Design By Canva

Hello HIVE Learners Community! Welcome to my blog. Inflation rate is now in worst state throughout the world. To get relief from its adverse effects, we need to educate ourselves about Financial Literacy. People who didn't know anything about it, they can't manage their life well. I've seen these sorts of people are pressed under the burden of loans and sever poverty. Hence, we can't nullify the importance of this topic. Either they are market dealing, business or job, everything has direct or indirect relationship with money management. Either you are making a budget or you are saving your assets in the banks, you should learn different aspects of Finance. We should use our money effectively. We should have a proper investment channel to lessen the burden of expenses. We should learn how to design a budget, we should learn how to save money and we should learn how to decrease the loan ratios in couple of months.

What is Financial Literacy?

Financial Literacy refers to the effective decisions in money management. It includes money budgeting, savings, debt management and retirement planning. To get freedom from financial Stress, financial management is essential. We should get Training as well as Educational Workshop about it. There are several applications available that can help out in effective money management.

My Financial Experience

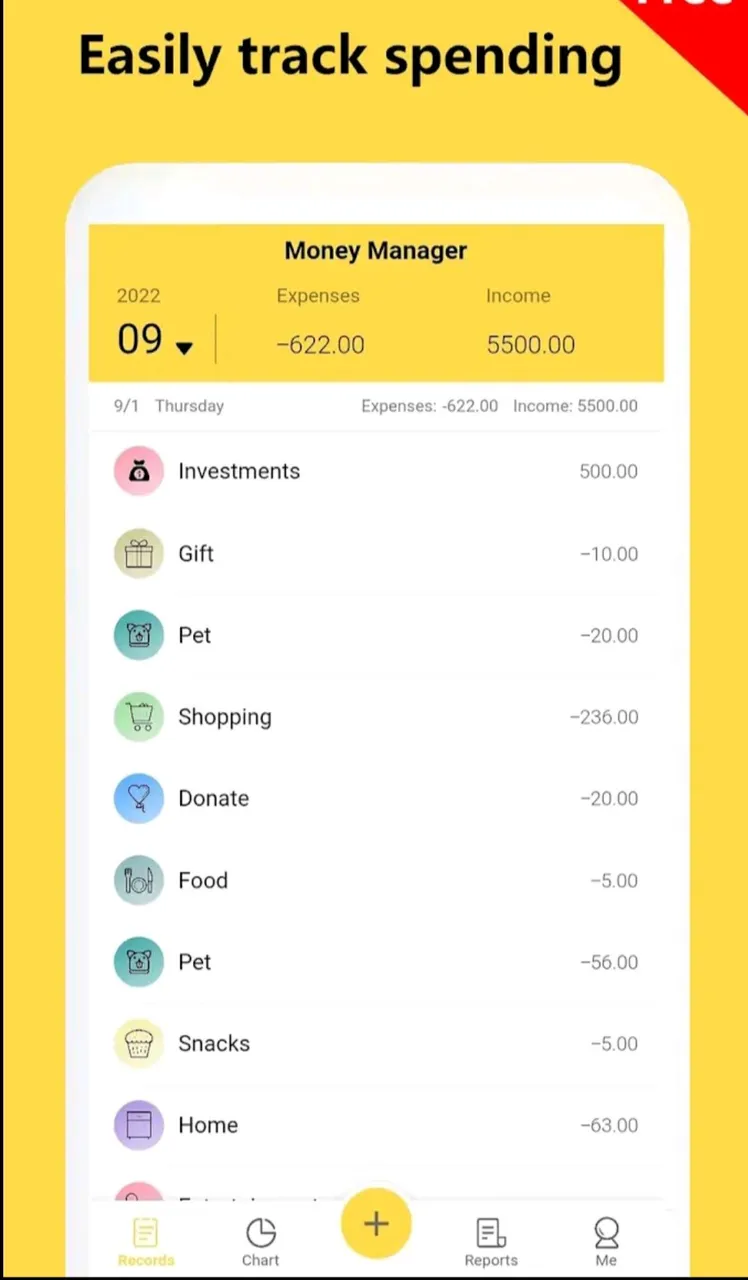

Last year at University, my expenses exceeded badly. As a result, I've to take loans from my friends. Although my friends helped me in giving loan to me but I failed in returning their money on time. It was all due to my financial ignorance. I was stressed because it was final year and everyone needed to clear the dealing with friends. One of my friends asked me to get financial Literacy from University Workshop as he was known that I'm facing financial troubles. To attend this workshop, I also needed money to pay class challan. Anyway I managed this money from another friend as well. After getting Financial Literacy Training, I came to realise the importance of savings in money management. From my first year to last year, I had not saved anything. Now I decided to save money in either case. Moreover, I also downloaded following application that helped me in controlling my expenses, debts and budget. You can download this application from Google Play store.

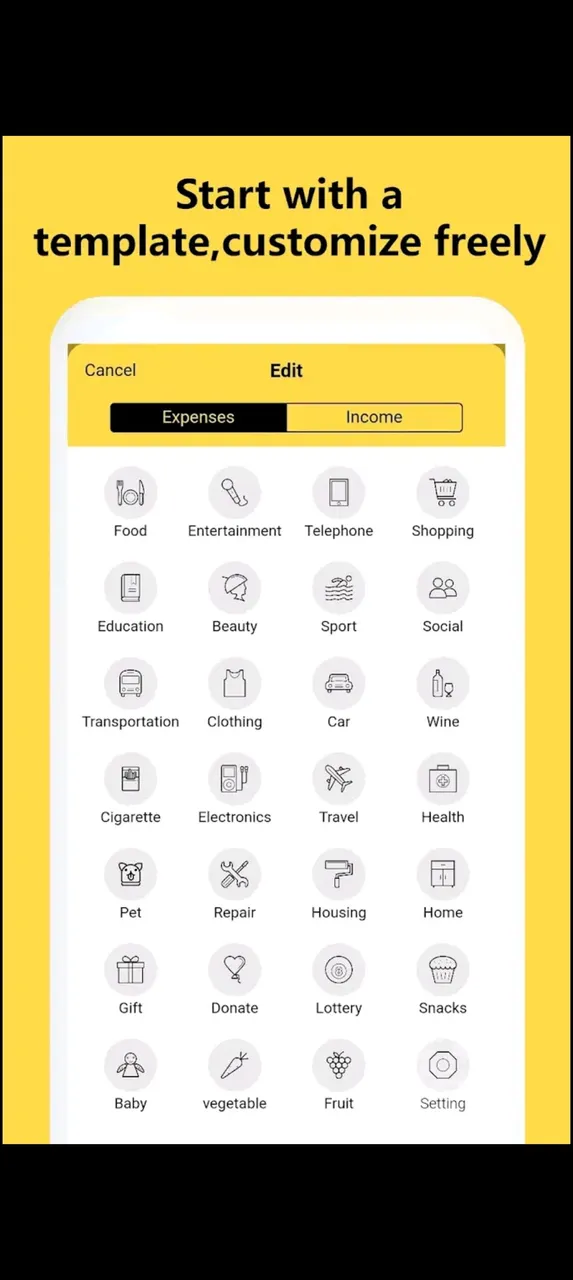

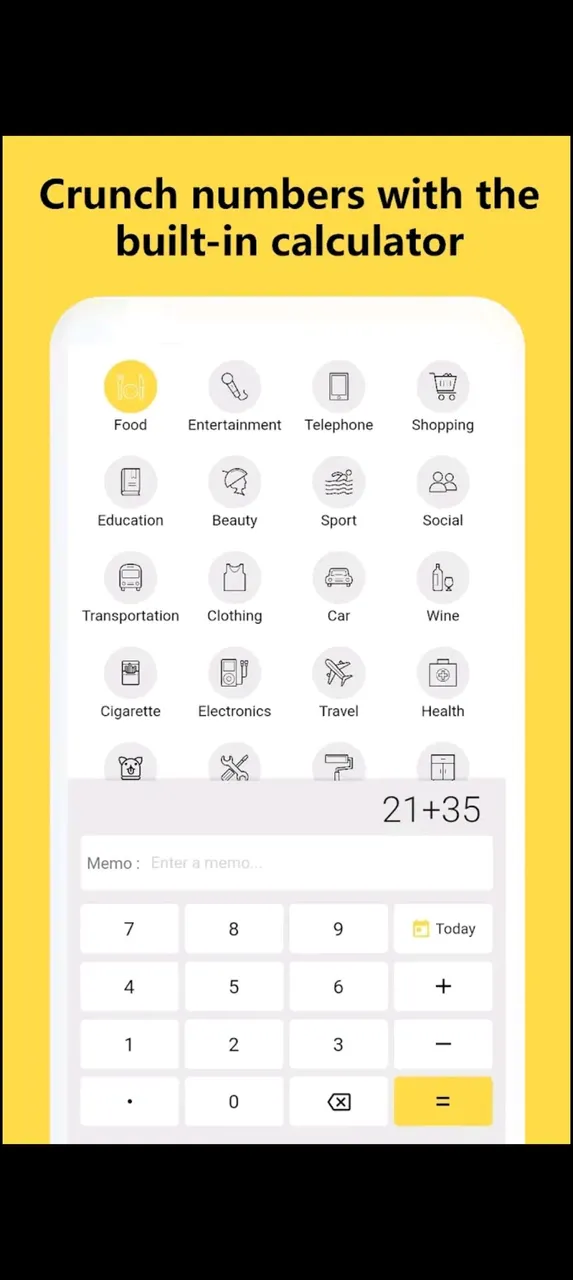

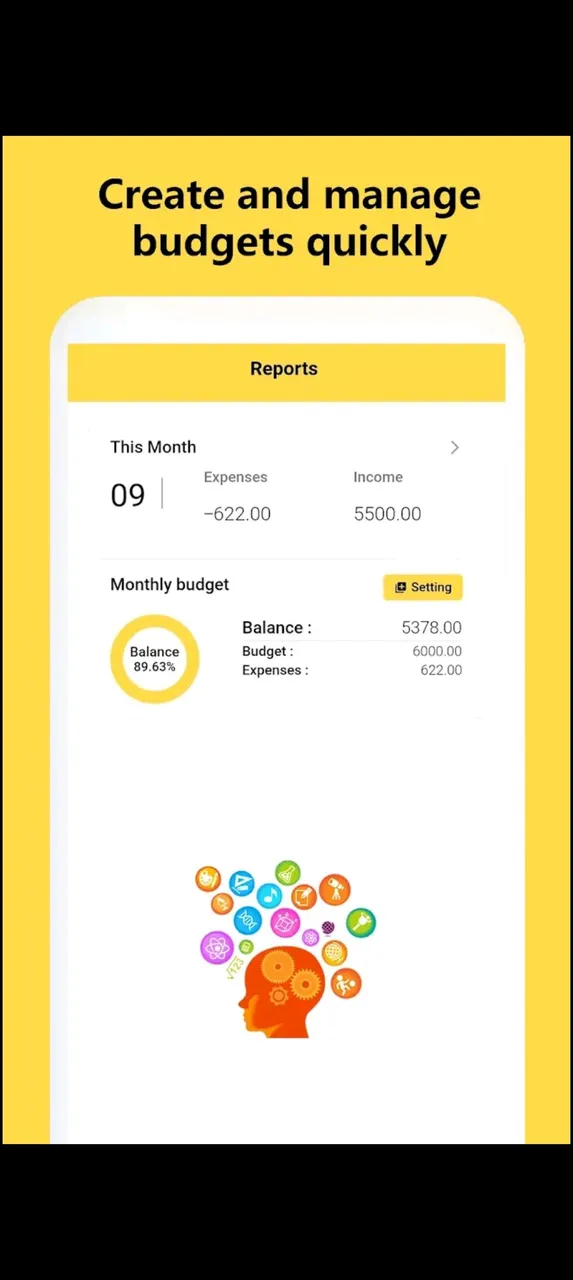

This application is good regarding different activities. You can save here your pocket money/salary, expenses, Income and loan. It will calculate your each expenses, leave some tips in notifications to save you from budget exceeding. It is fast and best calculation marker in 2024. You can see it's benefits after its use.

Conclusion

We should learn about money management especially learning about how to balance our income and expenses. It is essential to save ourselves from financial stress. There are several online courses available for Financial Literacy. We can do them on Coursea as well as we can get classes about it if any institute provides workshops regarding Financial Literacy. Additionally, if you didn't have time and can't afford workshops then you can manage your income and expenses through different Google Play store applications. I shall highly recommend you Money Manager. I'm currently using this application and it is fantastic regarding money management. Loan pressure, budget exceeding and negative behaviour towards financial literacy can result into big loss. For a smooth and happy life, we should be aware about effective ways to control money consumption.

This post is my entry for HL Weekly Featured Content Financial Literacy. I hope you will enjoy my post. Thanks!