Hey All,

Expecting a income tax refund and then you get this error that the refund re-issue failed is a bit annoying. One has done all the hard work while filing their income tax return and when it is the time to get the refund seeing this error makes you thing what went wrong. In this post I am going to share my experience of how one can work through the process of resubmitting the refund request on the income tax portal itself. But before that it is imperative to understand that an income tax refund, or IT refund, occurs when the tax paid by an assessee exceeds their actual tax liability. In such cases, the income tax department returns the excess amount to the taxpayer. I was doing it all wrong this time and have had the refund failure three times::

Last I tried raising the request on 22nd August and it failed again and this time I found out that first one need to confirm the bank account in profile section. There may be a default bank account which doesn't have the PAN linked and this error of refund reissue error will occur. As all eligible income tax refunds are now transferred in electronic mode only. Further, tax refunds will be made only to the bank accounts which are linked with PAN.

Go to the profile section and then select My Bank Account it will display all the bank details which you would have added. In my case there were three banks and note that the Axis Bank had a restricted refund disabled and in this case first I need to nominate a bank which meet the below conditions;

- Your Aadhaar number should have been linked to your PAN.

- You PAN is linked to Bank Account (Account can be Savings, Current, Cash or Overdraft).

- Your bank account should have ‘validated‘ status in e-filing Portal.

All these steps need to be performed before submitting the refund reissue request. And this was the mistake that I was doing all the time. I was thinking that while submitting the request and selecting the bank which had PAN and Aadhar linked will do the job but it wont has you need to select the "Nominate for refund" bank account where you need the refund. So once you are done with selecting the right bank and all the mandatory conditions are met proceed further to submit a fresh request for refund.

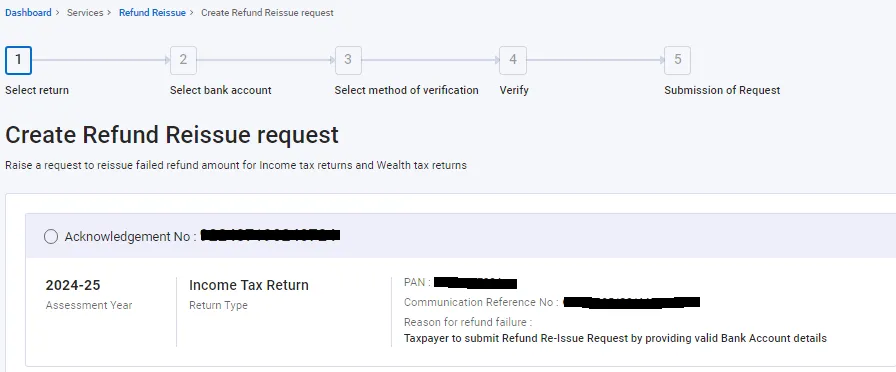

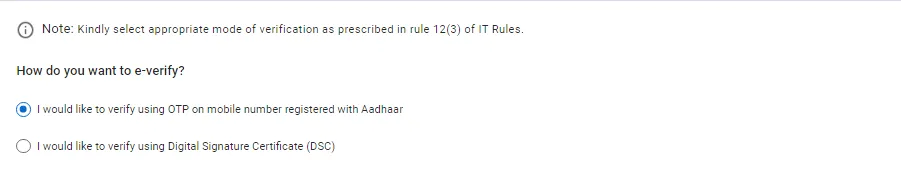

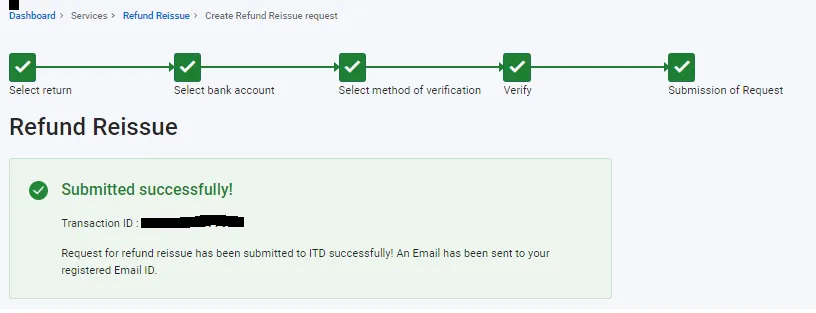

I have put in the sequence of the screens that comes while submitting the request. Just follow them providing and selecting the appropriate information - you will need to confirm the transaction via the OTP and once done the refund reissue will be submitted successfully. Now just wait for the refund to be issued. Hopefully this resolve all the problems tied to refund issue bank failure. Lets summarize before I end this post.

- Update profile with the appropriate bank to receive refund

- Ensure that the bank is eligible to receive a refund - PAN & Aadhar linked and validated

- Select the right bank account where you want to receive the refund

- Finally submit the refund reissue request

Well this should be it for todays' post and all that one need to do to get their refund of income tax incase they are struggling with the refund issue failure error.

India - Income Tax Refund Failed? How to raise Refund Reissue request online?

#tax #income #incometax #india #taxfiling #incometaxfiling #utility #incometaxgov #refund #taxrefund

Have Your Say on Incometax filing/tax refund fiscal Year 2024-2025

Are you done with your incometax filing for this Year? Online Vs Offline? Did you explore the desktop utility for you tax filing. Did you get this error of tax refund? Let me know your views in the comment section below..cheers

Image Courtesy:: incometax, relakhs

Best Regards