Source: Screenshot of some of the top stories related to Carbon Tax in Canada today.

So, if you're not a Canadian citizen, this may not be news that you're aware of, but it's super topical here right now for a number of reasons. For those of you not following Canadian news an politics, I'll give a brief summary to catch you up.

The Liberals and Justin Trudeau introduced the tax in 2018, anticipating that it would remove an average of 50 million tonnes of CO2 per year. They recently increased that tax price as of April 1st, while at the same time increasing salaries to every member of parliament. Talk about a fun April Fools! The joke's on all of us, as we deal with massive inflation, wage growth that doesn't keep up with cost of living, and taxes that "are for the environment" and "provide rebates you'll probably make more off of"!

Carbon pricing in Canada is forecast by Environment Canada to remove 50-60 MT of emissions from the air annually by 2022, which represents about 12% of all Canadian emissions. However, Canada needs to reduce emissions to 512 MT by 2030 to meet its Paris Climate Change Accord. This would mean reducing annual emissions by about 200MT from the 2018 levels. In addition to carbon pricing, the government is pursuing a range of additional policies including improving fuel standards, energy efficiency, and closing coal plants.[50]

Source: https://en.wikipedia.org/wiki/Carbon_pricing_in_Canada

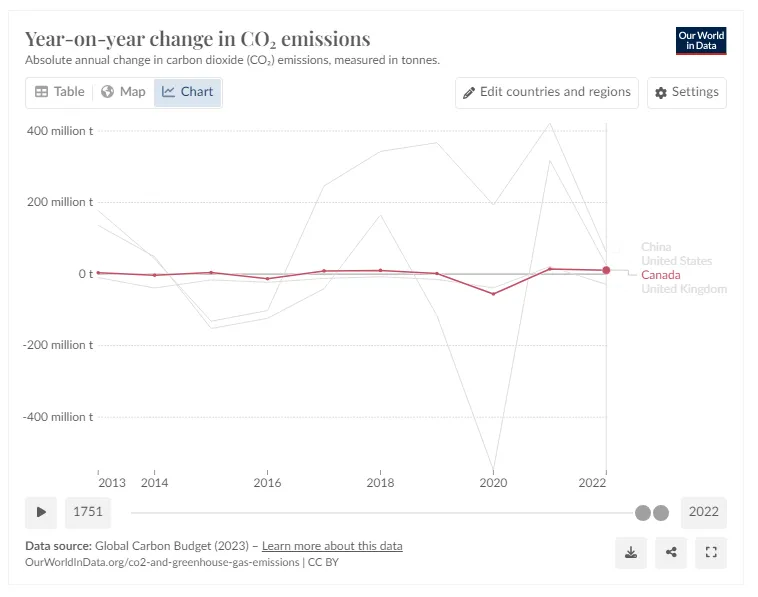

So, how has that gone? About as well as you'd expect from a tax that effectively punishes the working class:

In 2020, we did manage a net negative in emissions of about 50 million tonnes... but then increased in 2021 and 2022. We have no data on 2023, but the data we do have doesn't suggest that we'll that -50MT y-o-y that they forecasted.

And, let's be real - of course, we won't see that, because the Carbon Tax is purely punitive. On paper, it's supposed to push the average Canadian into investing in more efficient technologies and using our vehicles less.

They said then, in 2018:

"Consumers and households will save money over the long term by improving energy efficiency (such as better insulation) and using cleaner technologies such as smart thermostats. As new technologies become available, their cost will likely fall, and they will likely become more widely available and effective over time."

But over 1/3rd of Canadians are renters, and when was the last time you stepped into a rental that was equipped with a Smart Furnace? Of those 2/3rds that own their homes, how many are investing in things like home solar systems, energy-efficient appliances, and all the rest? Who can possibly afford to?

We've already seen that the estimations they gave us in 2018 when they instituted this were wildly inaccurate. We hit -50MT once, and it hasn't happened again since. But the government gets to pull in a few billion dollars per year, set it in an account to gain interest, and then dole that back out to us in the form of rebates.

Yay.

Most Canadian cities suck for public transit, making that a non-viable option for the vast majority of the working class. Hybrid or full-EV vehicles may help, provided you live in a city with charging stations available, and the money to buy one. A lot of folks simply don't have that luxury, in the same way as they don't have the luxury of being able to install solar. So, every single time we turn on a vehicle to get to work, we're being hit with carbon tax in the form of gas use - which we have to use because if we don't work we don't get paid. There's a fun cycle for you.

But on top of that, everything that is trucked anywhere in the whole damned country also is hit with carbon pricing, and it's not like we can just stop having trucks deliver goods to fucking Walmart or any of the other businesses out there. So those prices go up to compensate, and the average person in effect gets hit with a secondary tax on everything we buy.

And, in the end, what does all that taxed money do? It generates revenue for the government. Which they use for... what? Who knows! They can use that for whatever they want, because the interest gained is free money for them. They pass the buck by saying 'well, your local governments could be using this to put towards green initiatives but instead they provide you rebates'. So the Feds get to wash their hands of doing nothing, while the Provinces do the best they can to not have folks riot.

All the while, Canada produces 1.89% of the CO2 emissions we're hoping to curb.

(Source: https://www.worldometers.info/co2-emissions/co2-emissions-by-country/)

Now, 1.89% does still leave us in 7th place globally, so it's not insignificant but no amount of reduction in Canada is going to offset the emissions China makes, and the money we're taxed isn't even being effectively used, which for me, personally, is the biggest kick in the teeth.

I don't even really care if we do pay a bit more at the pump, but what's the fucking point if, at the end of the day, those proceeds aren't being effectively used to invest in green initiatives?

We could be taking the percent of revenue the government collects and investing in solar, wind, and nuclear. Instead, we still have 9 coal-burning power plants active in the country, with hopes to shut them down by 2030. Instead, we have a black box on the spending, with the only details being that it'll be "directed to programs to help businesses, schools, municipalities and other grant recipients reduce their fossil fuel consumption."

Note that this says: grant recipients. So, for folks that request funds, and are approved, those will come from this pool of money. Which is all well and good except it's entirely reactive and not proactive. It shifts the focus once again from the government not doing anything useful to "oh, well, folks just haven't done what we needed them to, to get this funding" - a song and dance that the government (either party), just loves to play.

All while the PM sits on a 400k/year salary, while all the MP's sit on 200k/year, and pat themselves on the back as they fly around the country on the taxpayer's dime.

But hey, don't worry, the carbon is being taxed. 🙄