BFT IAO (Initial Ape Offering)

Its my first time participating in a IAO, or Initial Ape Offering, or in other word participating in a token launch "BEFORE" it was launched. Now, you can argue that I was participating in Hive launch, but that was a hardfork, not a technically brand new launch. You can also say, I was (still am) in CUB, true. I got some airdrop based on my Leo position, but my Leo position was tiny, and most of the CUB I bought after the launch, in the open market. So that doesn't technically count either.

This is really first token launch participation before the launch. Mind you, I am no stranger to the process out there in the real world. I bought Google's IPO (Initial Public Offering), also bought Mastercard's IPO, these are the two big ones I remember, there are also numerous small ones, that I mostly forgotten by now. IPO, or the first launch of a stock, is a very involved process, only accredated investors can participate. In US, that is a quite specific definition :

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

A natural person who has an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person.

When I was a student, but trading, for the longest times, I hated this guidelines. Still do. Simply because it restricts the access to financial freedom from both directions:

It limits the access to the potential money pool if you are an incubator company and want to raise capital

It limits the access to the potential investor, who understands the risks and willing to take it, but are handicapped by this government rule, just because he/she doesn't have 'enough' money as per some government organization's opinion

IAO Process

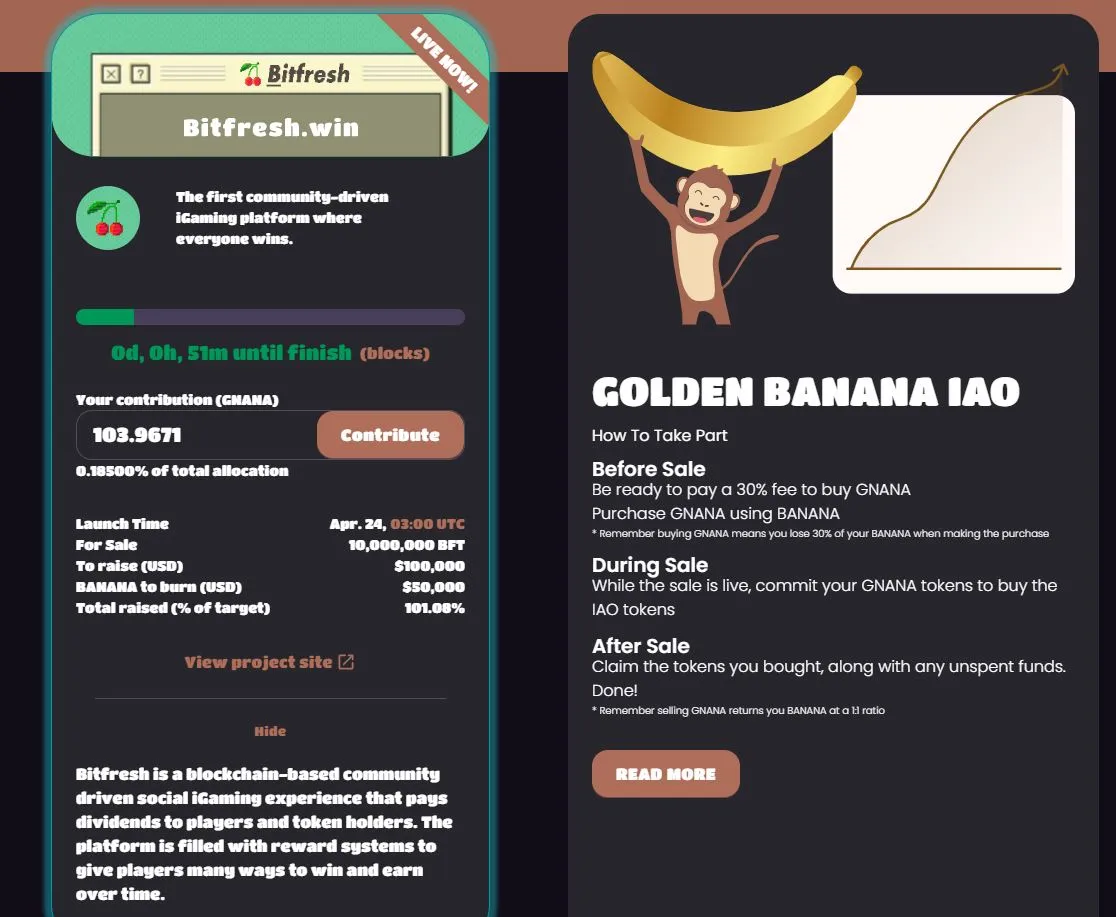

In comes, ApeSwap, which is a Decentralized Exchange / Automated Market Maker, Yield Farming, and Staking platform running on Binance Smart Chain. ApeSwap started in late February this year and offer 29 active farms + 15 active staking pools. This is fairly standard for most large BSC LP farms. ApeSwap also have a few innovative products and IAO is one of them. An Initial Ape Offering (IAO) is a fundraising activity for launching new tokens and bring liquidity to those tokens. Typically an investor commit their Banana-BNB LP token for the IAO and gets the new token in return. Also, just a couple of days back, investors can deposit their Golden Banana Tokens, and get the IAO token in return during the pre-determined 1-hour of IAO funding process.

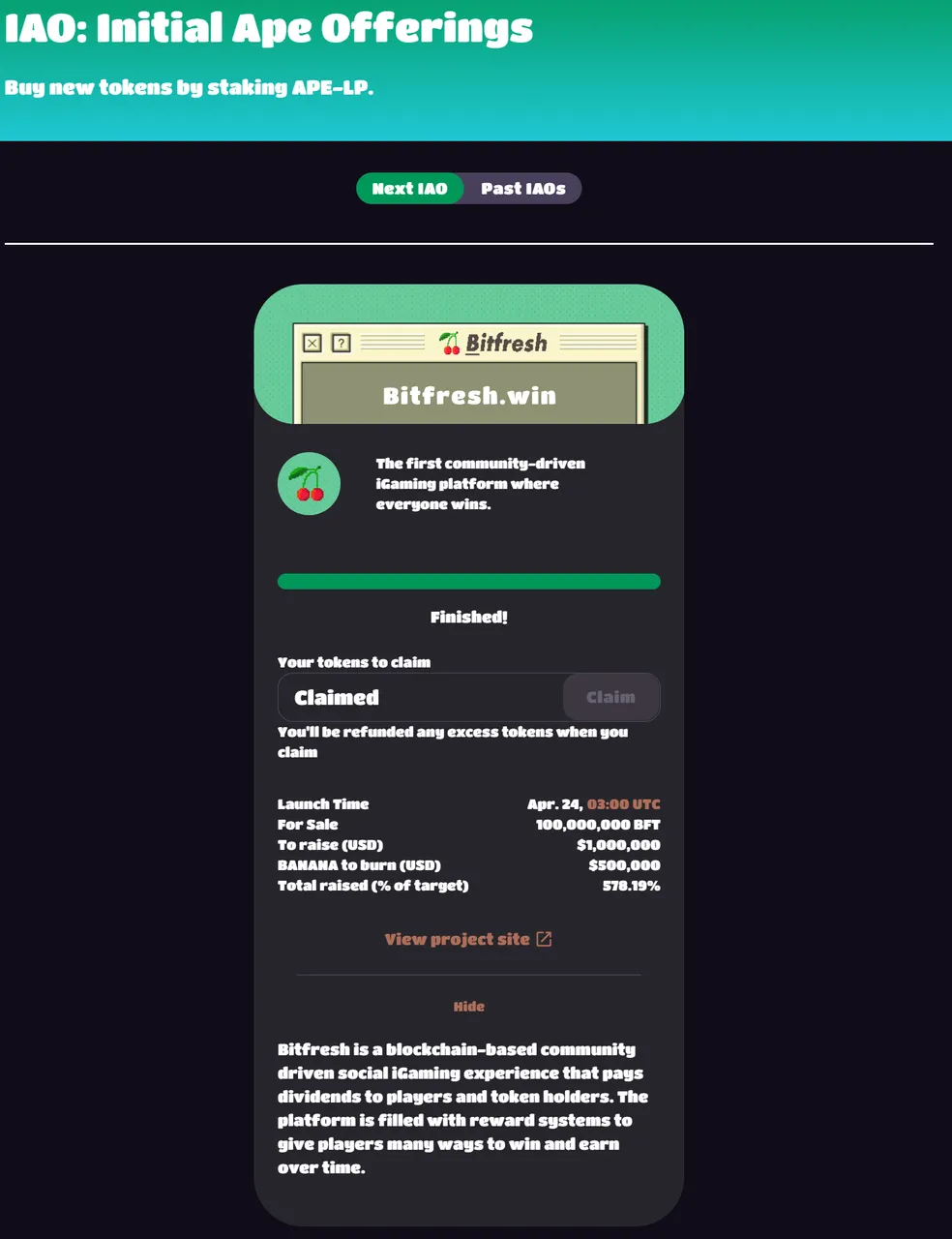

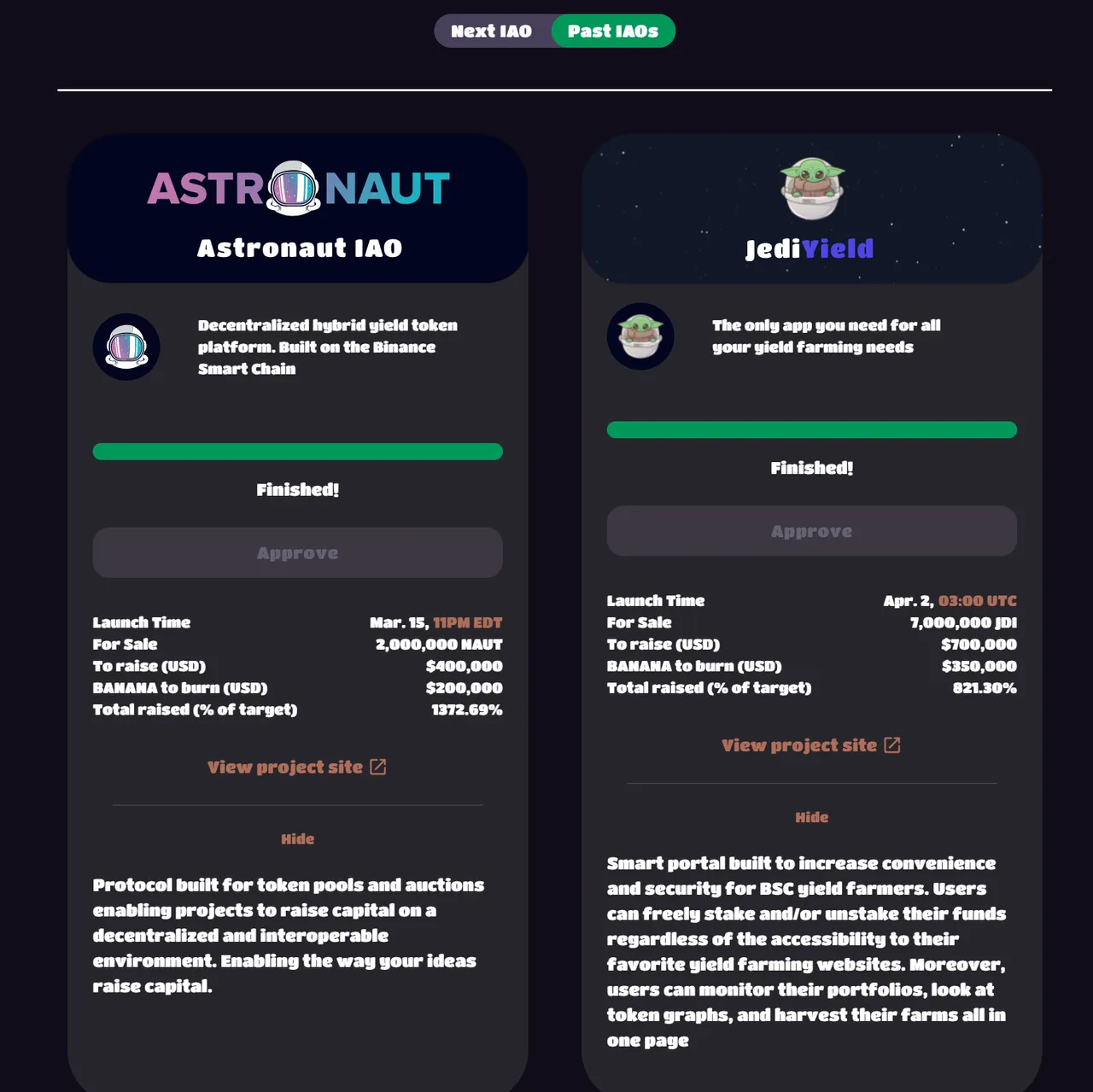

Funding is done via the "Overflow" sale method. In the “Overflow” method, users can put in as much or as little as they want to the IAO, and their final allocation will be based on the amount of funds they put in as a percentage of all funds put in by other users at the time the sale ends. Users will receive back any leftover funds when they claim their tokens after the sale. Please note, that it is not a direct purchase, until the IAO process is over, you won't know how many IAO token you will get. That depends on the subscription. I participated in the BFT IAOs at the ApeSwap platform. Prior to that there have been two previous IAOs. Images from above shows that Atronaut and Jediyield have been subscribed to 1372% and 821% respectively! Compared to that the BFT IAO was subcribed 578% (+ it had some golden IAO subscription, and target was higher than the previous two)

BFT IAO Process

Well it was 10PM Friday night! Reasonably comfortable time for me, but I hate to keep something on my calendar late night. Also that is the start, I went to bed past midnight. Let me run through the process.

- Slightly ahead of time, I have un-staked my Banana-BNB tokens (I love the silly way of flying banana animation!)

- I had about 83 odd LP tokens, when the clocks hit 03:00 UTC (10 PM CST) a button appreared to commit the LP tokens, and I committed all of them

- I also had about 100 odd Golden Banana tokens, (which I have purchased earlier using my banana tokens), I contributed those as well

- Withing 10 min time the BFT IAO was oversubscribed! Imagine raising 1M dollars in 10 min without much of a process!

After that I just watched capital invested to pile up. Then, at 11pm CST, I have been able to claim my BFT tokens. I think I got a total of 72210 BFT tokens. Below is the screen shot from my Metamask wallet.

Aftermath

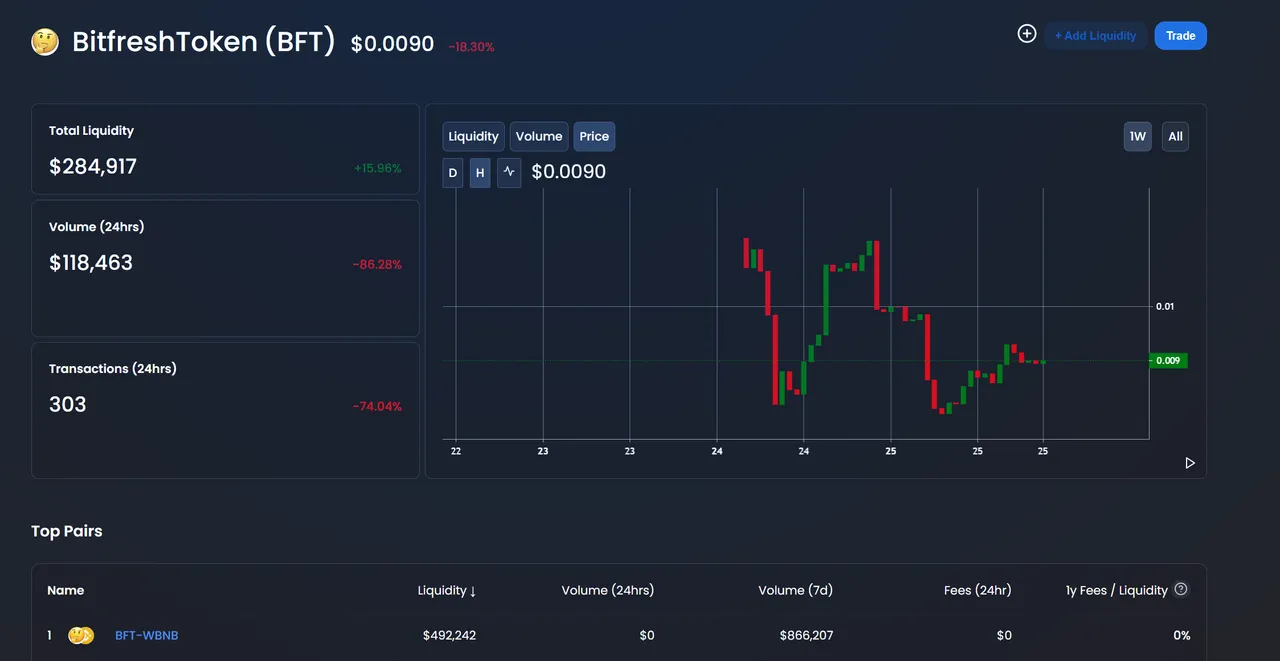

BFT token started trading immediately and I must say there was a lot of sellers in the beginning. This is also very common in IPOs. Below is the current chart of BFT, and its been trading between 0.008 - 0.011 so far. It is a blockchain gambling project and it is currently in alpha, so I do not expect any strong price action soon. My intent was to understand the IAO process as oppposed to speculate on the BFT token itself.

https://info.apeswap.finance/token/0xa4f93159ce0a4b533b443c74b89967c60a5969f8

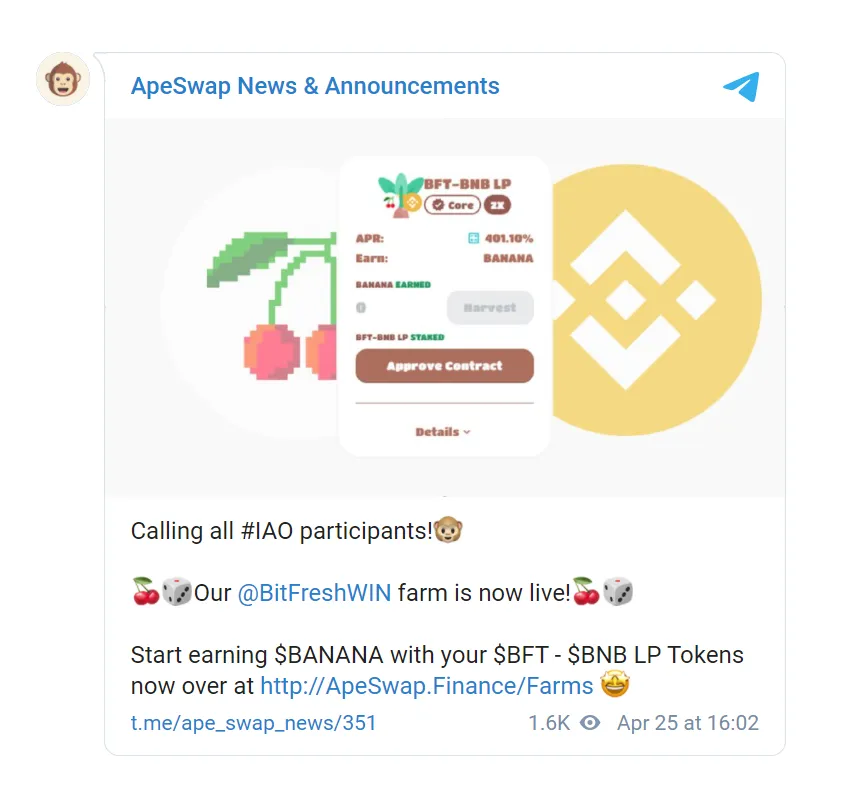

After a couple of days, yesterday actually, BFT-BNB pair was launched in the ApeSwap farm. ApeSwap has a very active team and they keep us updated well in Telegram, Twitter and Discord.

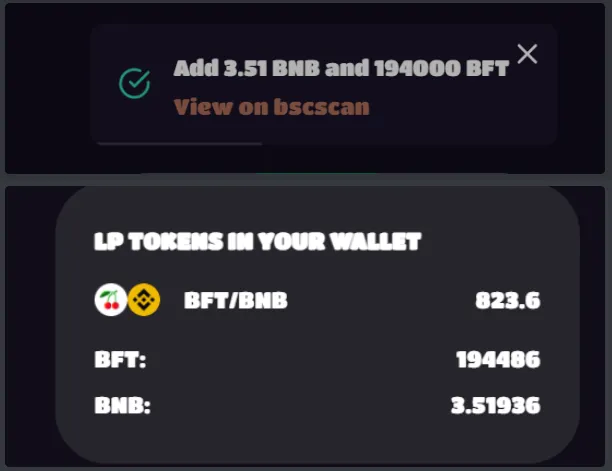

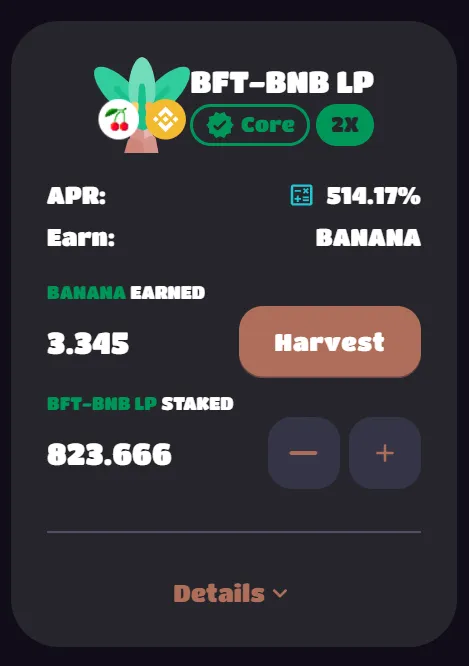

Immediately after that, I bought some additional BFT from the market as it is trading below the IAO price. I combined my total BFT (about 194K with 3.5 BNB) to get 823.6 BFT-BNB LP token. This I promptly staked.

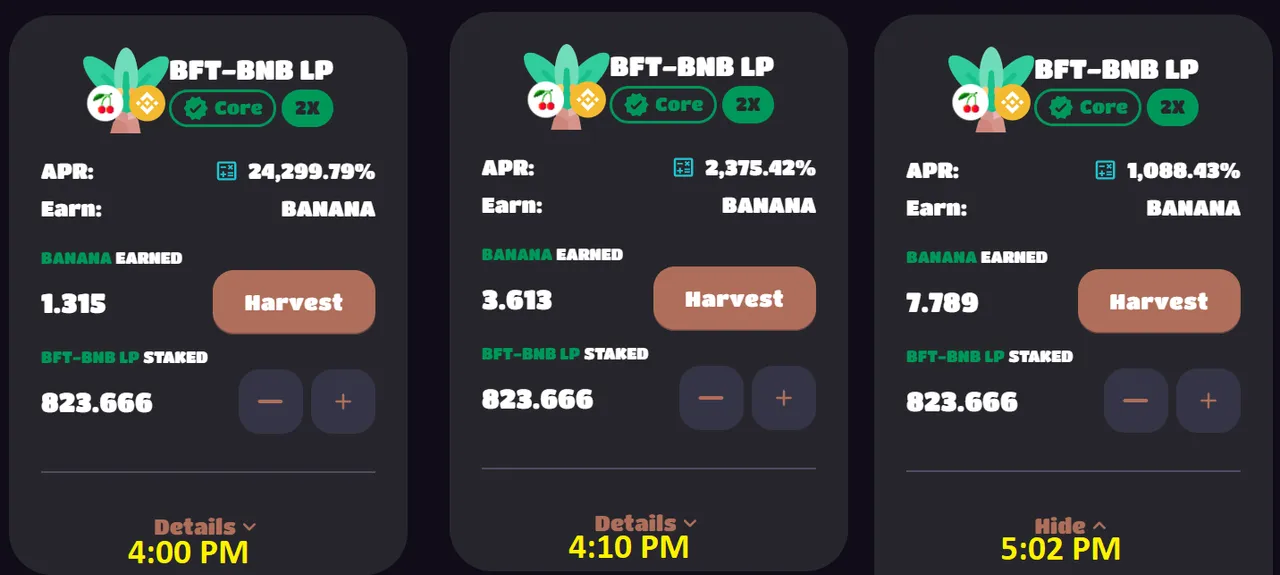

Initially the yield APR was crazy high, as is normal for most of the new LPs, but soon it drops to a more reasonable number. This time I kept a record of the early drop of APR, so that I can refer to it in future.

As you can see it is a fairly rapid drop. And as an early investor, I was rewarded about say 5 Bananas, at market price of that time it is about $5. Currently it is about 500%. I have proven, most normal token's yield is about 300%, or daily yield of about 1%. I am sure BFT is heading that way.

So that is my little adventure into the world of IAO. I am sure there is more to come in the future. Most interesting item on this from a personal point of view is to see the rally of Banana price immediately after the IAO, and I like to say, due to the Banana burns! Below of the yield comparison of common project. Nearly $10/day return for $1000 invested translated to 1% daily return

Price & Yield Comparison

| Project | CUB | BANANA | EGG |

|---|---|---|---|

| Current Price | 3.06 | 1.615 | 14.287 |

| Token/$1000/day | 2.76 | 6.95 | 0.59 |

| $Return/$1000/day | 8.44 | 11.22 | 8.42 |

| $TVL | 18.46 M | 88.79 M | 113.93 M |

| Project Start Date | Mar 09, 2021 | Feb 21, 2021 | Feb 11, 2021 |

Current prices and yield at the time of writing (updated at 03:40 PM CST, 04/26/2021)

Finally, this is the best looking chart for Banana I have found! It is getting some serious momentum!

https://dex.guru/token/0x603c7f932ed1fc6575303d8fb018fdcbb0f39a95-eth