What can we learn from this classic tale of Babylonian riches?

Here we have one of the seminal works in financial management. A true great in acquiring riches, keeping them, budgeting and making wealth grow for you and those around you.

Told in the style of a collection of parables set in ancient Babylon, it follows the antics of Arkad who started off a poor scribe, and became said richest man.

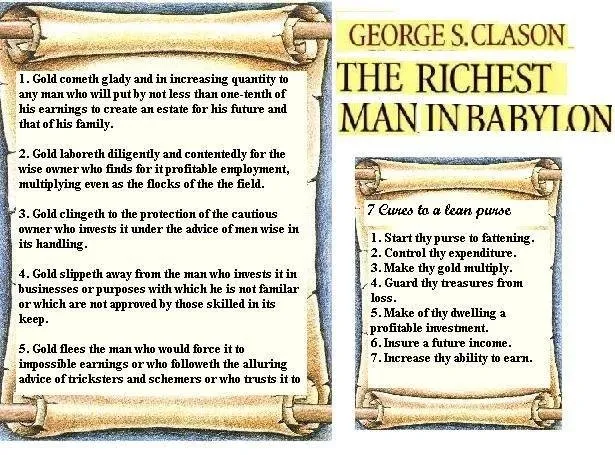

We get some of Arkad's advice including the Seven Cures and Five Laws of Gold, which if followed, will stand you in good stead and are guiding principles when dealing with money.

Put together back in the 1920s it's still as relevant today as it ever was, as these principles don't change, although the medium of exchange and methods may differ.

And it comes at you from the angle of a story, rather than just blurting out flat advice, it gets into our psyche and is one step removed so can slip under the radar and be an enjoyable yarn too.

Babylon was known to be the richest city of its day, and here we can tap in to some of that timeless wisdom and perhaps help fill our own 'purse'…

Key quotes from the book followed by my thoughts…

To bring your ambitions and desires to fulfillment, you must be successful with money.

It's a fundamental requirement of life. You may not like it, but it doesn't change the fact that you need money in order to live a decent life, the way things are set up.

Yes, things can be altered over time and we may live in a post-monetary society in the future, but for now, we need to learn how to play the game and do it well. This not only improves our own lives (and those around us), but builds our influence so we can actually affect the way the world works, and use our own wealth positively.

Without it, we can't do all that much if we're just worried about our next meal or making rent.

You first learned to live upon less than you could earn. Next you learned to seek advice from those who were competent through their own experiences to give it. And, lastly, you have learned to make gold work for you.

The old idea of your outgoings being less that your income is pretty obvious but still we need to be reminded as many people simply don't follow this basic financial keystone. Then we need to seek out good advice (and avoid the nonsense and the scammers)… then make it work for us, ie. increase.

A part of all you earn is yours to keep.

One of the key concepts is paying yourself first. Everything you earn should have a portion go to you before all the other commitments.

For every ten coins thou placest within thy purse take out for use but nine.

Immediately 10% (or more if you can) should go to savings. As soon as that money arrives, a tenth gets taken away and put in a safe place, and ideally be used to gain interest. The other 90% then gets distributed accordingly as required and as you see fit.

For each ten coins I put in, to spend but nine.

That continues on from the last point. This will be expenses and essentials, along with any fun, leisure or luxuries. This golden rule of itself will mean your wealth is always increasing, and you won't notice much difference to if you just used 100% and didn't save any (plus then you're always on the edge and maybe going into debt).

That what each of us calls our 'necessary expenses' will always grow to equal our incomes unless we protest to the contrary.

Exactly. You will spend what you have, a little more here, a little more there and it just gets snuffed out. By removing it, you just work with what you do have, and you will also get used to living on that amount as it works both ways.

Budget thy expenses that thou mayest have coins to pay for thy necessities, to pay for thy enjoyments and to gratify thy worthwhile desires without spending more than nine-tenths of thy earnings.

You will then live on the that 9/10ths so will need to budget accordingly. The point here is to increase your earnings if you can and you would like a better lifestyle, but not dip into that last 10% to do so. Work with that 90% and within your means always.

Make thy gold multiply

Then we get into the realms of putting your money to work. It can't just sit there (well is can but it will decrease in value, plus you want to get a return and increase your wealth further). Find ways of multiplying.

put each coin to laboring that it may reproduce its kind even as the flocks of the field and help bring to thee income, a stream of wealth that shall flow constantly into thy purse.

Passive income. This is the money you've put to one side, making more money of its own accord. Whatever happens in your regular work and where you receive your 'normal' income, this goes on regardless without extra effort on your part. It also allows you to earn if your main source of income is affected.

Guard thy treasures from loss

Once you've got it, you need to make sure you don't lose it. That means looking after it in a literal sense so it's in a safe place and accessible by you and not others (or only trustworthy people). And also avoid the all the shysters, charlatans, chancers and rogues who will be happy to take a piece of your pie! (or the whole pie preferably ;)).

Guard thy treasure from loss by investing only where thy principal is safe, where it may be reclaimed if desirable, and where thou will not fail to collect a fair rental. Consult with wise men. Secure the advice of those experienced in the profitable handling of gold. Let their wisdom protect thy treasure from unsafe investments.

Keep your principle safe, so that is always there for you. Then you're working with the rest…

The other part is seeking the counsel of those who know what they're talking about, have a track record and pose minimal risk.

Make of thy dwelling a profitable investment

Turning your house into a great investment itself. Whatever you paid for it will have multiplied many times and that can be a great nest egg for you. There are many debates in this day and age about property, but either way, you want to make the most of something that isn't only a place to live but a huge part of a person's wealth.

Own thy own home

If possible, own your home. That way you always have a place to live, are in control and are sitting on many thousands of pounds/dollars/euros/etc. You can't be removed or have terms changed by bankers or landlords, and it's also a great source of leverage as well as confidence.

This is tricky to do to own a home outright as it may take years to get to that point. But it is a worthy ideal. You may have to adjust this policy to our modern age and your circumstances but of course go for it if possible and suits.

Insure a future income

This is making sure the money continues to roll in when you're a bit older and/or sick, or just unable to work for a period of time. Insure that your financial standing at least maintains, buy even grows through that time. As you may not be able to put in the work then, that time needs to be prepared for before.

Provide in advance for the needs of thy growing age and the protection of thy family

As above but also talking about providing for others. You need to make sure your family is taken care of and anyone else you want to 'see right'.

Increase thy ability to earn

Expanding your skillset and always improving, studying and adding strings to your bow. You need to move with the times as well as increase your value in the marketplace.

cultivate thy own powers, to study and become wiser, to become more skillful, to so act as to respect thyself.

It's all worth doing in order to not only build wealth, but also become a certain type of person you can be proud of, and respected by others.

Good luck can be enticed by accepting opportunity.

You need to be in it to win it. Yes, luck is a real factor but you need to put yourself into positions where 'luck' can find you. Take those opportunities when they arise and see what happens!

Action will lead thee forward to the successes thou dost desire.

It's all about action and making things happen. We can sit around thinking, reading, assessing and ruminating, but ultimately it's taking bold, decisive action that will make things happen. There's a time and a place for the other things, sure, but you can't stay in theory land forever and have to get in amongst the real world, learn and grow.

Men of action are favored by the goddess of good luck

And that's where our good friend 'luck' may show up. The more you're in the game, the more opportunities will show themselves. It's pure logic and a numbers game, rather than something just falling in your lap.

how much greater value I consider thy wisdom than thy gold. Yet, who can measure in bags of gold, the value of wisdom? Without wisdom, gold is quickly lost by those who have it, but with wisdom, gold can be secured by those who have it not, as these three bags of gold do prove.

It's far better to have wisdom than simply money. Plenty of money (and more) can be gained with proper use of wisdom, and you always have the ability to go again… and more wisely. Just having money without being savvy, will cause it to disappear with no way of getting more.

This was a parable within the overall parable of a son coming back having increased his stack, and the other did not.

If you desire to help thy friend, do so in a way that will not bring thy friend's burdens upon thyself.

Help people, sure, but be careful not to take on their problems!

Better a little caution than a great regret

Be careful out there. Better to wait and see if you're uncertain before making any big moves. Ok, you may 'miss out' on a big gain, but you protected your savings for another day. You don't have to jump at every opportunity, and the pain of regret will be far larger if things go wrong.

Where the determination is, the way can be found

Where there's a will there's a way and all that. If you are really determined you can usually find a way to make some progress, despite any apparent obstacles.

The Five Laws of Gold & Seven Cures for a Lean Purse:

Thanks George! Anything Else?

Another point not mentioned in the highlights, is getting out of debt. Here you still keep 1/10 of your earnings and then use 2/10 distributed amongst your creditors.

They may or may nor be happy with that initially as they want more and sooner of course, but it will bring it down over time, so they will be happy that you're regularly paying and consistently decreasing the amount owed.

That also means you're still increasing your wealth at the same time and then working with 7/10ths for your expenses and life, which is doable (and necessary) for a time.

A lot of 'olde worlde' language as you can see. Thou doth hast etc… so told in that kind of style. Fine for me once you get used to it, and adds a bit of spice.

Much in the vein of The Alchemist and The Greatest Salesman in the World, we're taken on that journey through story. And we also discussed how stories can help ideas catch on in the last BookBabble on Contagious.

A very enjoyable and fairly straightforward book, and it rightfully earns its place as a finance classic. Simple yet amazing wisdom that if diligently applied will solve our financial ills and potentially become wealthy ourselves.

It's not easy, and everyone has their own set of circumstances, but the path is clear, and much of it has been set out in this book. And sometimes we just need a reminder and the information to be presented from another angle and it can make all the difference.

A must-read for all!

Video review…

@adambarratt/re-leothreads-ru6nkh5h

First image my own, others linked to source

- 1-50: First 50 BookBabbles

- 51: THE DAILY STOIC - Ryan Holiday

- 52: MAKE TIME - Jake Knapp & John Zeratsky

- 53: GRIT - Angela Duckworth

- 54: WHAT I TALK ABOUT WHEN I TALK ABOUT RUNNING - Haruki Murakami

- 55: THE PURSUIT OF PERFECT - Tal Ben-Shahar

- 56: THE SLIGHT EDGE - Jeff Olson

- 57: CONTAGIOUS - Jonah Berger