This blog will be the 1st part of a 3-blog story focusing on why as many other (very smart) people 😅, I believe Bitcoin is set to thrive in the coming months and years.

I will try to develop the economic theories and explain why Hedge Fund managers and economists now see some utility for Bitcoin in our current world.

If you read this, you are probably one of the early adopters of this massive transformation. Whether you realize the underlying forces at work is not the question, but you saw something different in this “Orange digital gold”.

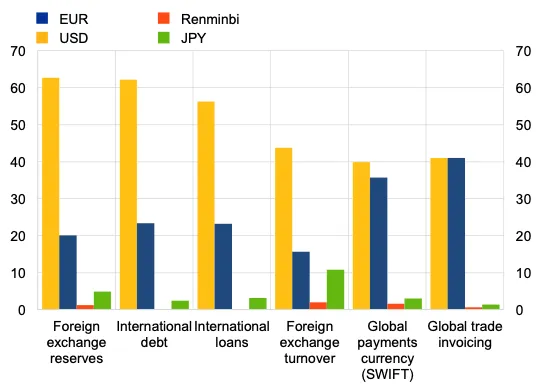

USD & EUR currencies dominate the world

In terms of value, the US dollar is ranked first, and its share of worldwide currency usage has grown from 47.6% in 2012 to 51.9% in 2014. The euro ranks second with a 30.5% share in 2014.

This means that Dollar & Euro represented 82.5% of worldwide currency usage in 2014.

Split of currency use

It may seem trivial, but this is one of the most useful soft powers the US and Europe have in addition to be considered as more prosperous and stable zones.

Emerging economies on the other end, have usually strict capital controls to prevent their currencies and economies from being too volatile.

Most of them also have laws to prevent their citizens to hold USD or EUR as it would weaken them.

Why does it matter for Bitcoin or cryptocurrencies?

On the other hand, citizens from these countries would benefit from holding these stronger currencies as they depreciate less rapidly than their emerging counterparts.

Since these citizens cannot buy as much dollars or euros as they would want in their local banks.

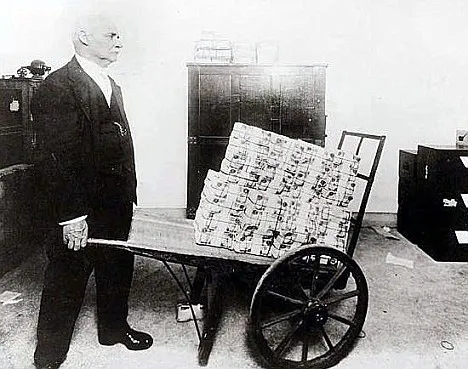

How can they protect themselves from dramatic situations seen in Venezuela, Zimbabwe, Argentina or more recently in Turkey or China?

Bitcoin has been a way for these people to save their wealth in a USD denominated asset.

Because of COVID19, a worldwide economic crisis could be around the corner. Tech savvy citizens have seen BTC as a way to protect their wealth against their currency’s depreciation.

This is also a major reason why USD did not depreciate even with the renewal quantitative easing policies: Safe-haven demand from emerging countries and investors!

So fine? And so, What?

Well as the crisis, devaluation accelerates; BTC has seen an increased demand. I will show you 3 recent examples

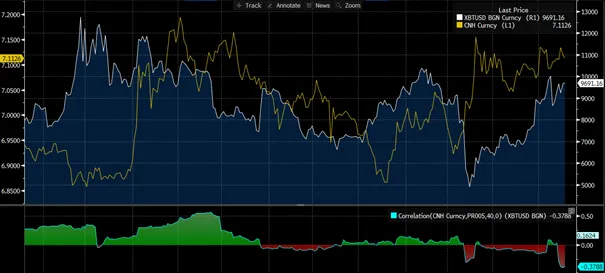

China: BTC (in USD) and USDYUAN

The correlation or should I say reverse correlation as in my graph has been true for the past 2-3 months. Meaning as Yuan depreciated versus Dollar, Bitcoin price went up (reverse correlation between 0.2 to 0.45).

As we will see later, it is more difficult to see the link to Bitcoin Google Trends as we do not have correct data (Google is still not used in China).

Turkish Lira vs BTC Google Trends

As you can see below with the Turkish Lira / USD pair, depreciation started in January due to political reasons and a negative economic environment.

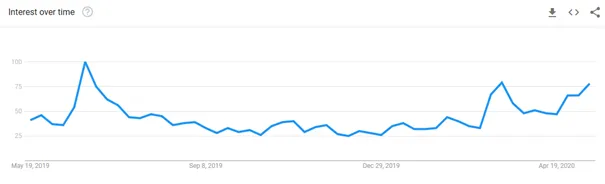

Google Trends for the keyword “Bitcoin” in Turkey

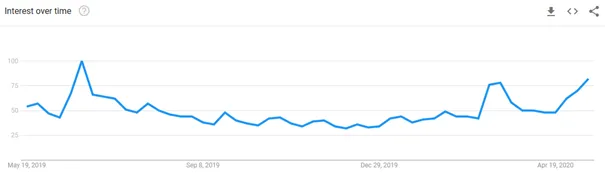

Google Trends have been catching up from end of February (much earlier than in the rest of the world).

Argentina Peso vs BTC Google Trends

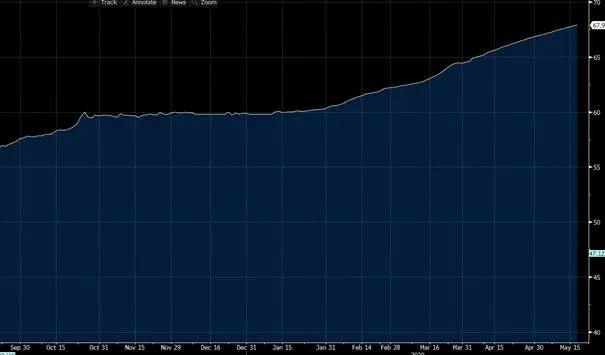

You needed to have c.57 ARS for 1 USD in September, today you need 68 ARS to get the same USD.

Sounds almost like Cryptofun right? Well it ain't fun when this is your everyday currency...

Google Trends for the keyword “Bitcoin” in Turkey

Bitcoin searches are at an All Time High in Argentina as the Argentinian Peso is at an All Time Low.

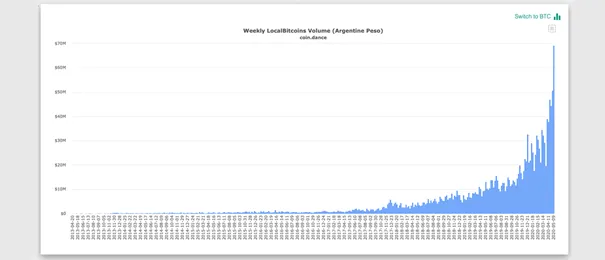

A dollar black market has been in placed in Argentina for many years but Bitcoin makes it just easier and less expensive as dollars in Argentina were negotiated at a premium.

A recent article P2P Bitcoin Trade Volumes and Inflation in Latin America Are on the Rise shows the scale of the recent demand !

Bitcoin was born in 2008 after the biggest financial crisis. I believe the COVID19 Crisis could crown it as the only true global currency.

As R.Huang stated in Forbes on the possible link between inflation and unemployment:

This is what happened in the 1970s in the United States, a period when gold boomed as a hedge for sliding currency value in an economy with mass unemployment. The COVID-19 world looks something like that: there’s massive inflationary monetary policy, with aggressive expansion of the monetary supply due to monetary policy, and prices keep on increasing due to supply shocks caused by lockdowns. The lockdowns have also shut down businesses that operate largely in physical spaces, leading to a mass increase in unemployment.

Let us conclude on a more positive note: Worldwide Bitcoin Google Trends are increasing rapidly, almost at ATH for the past 12 months

➡️ UpTrennd

➡️ Publish0x

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

Proud member of: