These are two easy yet fundamental questions that you may ask and depending on who you ask, you may get different answers! First lets check out the definitions of these two terms, how to calculate them and why it is important.

Market Cap = Price (X times) Circulating Supply

Wherever you go, coinmarketcap, coingecko or Bitpanda, this is the standard defintion to calculate the market cap. Here you can see their example for Bitcoin.

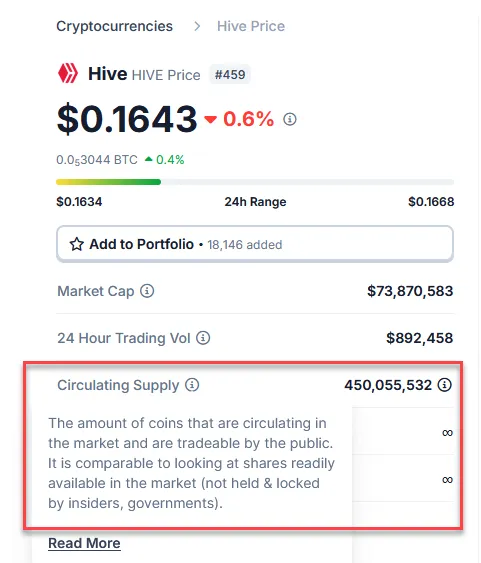

A key thing to note here is Circulating Supply. In particular this is highlighted by both coingecko and coinmarketcap as such:

Circulating supply excludes locked up shares such as those held by a DAO and not publicly tradable. This is important and a good reason why we follow unlock calendars for cryptos as we know this will clearly dilute the overall market cap if it unlocks.

So what is Hive's market cap? It should be straightforward to calculate now we know all the variables and the caclulation is very easy.

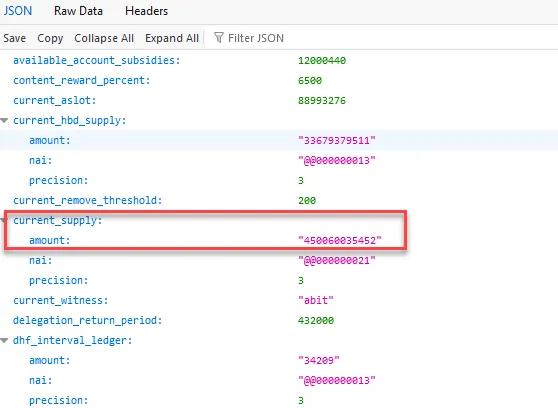

We can take the Hive circulating supply from the Hive Explorer API here that shows

450,060,035 Hive current supply.

We then need to take the locked up DAO Hive that is not freely circulating, but actually being converted into HBD slowly. You can find this number by checking the DAO account @hive.fund and you will see:

40,870,646 Hive

If we then remove the fixed DAO supply from the Hive Total Supply, we would be left with: 450,060,035 - 40,870,646 = 409,189,389 Hive

We are then almost complete with the equation and must just take the latest Hive price from the internal market/coingecko or Binance. For me they were almost harmonised on $0,1644.

Market Cap = Price (X times) Circulating Supply

$67,270,735 = $0,1644 x 409,189,389 Hive

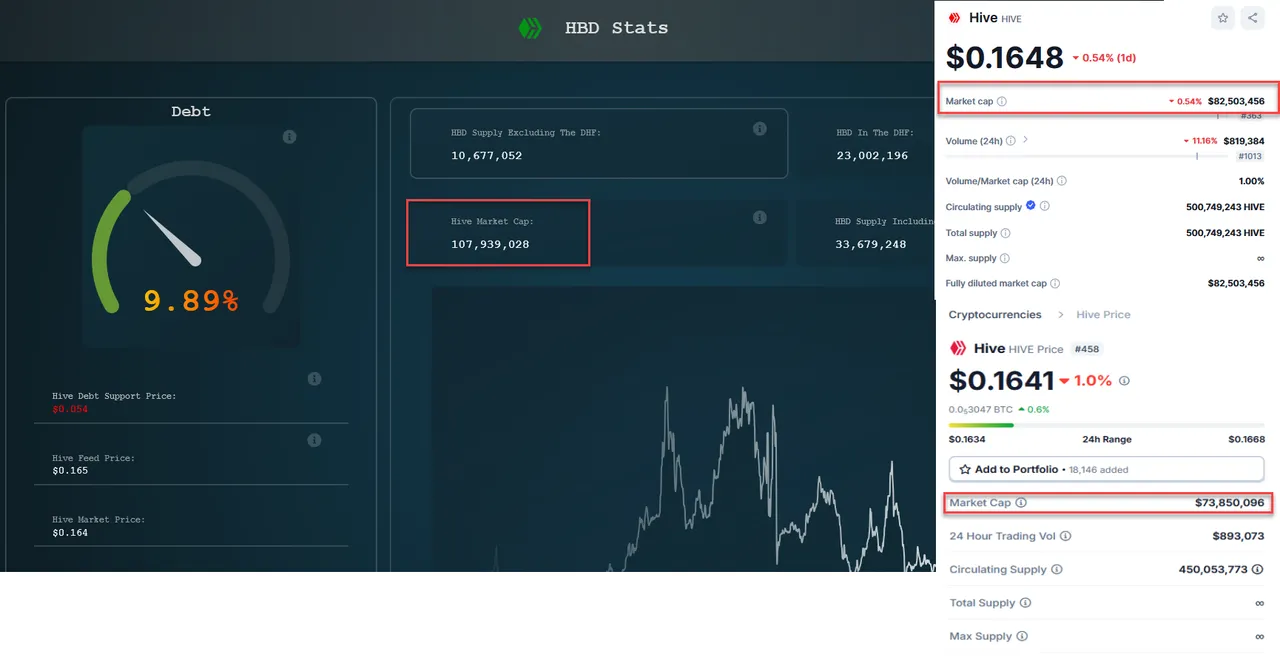

Therefore the marketcap of Hive is just over $67m. You may be wondering then, how could coinmarketcap, coingecko and HBDstats.com all have different numbers?

I think it is mostly that coinmarketcap and coingecko do not understand the DAO/HBD debt dynamic and do not spend much time to figure this out, although coingecko tries to give the most accurate picture but is not aware of the fixed DAO Hive amount.

With regards to HBDStats, although it says Hive Market Cap, its calculation includes not only the circulating supply, but like coingecko, the fixed DAO part (450M) and then a conversion of the HBD held outside of the DAO converted to Hive as though it is equity. Yes the $10.7M HBD DEBT is included and labeled equity which massively inflates this number. $107m - $67m is a $40m inflation of the Hive Market Cap!!!

Why is this important? Well lets move onto the debt limit and find out.

HBD Debt Limit

So we already know the market cap calculated above, now lets look at the debt which is HBD in the Hive world. We can get the total HBD supply from the API above where it shows 33,679,379 HBD, which if we say that it is at peg, also = $33.67m.

We can then see that 33,679,379 / 67,270,735 = 50,07%.

Yes, including the Hive DAO HBD, the current debt limit is just over 50%!!! But should we include the DAO HBD in the debt limit? As the DAO is paying out around $250k per month to projects vs. around $100k HBD interest to HBD outside of the DAO, it would make sense to include it in any debt limit, as it is now debt being serviced!!!

If we did fictively remove the DAO HBD debt and look at the impact of HBD outside of the DAO, how does the debt limit look now?

We can take the total HBD from the Hiveexplorer API above and and minus the amount of HBD held in the DAO wallet shown above 23,002,194 HBD. Therefore we get 33,679.379 - 23,002,194 = 10,677,185 HBD/$

The debt limit would then be excluding the DAO:

10,677,185 / 67,270,735 = 15,87%

Conclusions

With the recent crash in Hive price from $0,3x to $0,16x area, it has massively lowered the market cap which in turn has increased the debt limit to more than 50%. We can see that the DAO is the majority of the debt at over 34% and that it is the biggest monthly outlay.

How Does Hive Blockchain calculate the Market Cap and Debt Limit?

If you check hbdstats.com, you can see the RESULTS of how it is calculated on chain or read this technical post, to see the details of the way the market cap and debt limits are calculated on chain, this is to say, the blockchain has other assumptions that it uses instead of the generally accepted way that aggregators like coinmarketcap or coingecko would accept.

Although the term marketcap is used, it is referring to something called the Hive "Virtual Supply", which is a fictive calculation including all circulating Hive and non circulating Hive from the DAO = 450M, plus the total of the HBD Debt held outside of the DAO converted to Hive. So $10.7m of HBD is converted to Hive and added to this figure to bump up the number giving around $107m "Market Cap" although it is not market cap of course.

The debt limit used for the soft and hard limits are then used against this "Virtual Supply" number... so $10.7m / $107.9m = ~9.9%. Which of course is way below my real calculation of the debt limit.

So to summarise, the blockchain only considers the debt outside of the DAO, plus it adds on the debt to the market cap which is really odd because why would you add the debt to the equity part of the ratio you are trying to find the limit for?

Consequences

What does this all mean you might ask?

The Hive total debt is already at over 50%, so the value of HBD is higher than HIVE itself!! The Hive equity supporting the HBD debt is becoming smaller and smaller and the debt burden more onerous.

It means the debt limit is being massively understated on-chain and it is not a FIXED debt limit of 30%, but a dynamic debt limit that fluctuates with the size of the HBD held outside of the DAO!

If the HBD stays around the same proportion as now, the hair cut will kick in at a real debt limit (excluding DAO) of around 45-50%! Of course, the DAO debt will be so high to dwarf everything.

Most likely, the soft and hard limits are not going to kick in on time to save Hive, we could face a Terra Luna moment.

Thanks for reading.

Credits:

Title image created with Hive logo. Screenshots from HBDStats.com, coingecko and coinmarketcap.

Let's connect : mypathtofire