Our weekly report for both delegators and token-holders of M.

Delegators have received their token distribution and token-holders see the price rise to increase their value this week.

M News

As promised last week, we have been able to increase our buyback price today by a further 0.1 cents. However, actual income has dropped a little, in line with the Hive blockchain yield.

After procrastinating for many weeks, I have decided what to do with M.

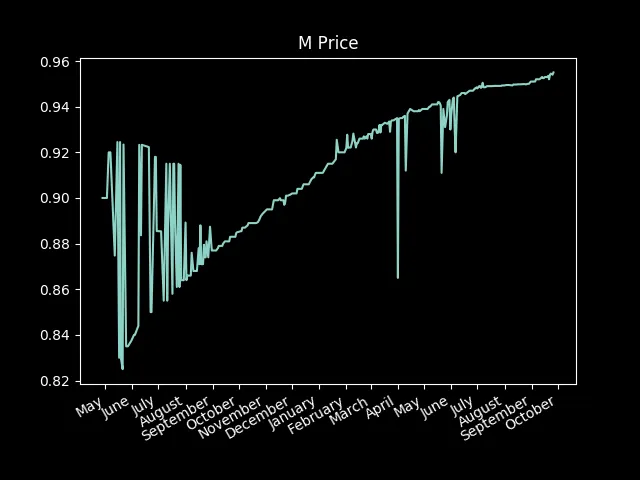

For those delegators with at least 100 HP, we shall continue as normal until we reach a price 0.960 HIVE. The price shall then be frozen and token distributions shall then continue for just 1 further week from that point. Because of the lengthy powering-down process, full buybacks will take somewhat longer. We have plenty of cash to cover our asset-backed tokens - which is why they are asset-backed!

Those with under 100 HP delegated, will see their last token distribution next week, Monday, 4 October, 2021.

No further new delegations shall be accepted.

I don't really wish to tag a long list of users - paying attention has its benefits - but will do so near the end, if the need arises.

We continue to navigate through a volatile period. It remains interesting to see that what may be good for HIVE need not always be so good for the tokens priced in HIVE.

The Numbers

Distribution to delegators = 0.191% = 10.0% APR

Buyback price = 0.9550 HIVE (+0.001) = +5.6% APY

Hive gross actual vote = 19.5% APR (-0.1)

Hive net author rewards = 9.3% APR (-0.6)

Dlease Hive lease max = 10.0% APR (-3.2)

The Hive vote estimates are calculated based on the average weekly prices. The "gross actual vote" is now calculated based on our HP and is the same as the old "gross linear vote", that we have now removed; the "net author rewards" estimates the payouts adjusted for HBD and assuming a "gross actual vote".

Minimum delegation is 100 HP. Changes in delegation, including new ones, start earning rewards after 2 days.

Existing delegators under 100 HP who change their delegation must then conform to the new minimum or forfeit earnings.

The buyback price increase is shown as an APY because members are automatically compounding their tokens, whereas the distribution uses an APR value as that reflects the delegation income. Older-style info can be seen in our last post using the old format. The new format is explained in more detail here.

The story of M:

Have a fine week!

Any questions, please ask in the comments below or in our public chatroom.

[BUY MPATH] - [READ MPATH]

[BUY M token] - [READ M posts]