This post is intended as a tool that you can use to improve your decision making - by quantifying your personal risk appitite and your expectations for the future.

The example described is based on the project Genesis League Sports and it's Governance token GLX (https://whitepaper.genesisleaguesports.com/)

Discounted cash flow:

Discounted cash flow (DCF) is a method to assess the value of a corporation based on it's expected cash flows. This method is often used in mergers and acquisitions in traditional finance. Applying it in crypto is interesting but complex as the future cashflows of the project are very uncertain. Moreover as crypto prices are mostly based on speculation and strong emotional market sentiments it is very likely that the market price is different from the calculated value with the DCF.

Calculating the DCF is using rational decision making in an irrational market. Despite it's limitations in crypto I believe that it can be useful when you combine it with tools like the scenario analysis to address the speculative value.

Example - applying the DCF on Genesis League Sports

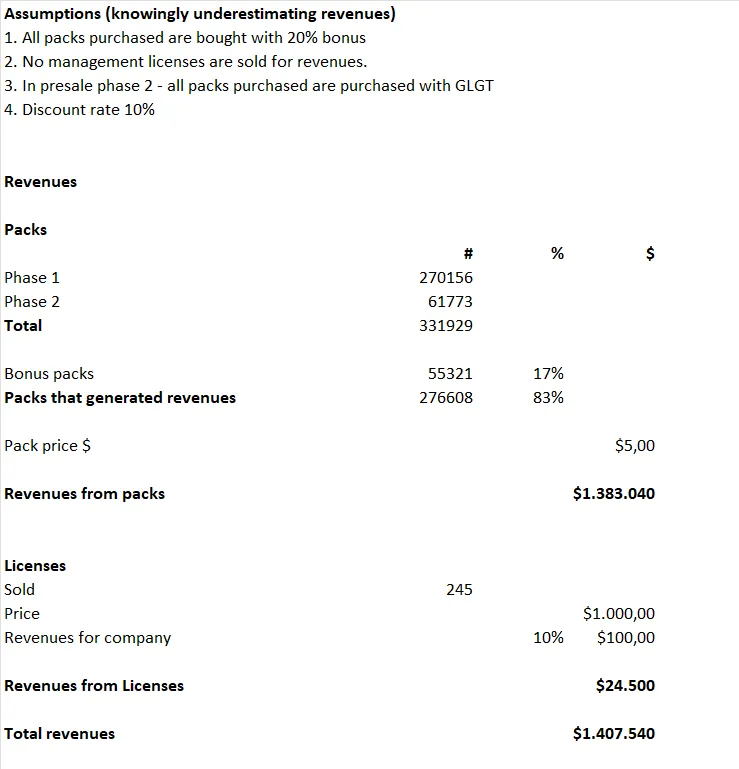

1 - Let's start with what we do know, a decent estimation of the company store revenues from the last 6 months ($1407540)

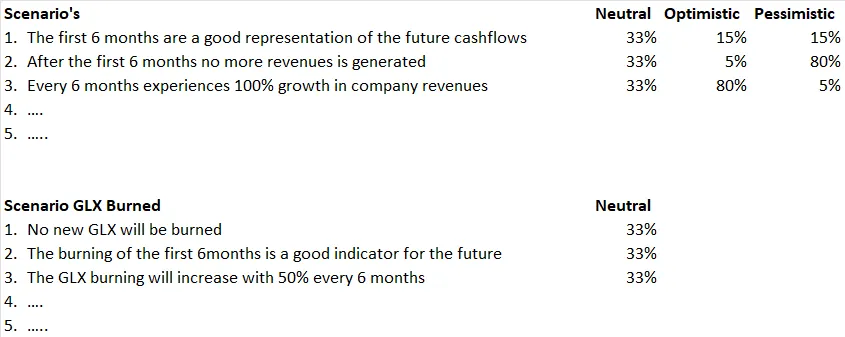

2 - After that we can create different scenario's for the future and add weight to them based on how likely you personally think each scenario is.

For this example I did not include my personal views but illustrated the calucation based on 3 different views (Neutral, Optimistic and Pessimistic)

Should you make this calculation yourself - it is likely that both the scenario's aswell as the weight attributed to the scenario's is different from the example used here.

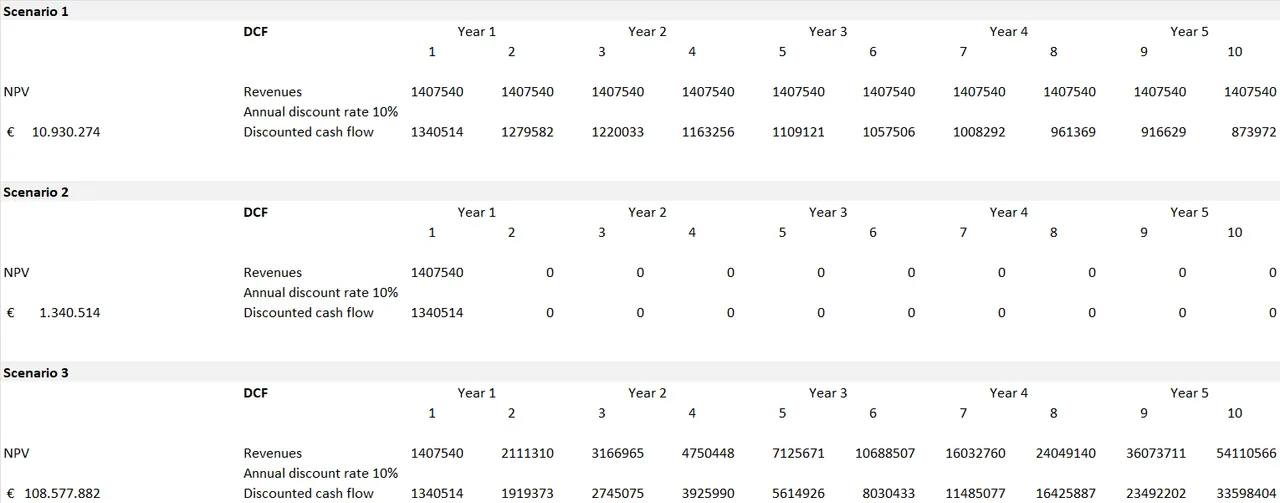

3 - Our next step is to calculate the discounted cash flow for the different scenario's:

- Use a 5 year timeframe

- In this example we used a 6 months interval

- Discount rate I picked is 10% - which means that each revenue stream is corrected for the opportunity cost of a investment in an other project that yields 10%. Pick a discount rate that works for you (for example if you are big on HBD savings 20% would make sense).

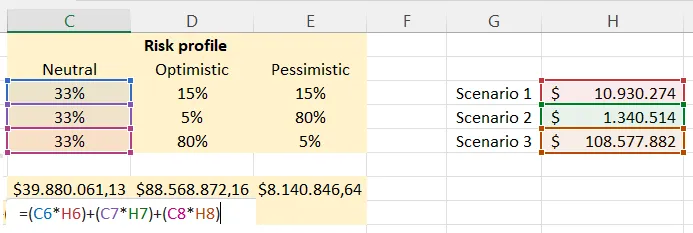

4 - We found the present value for the different scenario's. By multiplying these values by the weight that we addressed to them in step 2 we can get a personalized fair present value. Formula in picture below shows how to do this for the neutral profile.

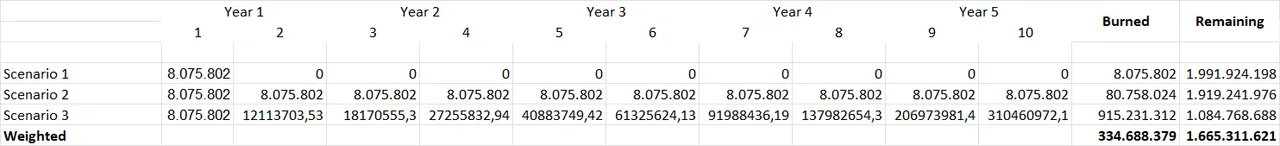

5 - The last step before we have a view about the fair value of the token is to estimate the number of tokens by which we will devide the weighted present values. Because I used a 5 year time frame I will use the full 2 billion GLX. This number will be reduced by the number of GLX that are burned. Step 2 included 3 scenario's for the number of tokens to be burned over the 5 year time frame.

Leaving us with a range of different tokens which you again multiply by the weight you give them based on your personal view with regards to the likelyhood of each scenario - in this example I used equally likely for each scenario.

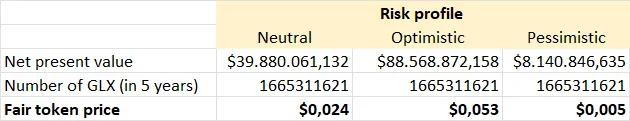

- Finally we devide the personal fair present value from step 4 by the expected number of tokens we found in step 5.

For each risk profile this will give an estimate what the fair token price should be based on your personal risk profile and allows you to compare to this value against the current market price and determine if you view the current price as correctly or under/over-valued.

For those interested - I would be happy to share the template.