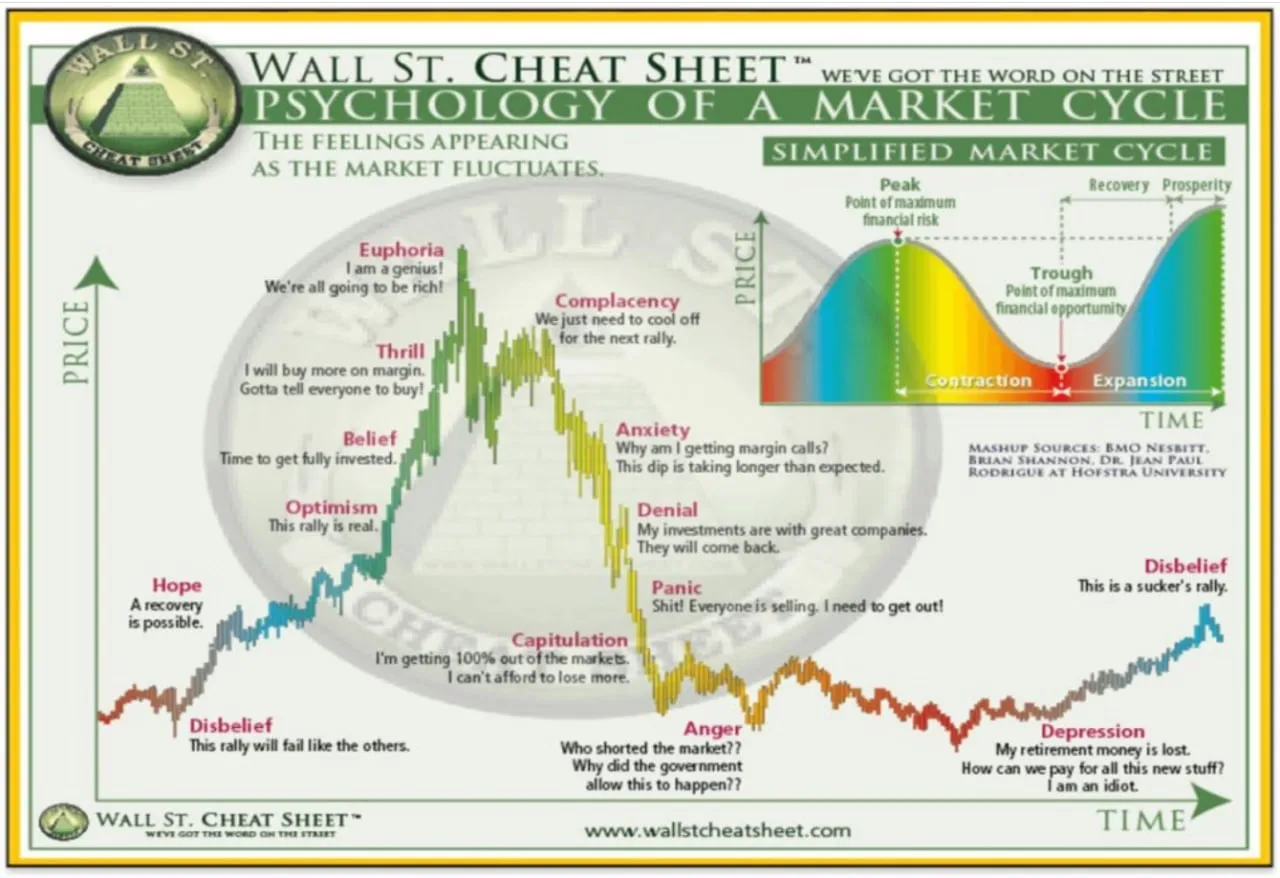

Wyckoff's pattern of distribution in Weekly is almost at the end of phase D marked by capitulation before entering the last phase E of rage and depression during the end of a market cycle.

https://www.tradingview.com/x/rF1s3Z47/

8000 BTC left the exchanges today, a small bullish signal next to all that remains on the balance for dump since the big bullish peak of August 3rd.

Unfortunately we are dependent of the stock market with the Dollar Index DXY and the S&P 500, so be patient until Monday.

👉 Follow the links below to the best & Secured Exchanges that I use for trading & often gives rewards for using their platform like Learn & Earn Program, making deposit & Trading on spot or Futures, Trading Competition, ...etc.

📈 Binance: https://www.binance.com/en/register?ref=12258276

📈 FTX: https://ftx.com/#a=1768923

📈 Coinbase: https://www.coinbase.com/join/amine_f

📈 Bybit: https://www.bybit.com/app/register?ref=7Wgmj

📈 Phemex: https://phemex.com/register?group=718&referralCode=BAR9K

📈 Bitmex: https://www.bitmex.com/app/register/xXePh3

📈 Kucoin: https://www.kucoin.com/ucenter/signup?rcode=Kvyf2d

📈 Huobi: https://www.huobi.com/en-us/topic/double-reward/?invite_code=33423

📈 Bitmart: https://www.bitmart.com/en?r=7cxGAc