Bitcoin's price faces a 4.9% correction after failing to breach $28,000. We delve into the bear-dominated market sentiment and what it means for Bitcoin's future. Is Uptober over?

Uptober may mark a downturn for Bitcoin, as it experiences a 4.9% correction after failing to breach the $28,000 resistance on October 8. While this has led to a fear-dominant sentiment in the market, it's essential to examine the broader context in which Bitcoin operates.

**Bitcoin's Resilience:

Compared to traditional assets like gold and Treasury Inflation-Protected bonds (TIP), Bitcoin has demonstrated remarkable resilience. Gold has seen a 5% decline since June, while TIP bonds have dropped by 4.2% during the same period. In contrast, Bitcoin has maintained its position at around $27,700, outperforming these conventional assets in the world of finance.

Signs of Bear Dominance:

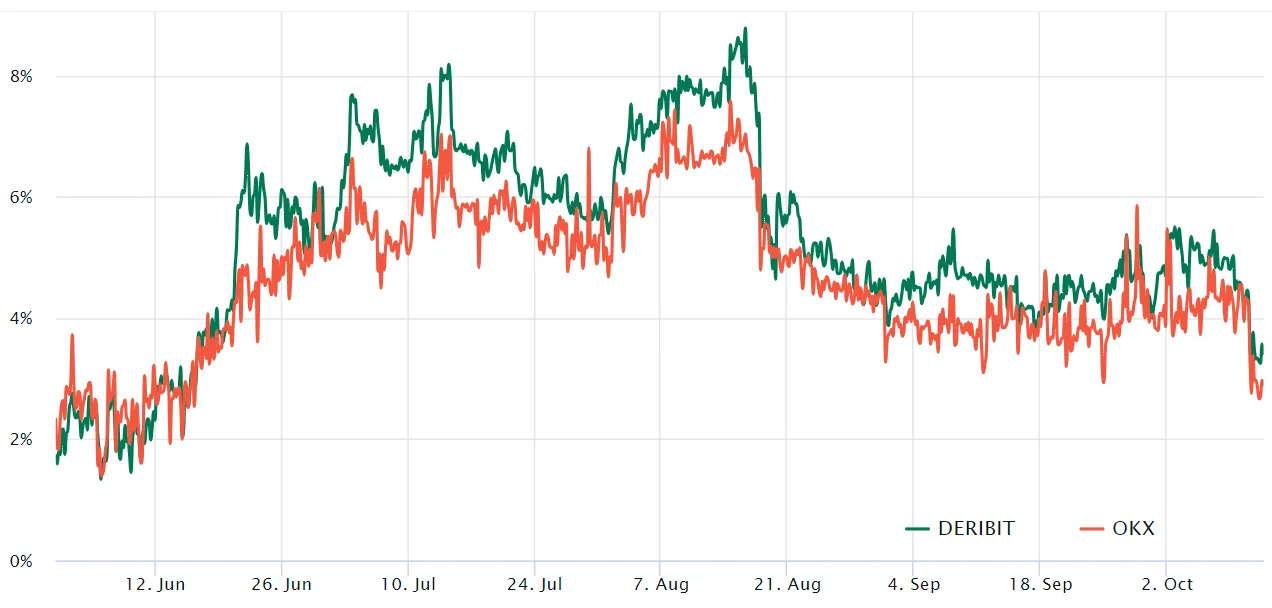

However, the rejection at $28,000 on October 8 raises questions about the dominance of bears in the Bitcoin market. A key indicator to analyze in this context is Bitcoin's future contract premium, also known as the basis rate, which has recently reached its lowest point in four months. Typically, Bitcoin monthly futures trade at a slight premium compared to the spot markets, signifying that sellers demand extra money to delay settlement. In a healthy market, futures contracts usually trade at an annualized premium of 5% to 10%. The current 3.2% futures premium (basis rate) is at its lowest level since mid-June.

Fear in the Bitcoin Options Market:

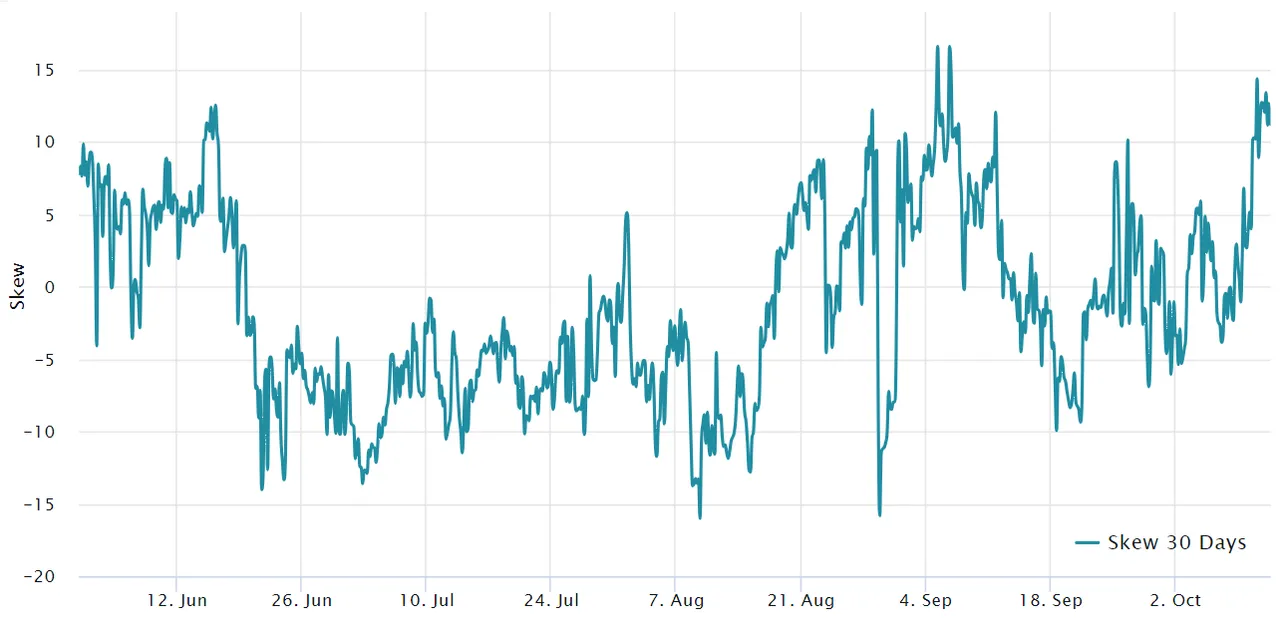

Traders concerned about Bitcoin's price outlook should also consider Bitcoin options markets. The 25% delta skew, which reflects the pricing disparity between protective put (sell) options and call (buy) options, is particularly revealing. When traders anticipate a price drop, the skew metric rises above 7%. As of October 10, Bitcoin options' 25% delta skew had shifted into "fear" mode, with protective put options trading at a 13% premium compared to similar call options.

The Influence of Negative Sentiment:

The negative sentiment toward cryptocurrencies, influenced in part by the multiple delays in the SEC's Bitcoin spot ETF decisions and concerns about exchanges' associations with terrorist organizations, has led to reduced confidence among traders. This scenario potentially overshadows the benefits of using Bitcoin as a hedge in times of macroeconomic uncertainty and its attractive predictable monetary policy.

All these factors combined suggest that the likelihood of Bitcoin breaking above $28,000 in the short term appears rather slim from a derivatives perspective.

#Bitcoin

#CryptoMarket

#BearishTrends

#BitcoinPriceAnalysis

#Cryptocurrency

#FinancialMarkets

#Uptober

#Bitcoinprice

#bearmarket

#Bitcoinsentiment

#cryptocurrencymarkettrends

#cryptoanalysis