Hello Readers,

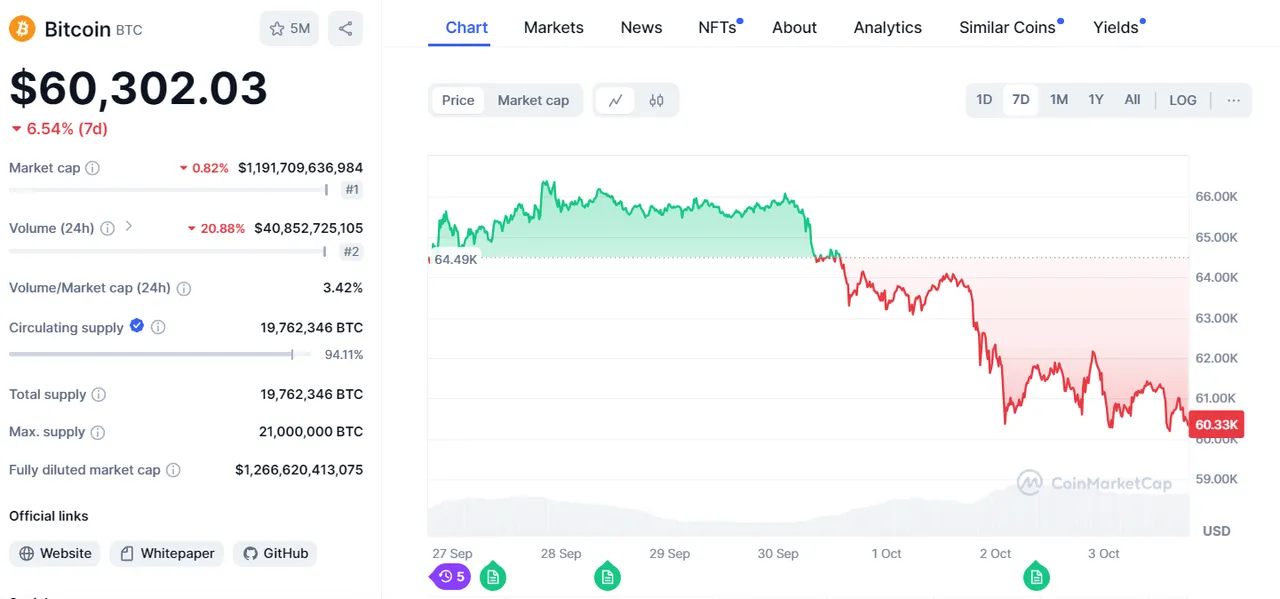

I hope you are all enjoying the day with your family and friends and also hustling well in this wild world of crypto. Now, if we look at the current crypto market condition, it does not look very good because most of the coins including Bitcoin and top alt-coins are currently experiencing a downtrend and not to mention our Hive has also been affected by this sudden downtrend. The majority of the crypto people were hoping for a good pump in this month of October and the Bitcoin analysts and enthusiasts also had high hopes for October 2024, a month often dubbed "Uptober" because of Bitcoin's historically strong performance during this time. However, instead of the usual price surge, this October started with a disappointing 6.0% drop in Bitcoin’s value in the last 7 days. Most of the Alt-coins were not being spared either where ETH is down by 10%, BNB by 9.5% and SOL by 11.1%, etc with the total Crypto market capitalization shrinking by around a whopping $42 billion. So, what went wrong? In this post, Let us take a dive and try to find out why October 2024 began with a rocky start and whether there is still hope for a turnaround or if things will go harsher from here. So if you are interested, please continue reading.

What Caused Bitcoin’s Early October Drop?

From what I have read in the news, one of the key factors in Bitcoin's initial downtrend in October is the rising geopolitical tensions. When the world becomes uncertain, many investors try to move toward safer investments like gold and tend to pull out of riskier assets such as cryptocurrencies. This trend affected the crypto market terribly and vastly contributed to Bitcoin’s early downslide.

Another reason may simply be related to human psychology when we talk about finance. It has often been seen in the past that when a large number of people expect something to happen - like the Bitcoin's price rising because of the "Uptober", the market often does the exact opposite. This is a common occurrence in financial markets and some of the analysts also predicted this in the past.

Could Bitcoin Still See a Recovery in October?

Do not panic, as all is not lost for "Uptober" just yet. The month has literally just started and according to Bitcoin analyst Timothy Peterson, we might not see Bitcoin’s true rally until after the 19th of the month. So, while these first 2 weeks may be tough, there is still a considerable chance for a turnaround in the latter half of October.

If we look at the historical chart data and analyze it, we can see that Bitcoin has done well in October. Since 2018, the cryptocurrency has consistently shown positive performance, with an average gain of over 14%. So, while it is easy to feel disappointed with the rough start, if history is any guide, there is still a decent chance Bitcoin could still see gains by the end of the month. Crypto is a volatile market and we have seen large and sharp swings overnight so nothing is impossible in this realm.

What Should Investors Do?

The current time is not favoring the market at all and many investors irrespective of their portfolio size are understandably feeling nervous. The crypto market’s volatility right now, especially after massive liquidations of $500 million USD worth of leveraged positions, has raised concerns among investors on a global scale. But it is also a reminder of the risks of using leverage (borrowing money to trade). Future Trading or using high-level leverage is a very risky option and when things do not go your direction which is a very normal thing as no one can predict the future every time, the losses can pile up quickly. So as investors, we should behave more cautiously.

For any average investor, I think the key takeaway is to stay patient. Markets are unpredictable as they always were and Bitcoin’s past patterns don’t always guarantee future performance. However, understanding the risks and avoiding overconfidence in any one trend (like “Uptober”) can help you stay protected during market downturns. Trading is and always has been a risky area, especially in the Crypto market where 10% - 25% movement can happen in a blink of an eye. That’s what makes crypto so unique to other asset classes and creates more opportunity, but it is also a riskier path over the Share market or Gold, etc. As investors, we should not ever forget about its high volatility and act accordingly.

Information sources: