The DEC tokens have been going through a maturity phase in Splinterlands. It was the first token that the game introduced, effectively incorporating the play to earn system back in 2019. The initial design was to provide an in-game token with a semi stable value and use it for trade and price in the game.

DEC was introduced in 2019 and it was a reward token that gamers received when playing and winning games. At the beginning the focus was on providing support for the token on the downside, because usually in game reward tokens tend to be sold from gamers. To achieve this Splinterlands uses a so called “product backed currency” where packs and otter assets are sold in fixed DEC price.

Later, in 2021, the SPS token was introduced, that made the price of DEC surge on the upside. There were no efficient mechanics in place to limit the DEC price on the upside and DEC reached 10x the value it was designed to. There were some mechanics in place (printing more when the price is higher), but this was not effective enough to peg the price on the upside. This was back in 2021.

Since then, more tweaks to the DEC tokenomics were introduced. DEC is now not a reward token in the game. It can be created at a fixed price when burning SPS for DEC. This gives it a lot more effective limit on the upper side. On the downside, more products and use cases are introduced where DEC is used or burned. Some of the most recent has been the Land 1.5 expansion that requires staked DEC in order for the land to produce. Another one that is just fresh is the DEC fee to unlock reward cards. Users receive reward cards as locked, soulbound, and after some period they can unlock the burning some DEC in the process.

We will be looking at:

- Daily and monthly DEC created/burned

- DEC created VS burnt

- DEC supply

- Staked DEC on land

- Top accounts staking DEC

- DEC price and market cap

DEC Created VS Burnt

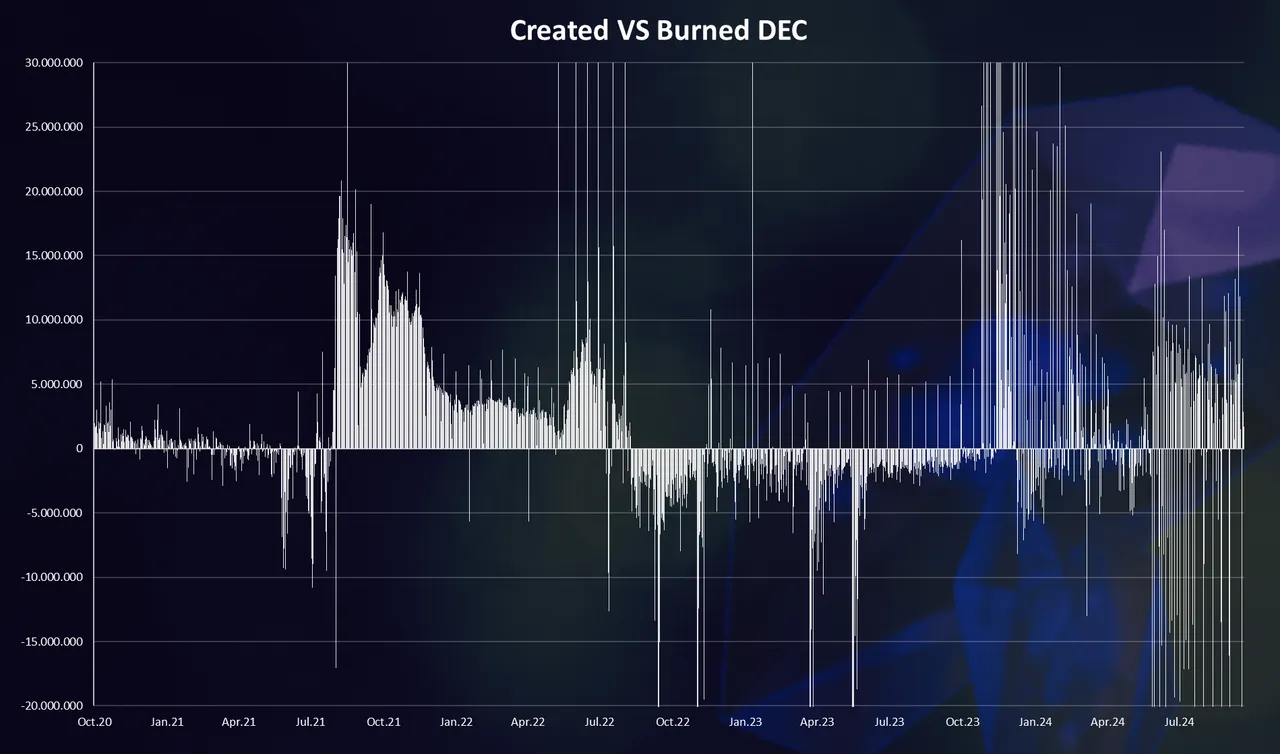

Here is the chart for the daily amount of DEC created and burned starting from October 2020.

A lot of volatility for the DEC token emissions.

At first, back in 2020 and 2021, the daily emission was low to around 1M and below. But then in August 2021, things changed, as the SPS token was introduced and an overall bull market for the Splinterlands assets begun. This triggered more DEC to be printed and for some time there was more than 10M DEC printed daily, that was x10 or even x20 from the previous emissions. These numbers dropped going in 2022. In August 2022, the game made a switch for the reward token, from DEC to SPS. Further emissions cuts were made in the following months, making the printing of new DEC tokens limited. Since then up to recently DEC was mostly deflationary with more DEC burned daily than printed.

The major way to create the DEC token now is with SPS burns. As the demand for the DEC token grows in game, we can see more SPS being burned for DEC.

From the chart above we can differentiate some phases for the DEC token. In the first phase from the creation back in 2019, up to august 2021, the amount of tokens issued and burned is relatively small. This is a period for maturing of the token. The second phase started in August 2021 and went on to August 2022. In this period a lot of DEC tokens were issued because of the bull market and the way the DEC tokenomics were designed. This is the expansionary phase. In the last period August 2022 to November 2023, the DEC token was in a contraction phase, where its excess supply is being removed.

Since December 2023 up to the summer of 2024 DEC was expanding, but now in the last few months we can see that it is contracting again or very little amounts of the toke are being put in circulation.

Monthly DEC Created VS Burned

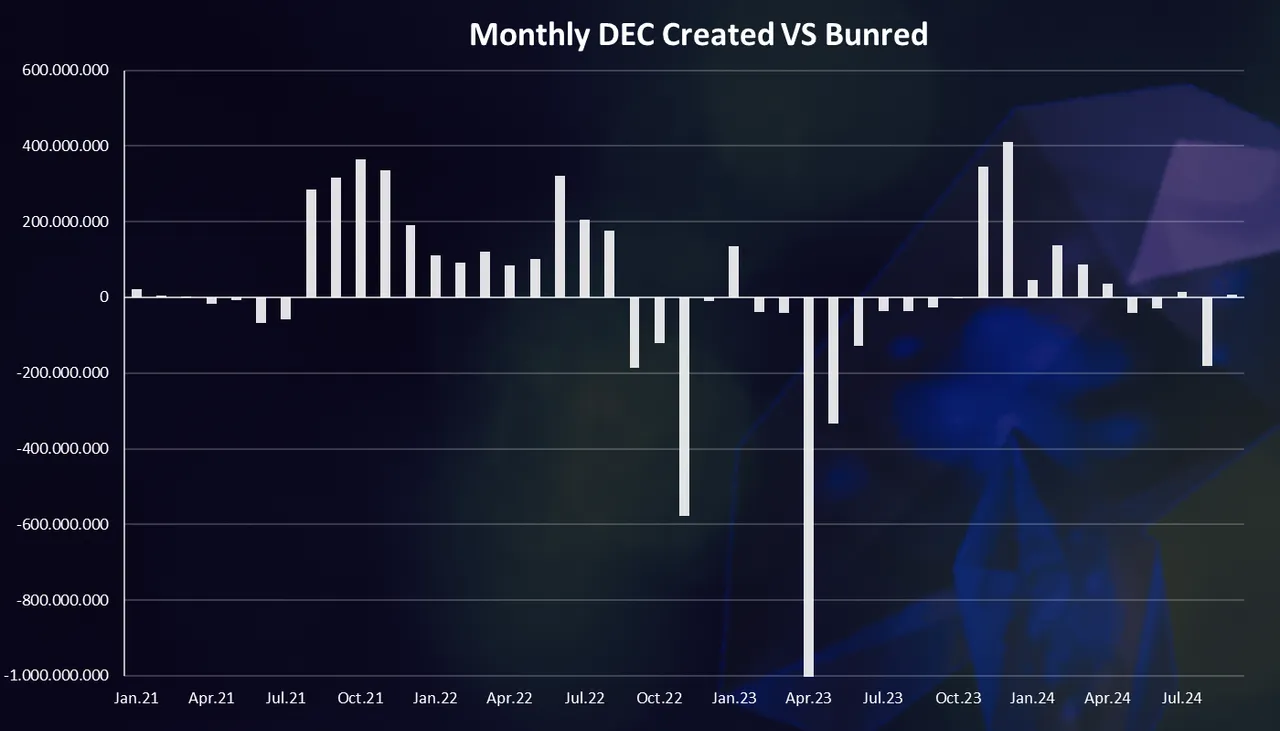

For a better representation here is the monthly chart for DEC created VS burned.

This is a clearer representation for the cycles DEC has went trough. At first small moves, then in the summer of 2021 printing DEC a lot up to September 2022 when the burning DEC started and lasted up to December 2023. A growth in the first half 2024 and now contracting again in the last months, especially in August 2024 where there was close to 200M DEC burned.

DEC Supply

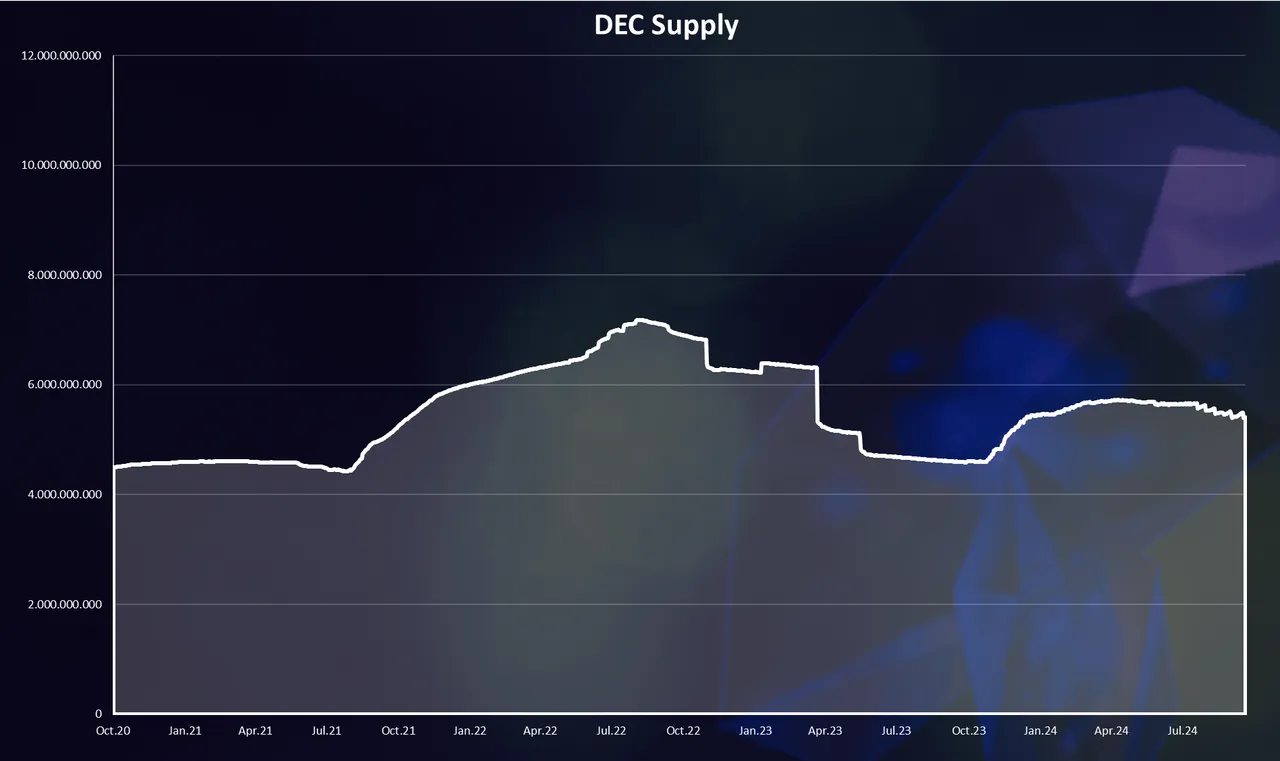

Here is the chart for the DEC supply.

This chart probably shows the DEC supply in the best way.

Steady moves back in 2020 with around 4.5B DEC in circulation. An uptrend in the summer of 2021 up to August 2022 when the ATH for the DEC supply happened around the 7B mark. A downtrend since then and a bottoming out in October – November 2023 around the 4.8B supply. An increase in the first half of 2024 almost to 6B, and a slow decrease in the last months to 5.4B where we are now.

When we plot this as a yearly inflation, this is the approximate data for the last three years.

| Date | Supply | Yearly Inflation |

|---|---|---|

| 1.1.2020 | 4,173,764,521 | 9.77% |

| 1.1.2021 | 4,581,715,347 | 29.90% |

| 1.1.2022 | 5,951,779,514 | 5.17% |

| 1.1.2023 | 6,259,245,902 | -13.55% |

| 1.1.2024 | 5,411,095,406 | 1.57% |

| 1.10.2024 | 5,496,000,000 |

Note that 2024 is not over yet. We can see that 2021 was the most inflationary for DEC, then a relatively small inflation in 2022 of 5%, and 2023 negative -13.55% inflation even with the new DEC created at the end of the year.

2024 has been a mixed bag, first a growth and then a decline and the overall supply is almost constant with just 1% up from the beginning of the year. We have three more months so will see if anything drastic happens.

Staking DEC on Land

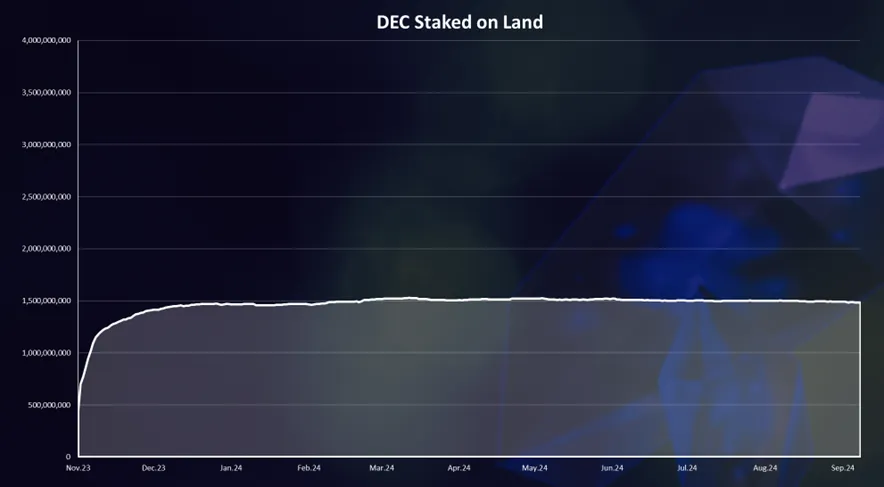

Staking DEC on land is relatively new, since November 28th . There are only few months with this option. Here is the chart.

As we can see the first days were massive with more than 100M DEC staked daily at first. Most of the staking DEC on land happened in the first month of the launch with some leftovers in the second month, and up to the end of 2023. Since then the amount of DEC staked on land has been very constant around the 1.5B mark.

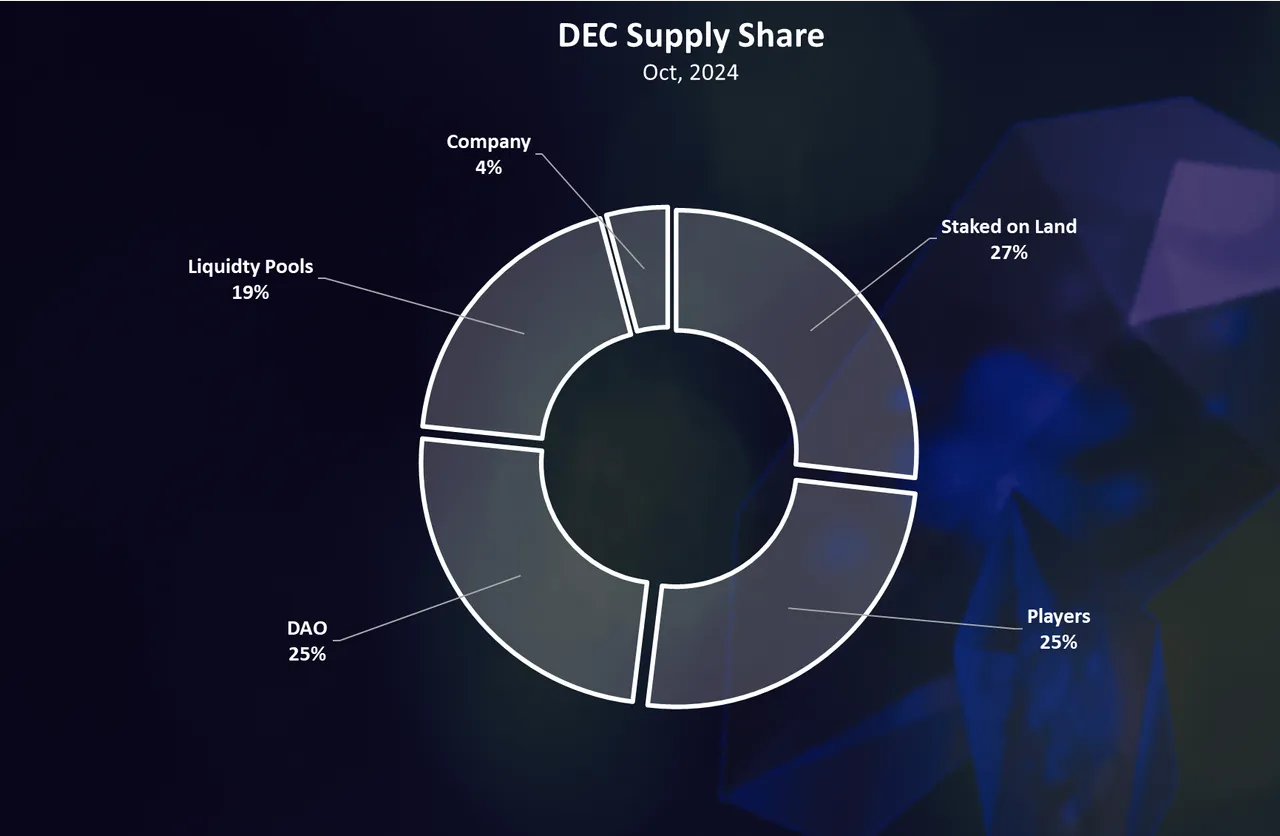

The chart for the current DEC allocation looks like this.

Courtesy of https://www.splintercards.com!

The lands stake is now the biggest share with 27% of the DEC there, then comes players that hold liquid DEC with 25%, same as the amount of the DEC that the DAO is holding. In the liquidity pools for trading there is around 20% of the supply or 1B. At the end is the Splinterlands company that has 7% of the DEC supply.

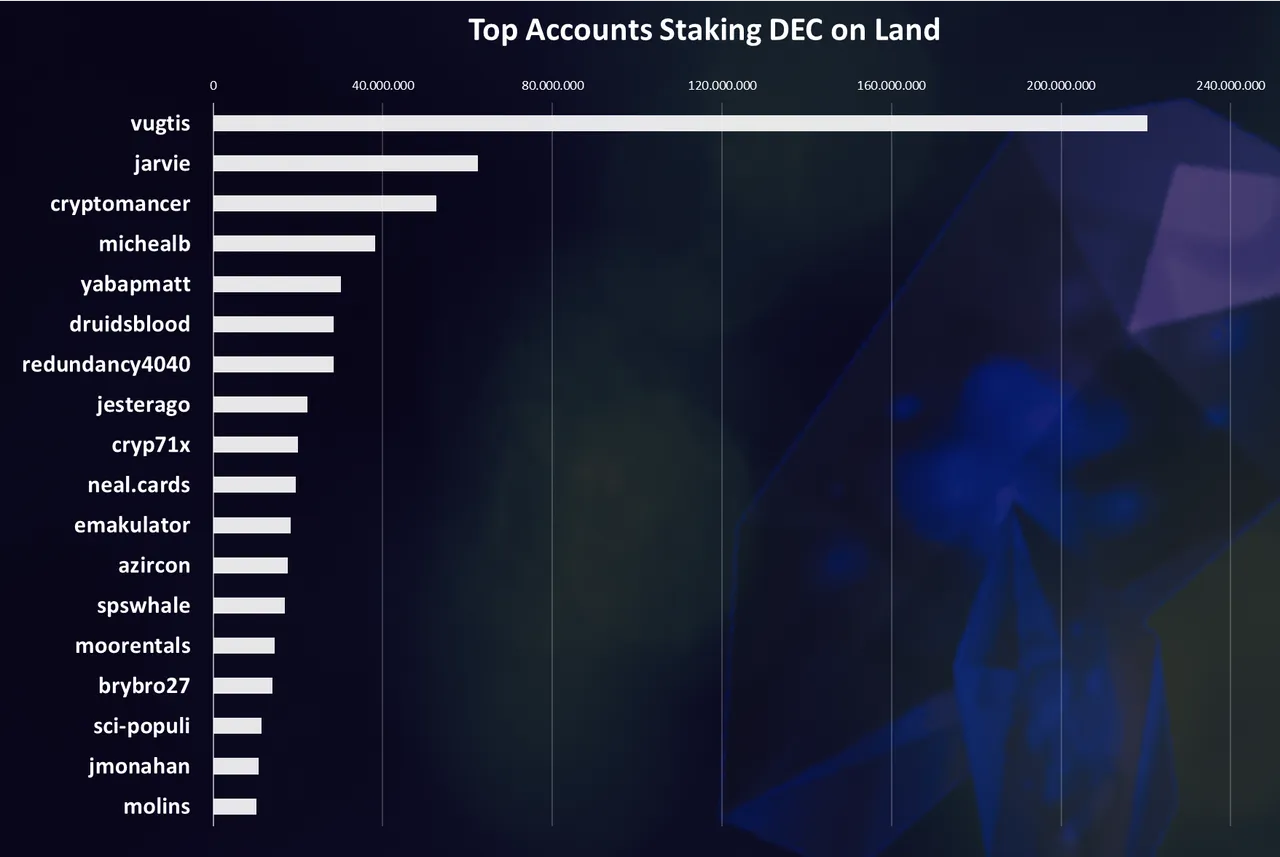

Top Accounts Staking DEC

Here are the top accounts that staked DEC.

The top account @vugtis has more than 200M DEC staked. On the second spot is @jarvie followed by @cryptomancer on the third spot.

Price

So, after all of this burning and use cases for DEC how is the price doing. Here is the chart.

As mentioned previously, in the past DEC had inefficient mechanics to limit its price on the upside and because of this at the beginning of 2022 the token was trading above its peg of 0.001 USD. Then the SPS to DEC conversions were introduced and this is a lot more efficient design. On top of this, the overall market took a major downtrend in 2022, so the upper side of the token was no longer a problem. DEC broke its peg on the downside, trading at 0.0006 for a period of time, or at 40% discount, for a short period of time.

In the last year, we can clearly notice a trend for the DEC price slowly climbing to its peg. DEC is now trading at the peg with occasional short downtrends usually when the overall market drops. With the new use cases for DEC land, unlocking cards etc, the demand has increased and we are now in deflationary phase for the token.

In terms of market cap, if we exclude the peaks back in 2021, the DEC market cap has been constantly been in the range of 4M to 5M USD.

All the best

@dalz