing on the main feed. Little by little this will be reflected in LEO price.

My Moves

The spread between buy and sell orders is now much thinner but about a week ago it was much larger and therefore I managed to make a nice series of trades. I sold a total of 100 LEO in two parts by setting up sell orders. Once they were filled, I immediately used that exact same amount of HIVE I got to make a single buy but bidding with a much lower price. The order was filled within a day and I ended up with a total of 128 LEO. These kinda little side hustles only serve one purpose - to grow my stack of LEO. Besides, it's quite fun once in a while. 🙂

RUNE

In addition to my activities on the Hive blockchain, THORChain and their native coin, $RUNE, have also been on my radar.

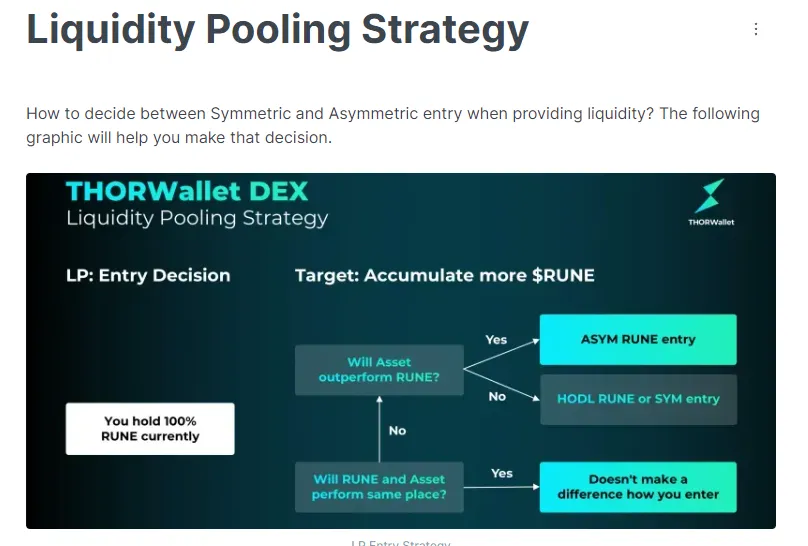

Just a few days ago I finished my liquidity pool test project with RUNE-CACAO pair on Maya Protocol. My goal was to increase my RUNE stack by jumping into LP with a one-sided, or asymmetrical RUNE entry. This means that even though I deposited only RUNE I was also exposed to the price movement of $CACAO which was the other side of the pair.

Here's a good graph that helped me a lot to understand the symmetric/asymmetric concept:

What I needed was CACAO to outperform RUNE as the pool was constantly re-balancing which meant if RUNE had outperformed CACOA, some of my RUNE would have moved to the CACAO side. This is called impermanent loss and since I didn't own any of that CACOA on the "other side", I would have had less RUNE if I had exited the pool.

Gladly this wasn't the case and CACOA, which has been flying with 411% weekly growth, did exactly what I was hoping for. So, I withdrew from the LP with more RUNE and took some profit by moving some to USDC at a time when BTC was starting to get shaky.

During the recent Bitcoin drop both RUNE and CACAO have shown some real strength and even moved past the levels they were at before the decline.

I've also moved away from stable positions and on THORChain I'm roughly now at:

33% $BTC

33% $RUNE

33% $CACAO

At the moment I'm monitoring the market while planning my next moves. In a scenario of Bitcoin starting to dominate, I could perhaps move that to RUNE and then further to CACOA. Also, if RUNE and especially CACOA would really skyrocket, I could "take profit" by moving some first to RUNE and then to BTC.

After a positive liquidity pool experience that could also be an option but this time I would consider the two-sided RUNE-CACAO pool.

CONCLUSION

I can almost smell the upcoming bull market, there's this good buzzing not only on Hive but in all of the crypto space. During the previous one, I was still pretty new to the game and didn't seize all the opportunities and at the same time, I didn't keep my head cool.

All sorts of projects will be launched at a rapid pace, some are good but some are not. DYOR(do your own research), "not your keys, not your coins", and other golden rules still apply so stay frosty.

As for trading, pooling, staking, and other degen hobbies of mine, I've learned to set goals and more importantly, to actually stick with them. Unless you have a clear exit strategy, it's really easy to get carried away and get lost in space.

Lastly, this is sort of a note to myself but the thing I will keep crystal clear in my mind is to prioritize projects that were built during the bear market or survived it. That was the ultimate test. One of those projects is of course INLEO and even though I've been grumpy sometimes, it's been absolutely amazing to be part of it as a user and to witness it taking shape.

See you there, thank you for reading!