0528e9ce4dc56bedabcadf2f30832bead96e0eb8

Proposal

The SPS DAO is providing liquidity and not being compensated for the services it is providing. Liquidity positions are a risky investment due to the the potential of impermanent loss. The DAO should not be risking it's treasury and not be compensated. PERIOD. I propose that the DAO be given its share of LP rewards for SPS:BNB and SPS:ETH.

The top goal of the SPS DAO as outlined in it's whitepaper is as follows.

When LP rewards end in the future, investors will move on, which can have a severe impacts on the ability of the markets to function. It will be the responsibility of the DAO to take over these LP and provide this valuable service. This is a massive financial undertaking that will require years of preparation to position ourselves to do. We must start now if we hope to have a smooth transition.

Benefits

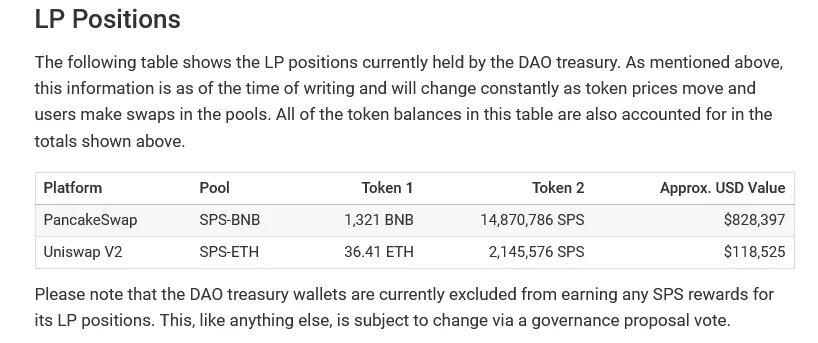

The DAO is providing the lion's share of liquidity for SPS:BNB and SPS:ETH (see below image).

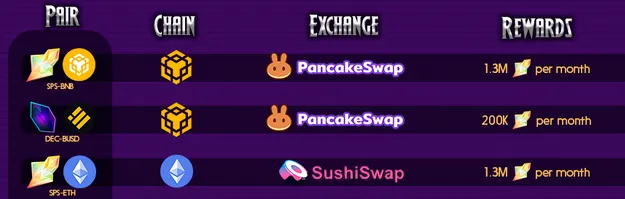

These pools pay 2.6M SPS/month combined.

The DAO could be banking $20,000+/month in SPS (2,600,000 x 0.8 x $0.021= $43,700). This not only better prepares us for the future, but significantly reduces the supply of SPS that can be sold every month.

Final Thoughts

We cannot let the interest of investors seeking a ROI cripple the ability of the DAO to function in the future. These two LP are low-hanging fruit since only a small portion of investor liquidity is involved. The 10% are taking 100% of the rewards. I would urge members of the DAO to consider taking this further. With the implementation of DEC payments for Riftwatchers the DAO has accumulated over 10M DEC in a short period of time. We now have the opportunity to significantly increase our stake in DEC:SPS and DEC:HIVE. I will not propose that here, but this needs serious consideration to build upon this goal.