Cyclical weakness

The chip sector is a cyclical business. There’s times when demand is higher then supply - like after Corona lockdown - and there‘s times like now when demand is weak. At least if you are not NVIDIA and have special customers. That explains why the prices of thise srocks are quite volatile but have in the case of Infineon (or NVIDIA) a clear upwards trend.

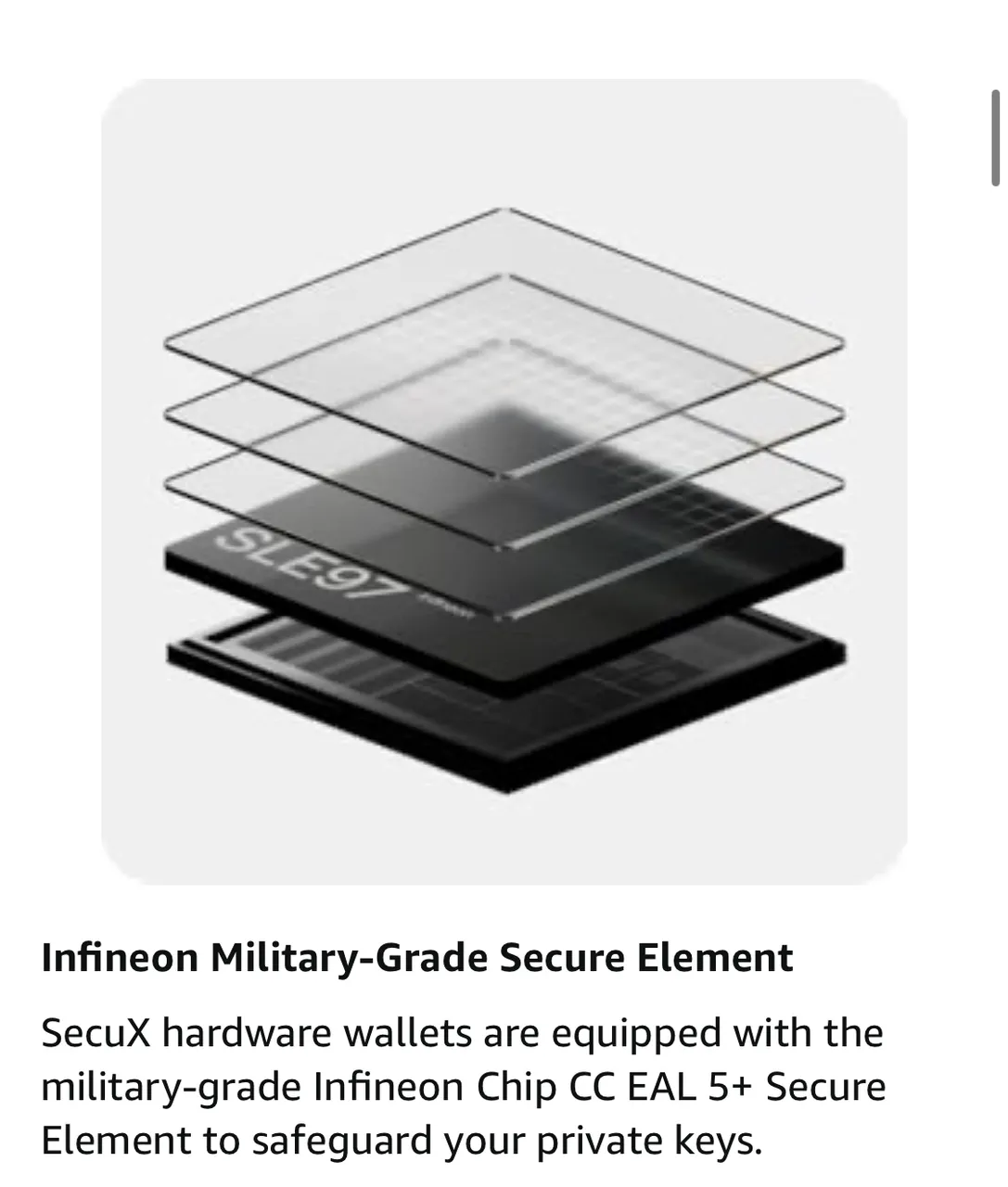

At the moment certain customer segments where the company is making good business are struggling like Automotive. The company is broadly positioned though and doesn’t depend on one segment only. In addition to the automotive sector they are producing chips for the energy sector and even for digital wallets. For example this one.

Chance to buy in cheap?

If you follow an anticyclical investment strategy times of weakness are normally a good time to buy. Infineon is trading with a 30% discount to its ATH of 43€. Over the past decade those dips have always been good buying opportunities. Same now?

The stock has performed very well the past decade with +300%. That’s much better than the german lead index DAX or even the S&P 500.

Personally I missed the Corona drop in 2020 and I see this dip now as an opportunity to build a position in this world leading innovative european chips company. Have begun with stacking via DCA.

Don’t expect a quick recovery though since world economy is still slowing but if you have a time horizon of several years this could turn out as an outperforming stock again.

What is your take on Infineon?