Agent banking is a way of providing limited banking services to bank customers, through the use of agents.

In Nigeria today, the rate at which agent banking is really growing cannot be overemphasized.

It has eased off the stress of entering the traffic congestion on the road and as well cuing up in the bank, just to make small transaction.

Agent banking provide whole lots of services to it's customers; varying from account opening, deposits, withdrawal, cash trasfers etc.

Like you can see in the picture, these are people waiting to carry on one transaction or the other with an agent banker.

The customers have built so much trust in this agent bankers in such a way that they can transact with them no matter where they are located. Just like i have in the picture below.

This is a market place and the agent banker is just using an umbrella and people are

still transacting business with him.

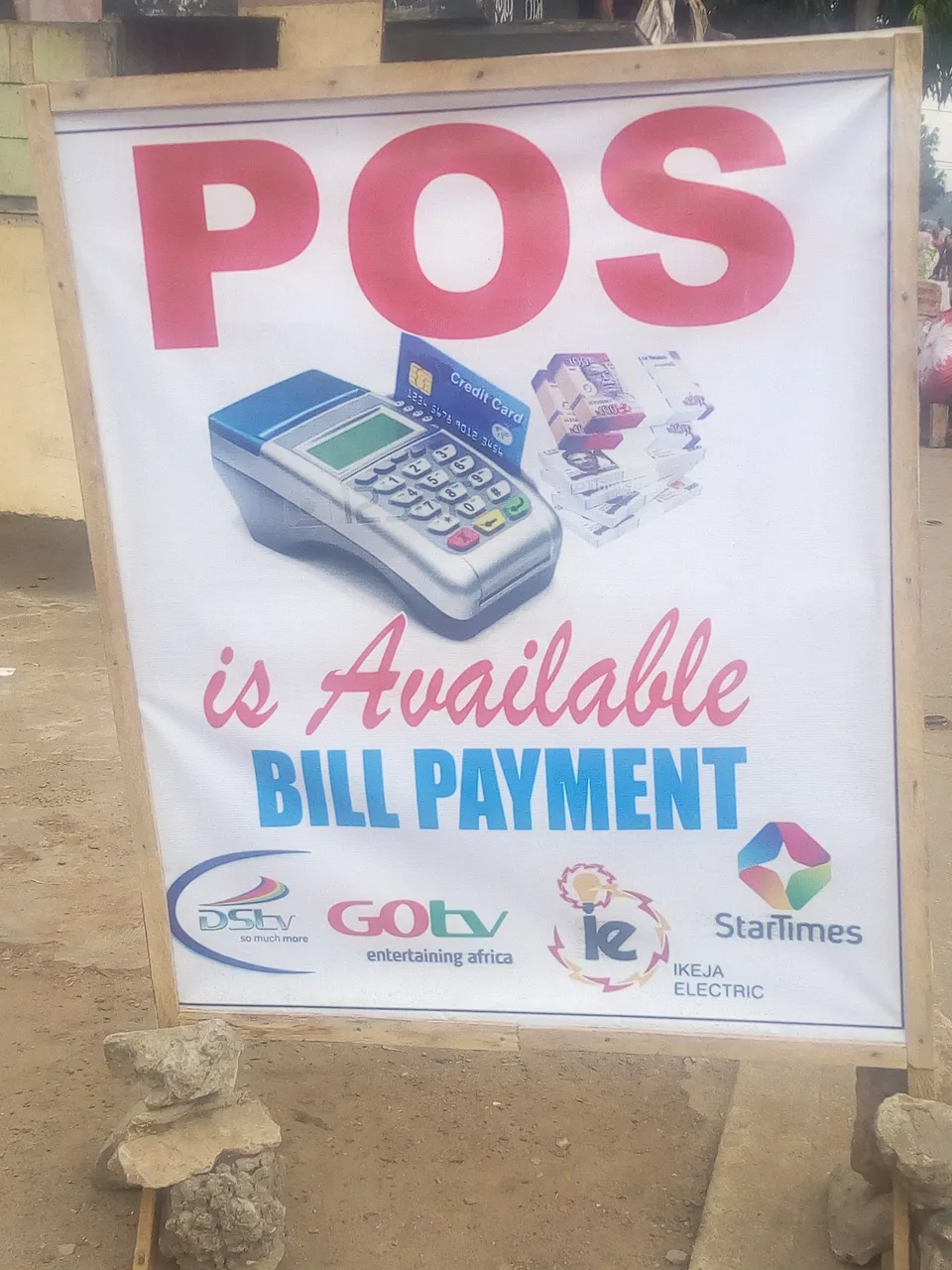

The agent bankers makes use of the POS (Point Of Sale) for the transactions.

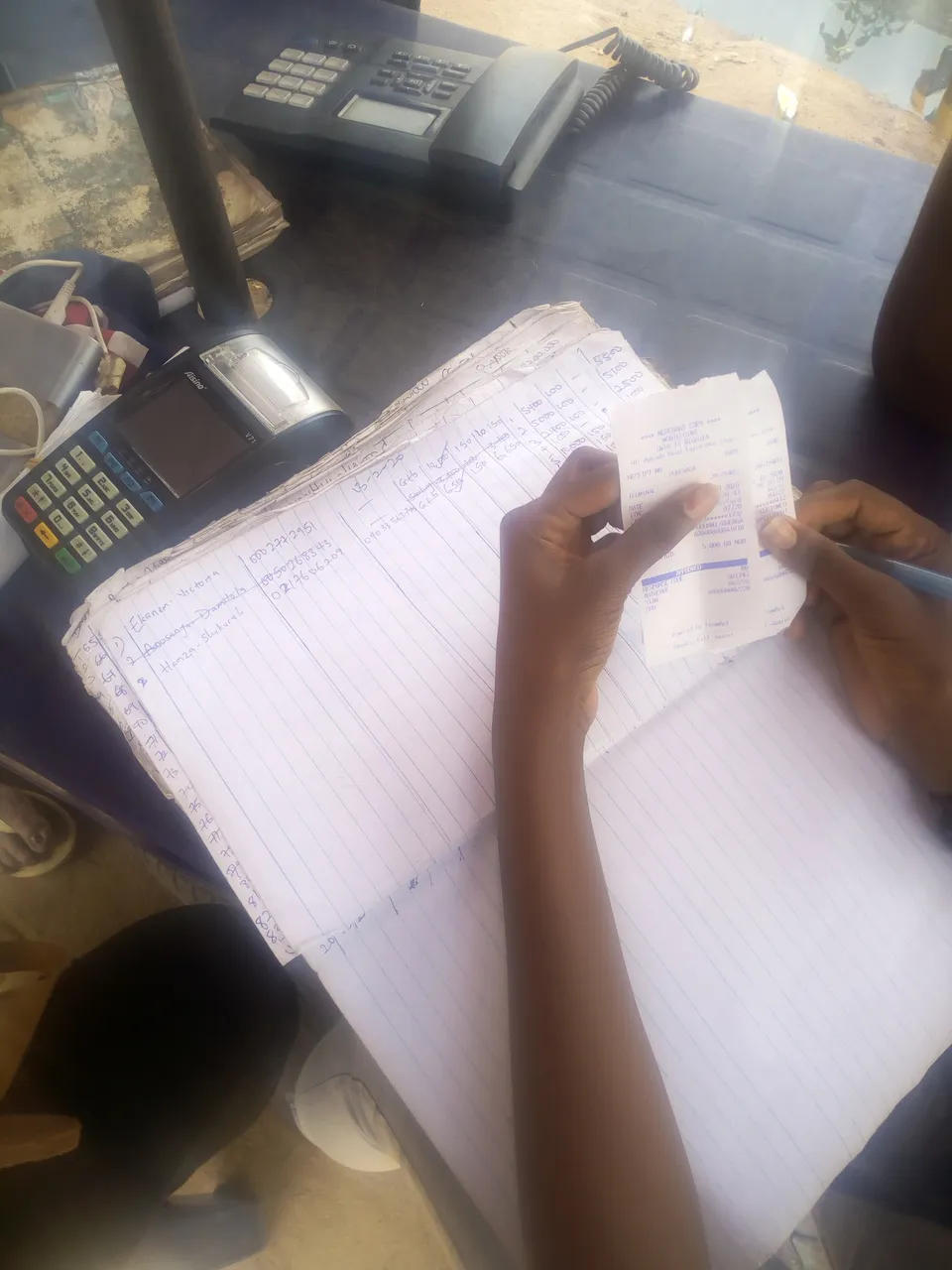

Once the debit card is slotted in and necessary buttons are pressed, the POS will print out a receipt which will in turn be documented, for account balancing purpose and for future reference, just like i have in the above picture.

RISK ASSOCIATED WITH AGENT BANKING

There are also risk associated with agent banking especially in money transfer and withdrawal.

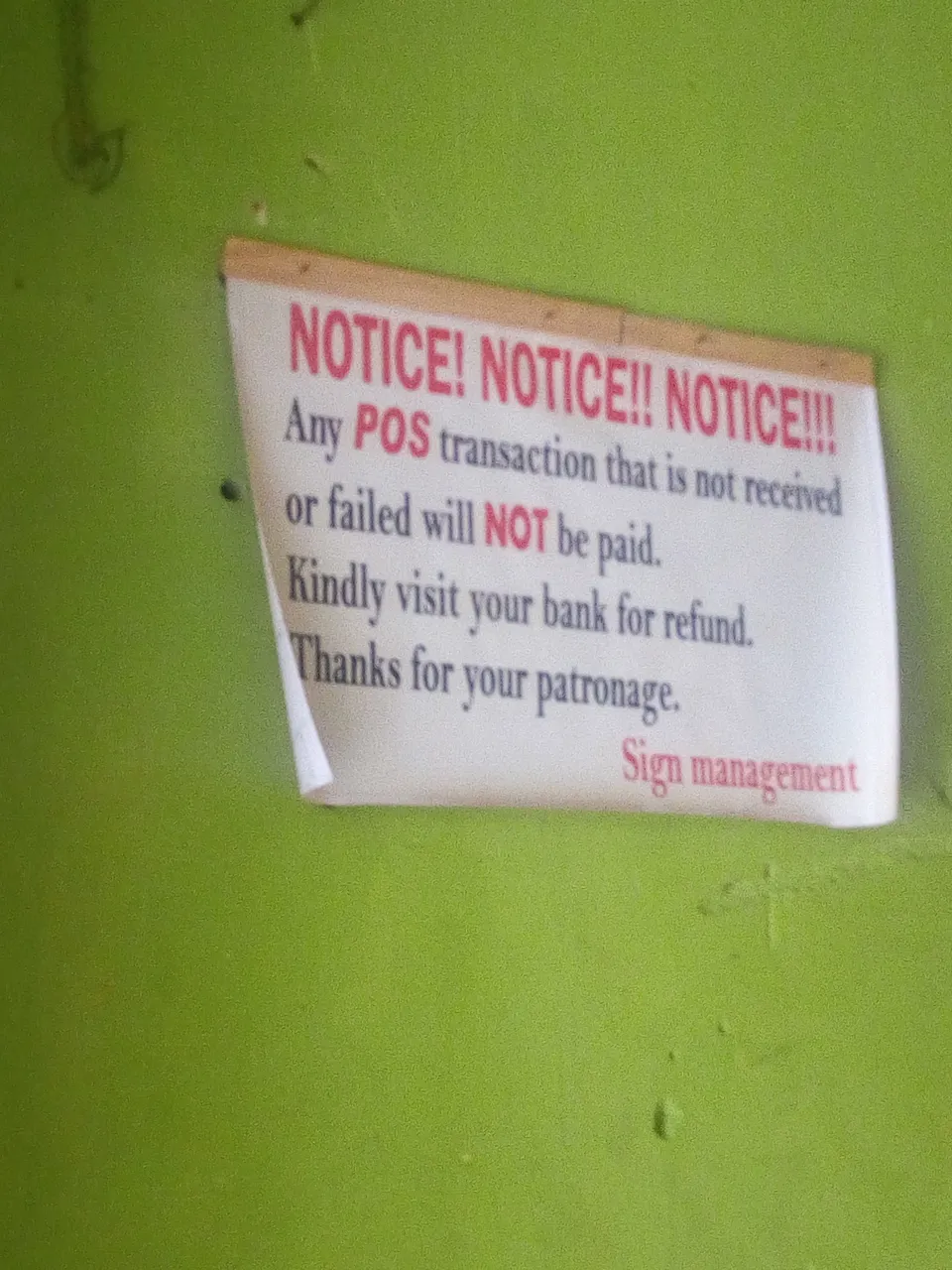

Most times the withdrawal will be declined and the customer will debited. At that point, the agent banker will advise the customer to visit their respective banks for refund. Some persons get their refund, while others don't.

The customer cannot do anything about it because it is clearly stated in a board of notice of the agent banker, as i have on the picture above.

On the part of the agent banker, they face a couple of risk, which includes;

- Paying for a transfer transaction twice or more. When the agent banker is faced with network issues in POS, some transactions may be declined, with subsequent trials on getting it done, the POS may payout without the notice of the agent.

- Another risk they face is in paying for utility bills like electricity. The customer may want to subscribe for #5,000(five thousand naira) and the cashier will mistakenly press #50,000(fifty thousand naira). All this is a loss to the agent banker. Although some customers with good heart may refund some of the money if not all. But the bad ones will not.

Agent banking in Nigeria have been of great help in Nigeria despite the risks associated to it. Because they bring the bank to the doorstep of the masses. And they also benefit themselves from the charges they give to the customers.

Thank you for reading through my post to this point.