Like specialized charts that help merchants to pick values and wares, crypto charts are utilized to settle on better speculation choices while managing cryptos.

Crypto charts are graphical portrayals of authentic value, volumes, and time spans. The outlines structure designs in view of the past value developments of the computerized cash and are utilized to detect speculation open doors. To comprehend how to peruse a crypto chart, we should examine a Japanese Candle outline.

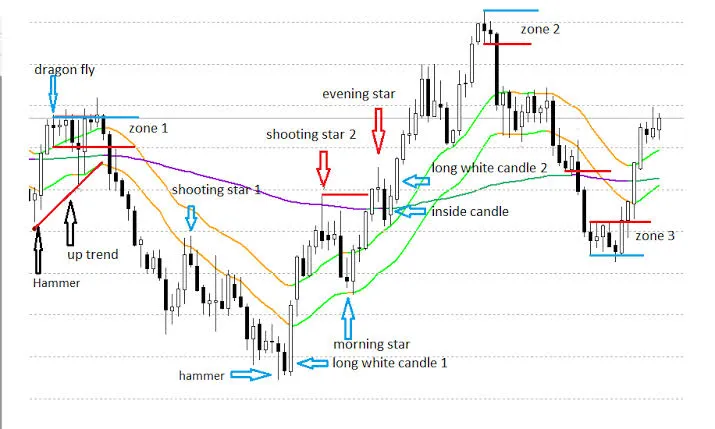

A Japanese Candle is among the as often as possible utilized outlines by crypto merchants. To decipher the chart above, you ought to know that a flame is addressed in red while the end cost is lower than the beginning cost during a predetermined time span. This implies the cost of the resource declined. Interestingly, the green light shows that the end cost was more prominent than the beginning cost. This shows that the resource's cost rose. These candle graphs structure a few examples. Contingent upon the shape, variety and size of the candle, merchants take positions or make changes in their exchanging techniques.

(1)Bullish and Bearish Patterns

Designs shaped on the graphs fall into two classes: Bullish reversal pattern and Bearish reversal Patterns For example, a Mallet Flame Example is a bullish reversal pattern which lets us know that a stock is approaching base in a downtrend. The body of the candle is short which addresses the top of the mallet while the more extended wick is an indication that dealers are driving costs low during an exchanging meeting, which would be trailed areas of strength for by strain to end the meeting on a higher portion. The vertical pattern should be affirmed by watching it intently for several days and the inversion ought to likewise be approved by an ascent in exchanging volume.

(2)Shooting Star Candle Pattern

A shooting star candle pattern is a bearish reversal pattern that happens at the level of a meeting prior to switching down. This example comprises of a flame with a long upper wick and a little body, as should be visible in the picture above. A falling star candle design shows drive-by purchasers which are met by obstructions.

(3) Wedge's

The example that is framed in the above picture is a wedge. They seem when a pattern begins to settle down lastly brings about a breakout. Showcases frequently move sideways to wedge to and fro until they move into a firm bearing.

(4) Support and Resistance

Understanding support and resistance are one of the most pivotal pieces of perusing a crypto diagram. Support levels in outlines allude to a cost level that the resource doesn't fall underneath for a proper period. Interestingly, resistance level alludes to the cost at which the resource isn't supposed to ascend any higher. This is the level at which the dealers dwarf purchasers on the lookout for a specific computerized resource. Specialists are known to propose support and resistance levels to help merchants while taking situations in crypto.

So this is about Crypto charts. I hope that all of you like this explaination about Crypto charts. Thanks for your kind review ☺️.