Ahhh... the joys of preparing tax returns in a Capital Gains regime when you hold even the smallest amount of crypto. Honestly, there will need to be an updating of tax reporting for these things, as they were designed in an age of glacially slow asset transactions. With crypto, you can easily blow out your transaction count pretty quickly just with a few trades or a smallest amount of on-chain interactions. And so, you need software to even stand a hope of keeping up... I use Cointracking, as that had per-transaction model of pricing instead of a subscription model. And it was what I started with, and I'm used to it!

But, like most tracking and tax reporting software... it has been also hampered by the fast moving pace of crypto assets appearing and disappearing overnight. Plus... the non-standard CSV and APIs coming from blockchains AND centralised exchanges. The one that really annoys me are the centralised exchanges... sure, blockchains are a herd of cats at best, and that is what decentralisation is all about... but centralised exchanges have no excuse to release and some sort of standard for their CSVs and API exports... and NOT change them constantly such that reporting software companies can't keep up.

Anyway, I have ended up finding that places like Coinbase and Binance have been pretty damn good with their exports... even though the Binance API is borked for me. They read easily and logically, and they are easily imported... but it is pretty much downhill from there...

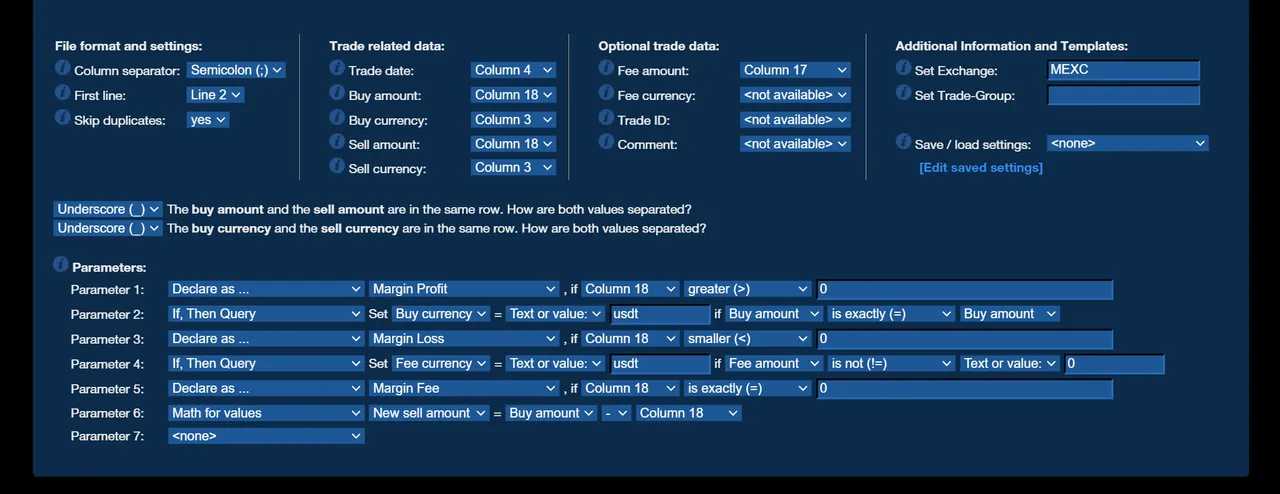

... in the end, I'm glad that Cointracking has lots of options for imports, even direct from blockchains... but most crucially, they allow for custom CSV/Excel imports... which means that I can load up a CSV, and then use the import logic to try and decipher the import into Cointracking. Sometimes, that does means some pre-cleaning of the CSVs... or sometimes just splitting them into groups so that the logic doesn't get too dense and prone to mistakes. It is time consuming, but when it works, it works... and it is pretty satisfying!

... and speaking of automated APIs... I've now stopped letting them run unchecked into the mail reporting account. I will now just spin up the API job for the tax year only and let it load into a test account... and the reason... well, lots of the lower tier CEXs end up reporting rubbish... which needs lots of manual cleaning once it is imported...

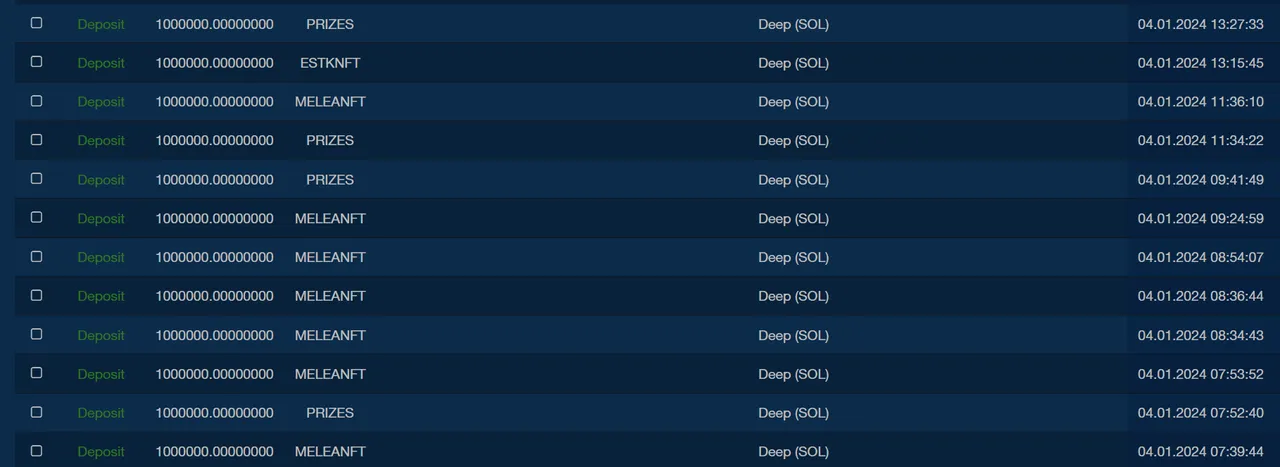

... and the blockchain imports are chockablock with spam transactions... ahem, SOLANA!!!!! Which means that there is a LOT of post import cleaning that is needed... thankfully, easy enough with the tools at your disposal in Cointracking... but still a bit of a pain. But better than manual IMPORTING!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Coinbase Wallet: Multi chain wallet with lots of opportunities to Learn and Earn!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

WooX: The centralised version of WooFi. Stake WOO for fee-free trades and free withdrawals! This link also gives you back 25% of the commission.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

KuCoin: I still use this exchange to take part in the Spotlight and Burning Drop launches.

MEXC: Accepts HIVE, and trades in most poopcoins! Join the casino!

ByBit: Leverage and spot trading, next Binance?

OkX: Again, another Binance contender?

Account banner by jimramones