Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 How Bitcoin Correlations Drive the Narrative

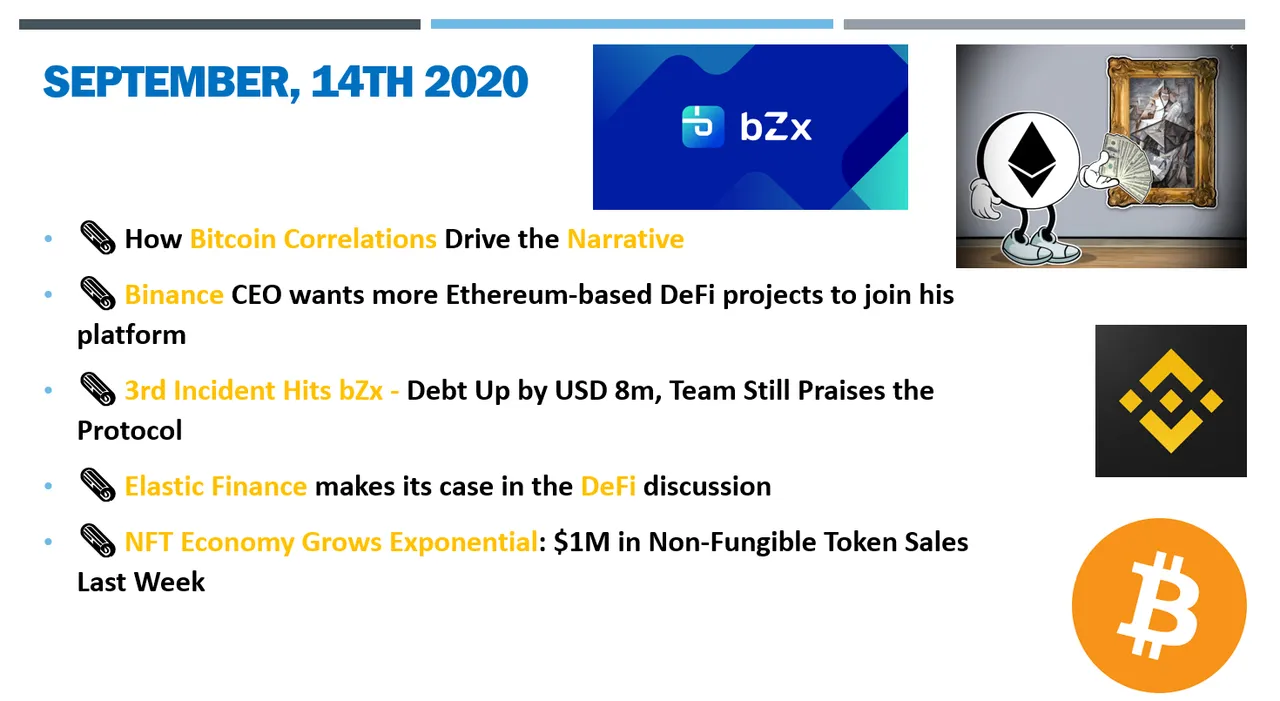

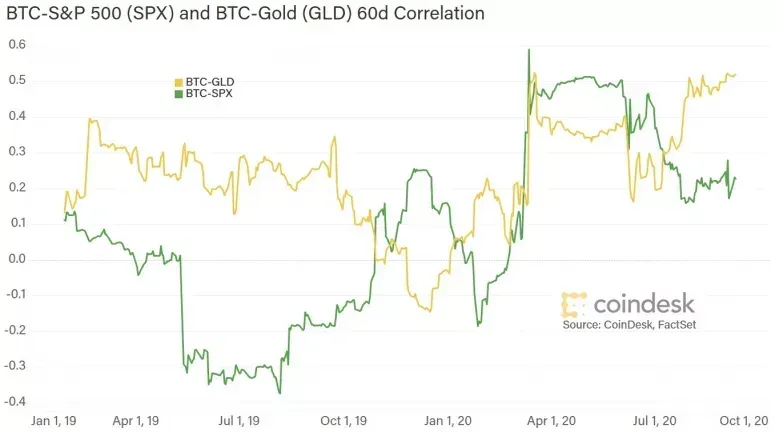

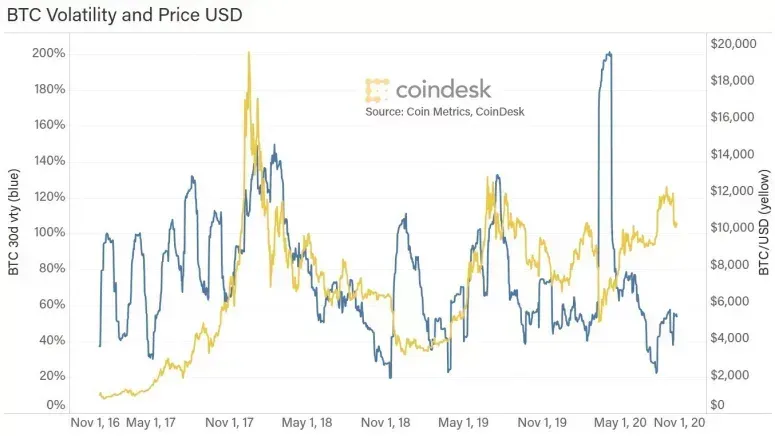

Every week there’s usually at least one article in CoinDesk, a blurb in a newsletter and several charts in the Twittersphere about bitcoin’s correlation with something or other.

BTC is a difficult asset to pin down. It is a scarce asset like gold, yet with a harder cap. It can be used for pseudonymous transactions, as can cash. It is a speculative holding for many, like equities. It is a bet on a new technology, like a growth stock. It is a hedge against a dollar collapse, a way to spread financial inclusion, an investment in financial evolution, a political statement. It is all of these, or none of these, depending on your intellectual leanings, economic philosophy and mood.

Make it a good one

BTC’s 60-day correlation with the S&P 500 has been coming down recently. That must mean it’s no longer a risk-on asset. Its increasing correlation with gold corroborates that, putting BTC back in the safe haven story.

With a happy ending

Correlations are based on price movements, which, especially in these crazy times, do not always respond to common sense. Prices have, on the whole, become untethered from fundamental factors and are being pushed around by sentiment. Sentiment fuels momentum, which we often mistake for a trend; it also perpetuates the directionality of prices, which can exaggerate correlations.

Anyone know what's going on yet?

As the relentless growth in COVID-19 cases around the world shines greater focus on the bumpy road to a vaccine, uncertainty in the timing of an economic recovery seems to be spilling over into stock market valuations. The S&P and Nasdaq look on track to have their second week of declines, for the first time since March.

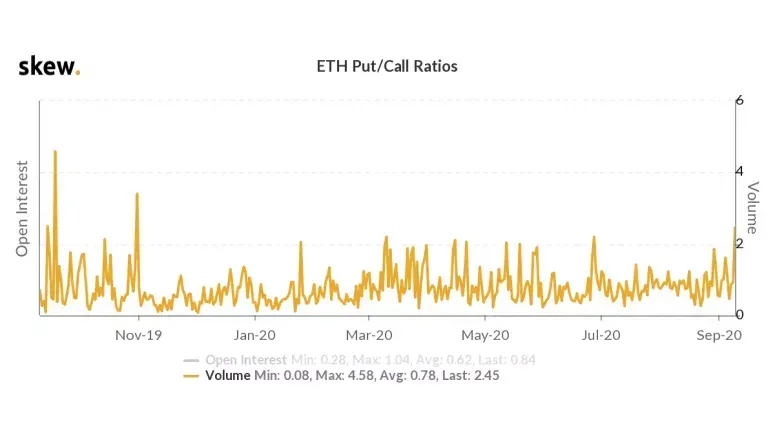

Options market data shows an upward trend over the past couple of months in the traded volume of ether (ETH) puts vs. calls, which hints at a growing fear of a price drop. TAKEAWAY: The bitcoin (BTC) put-call ratio is flat over the same period, which implies that the hedging is specific to ETH. This could indicate greater concern about the fragility of the recent inflows into some decentralized finance (DeFi) platforms, and the potential impact on the network’s congestion and token price.

The recent growth in bitcoin “accumulation addresses,” or addresses with at least two incoming bitcoin transfers in the last seven years and no spends, could indicate growing support for bitcoin in spite of lackluster price performance. TAKEAWAY: That we can even extract this metric is an example of the unique data sets available to crypto asset investors. Imagine having this level of information with traditional assets.

🗞 Binance CEO wants more Ethereum-based DeFi projects to join his platform

Binance CEO Changpeng Zhao welcomed more Ethereum-based DeFi projects to join the Binance Smart Chain (BSC) platform.

In a tweet discussion with another user, Zhao explained that this step would reduce the load on the Ethereum network, which will, in turn, lead to a reduction in Ethereum's gas fees.

Zhao later stressed that Binance Smart Chain is not a replacement or competitor to the Ethereum network and that it is compatible with it. Zhao added that Binance Smart Chain provides the smart contract creators with more options:

"BSC never aimed to replace ETH, BSC is just ETH-compatible. Smart projects are giving their users more options. Option for cheaper fees."

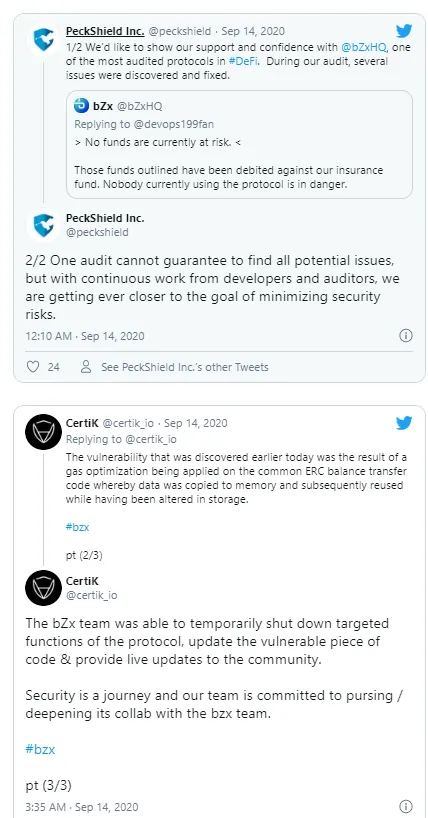

🗞 3rd Incident Hits bZx - Debt Up by USD 8m, Team Still Praises the Protocol

DeFi lending protocol bZx (BZRX) confirmed that "due to a token duplication incident" its insurance fund "has transiently" accrued debt of around USD 8m.

At pixel time (08:05 UTC), BZRX, ranked 138th by market capitalization, trades at USD 0.439 and is down by 32% in a day and 15% in a week.

Kyle J Kistner, Chief Visionary Officer (CVO) at bZx, said that due to a bug in their code "the user was effectively able to increase his balance artificially." According to him, borrowing and trading were not impacted, while the fix was identified and a new version of the affected iToken contracts was deployed with the balances corrected for duplications.

"Unfortunately, audits are not silver bullets. Our protocol is the most powerful, fully functioned lending protocol in the space, and this means that there is a lot of code to cover", he said.

🗞 Elastic Finance makes its case in the DeFi discussion

The DeFi frenzy has been making the headlines in the last few months, as crypto exchanges rush to list popular tokens within the decentralized finance sphere. However, another concept called “Elastic Finance” has emerged, which could be the next generation of financial platforms that can use unique supply elastic assets, said an expert.

During an interview with Cointelegraph, digital asset protocol firm Ampleforth Foundation CEO Evan Kuo said that Elastic Finance began with its own token, AMPL, a rules-based elastic digital currency that automatically translates price volatility into supply volatility.

“This operationalizes, in a way, the long-standing thesis by Nobel laureate James M. Buchanan that rule-bound “predictability”—–as opposed to human discretion—–might allow for more effective financial institutions. Further analysis had led us to hypothesize that these rule-bound supply changes might lower the correlation of the AMPL market capitalization with those of BTC and ETH.”

🗞 NFT Economy Grows Exponential: $1M in Non-Fungible Token Sales Last Week

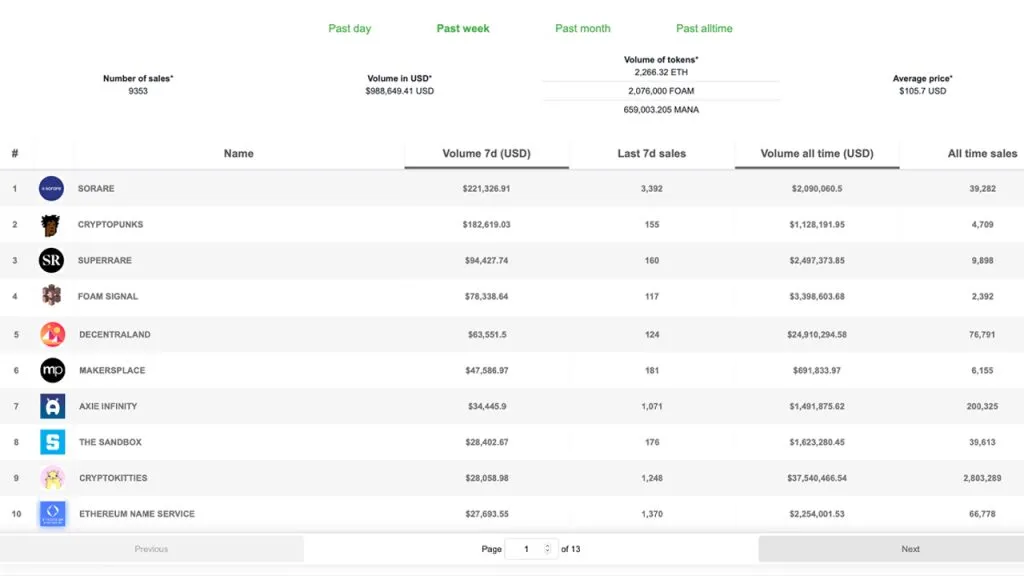

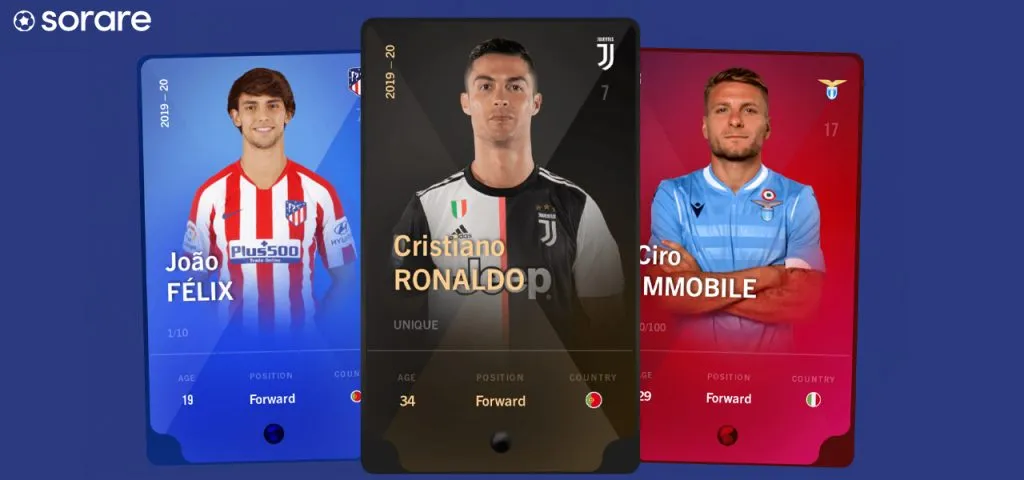

While a number of people are focused on decentralized finance (defi), the non-fungible token (NFT) industry has also exploded in demand in 2020. Last week, NFT sales soared nearing a million dollars in volume, as the blockchain-based Sorare fantasy soccer card game saw over $221,000 in sales during the last seven days.

When Satoshi Nakamoto created the blockchain, the innovative technology allowed for permissionless money, but also a number of tokenization features as well. One idea called the non-fungible token (NFT), also known as a ‘nifty,’ has gathered a lot of steam since the verifiable digital scarcity concept was first introduced.

This year, the popularity of NFTs has jumped considerably, as the concept is seeing a massive amount of funds flowing into the industry.

Cryptopunks, the project with “10,000 unique collectible characters with proof of ownership stored on the Ethereum blockchain,” saw $182,619 in volume last week. Then the Superrare digital artworks marketplace sold $93,733 in the last seven days.

🗞 Daily Crypto Calendar, September, 14th💰

- Waves (WAVES)

"$WAVES to be Listed on #LBank | Trading Pair: WAVES/USDT... Trading Open: 18:00 on Sep 14, 2020 (UTC+8)"

- TrustSwap (SWAP)

"Mainnet is going live in 96 hours."

- Akropolis (AKRO)

"AKRO and ADEL rewards for Aug 31 — Sept 9 will be distributed by Monday, September 14."

- Atmos (ATMOS)

"#Atmos will be listed September 14, 15:00 KST including a BTC trading pair @thenovusphere"

- Unitrade (TRADE)

"Third party security audit from reputable firm."

- yearn.finance (YFI)

"Yearn.finance (YFI) Gets Listed on #KuCoin!... -Supported pair: $YFI/USDT... Trading: 4PM on Sept 14, 2020 (UTC+8)"

Last Updates

- 🗞 Daily Crypto News, September, 13th💰

- 🗞 Daily Crypto News, September, 12th💰

- 🗞 Daily Crypto News, September, 11th💰

- 🗞 Daily Crypto News, September, 10th💰

- 🗞 Daily Crypto News, September, 9th💰

- 🗞 Daily Crypto News, September, 8th💰

- 🗞 Daily Crypto News, September, 7th💰

- 🗞 Daily Crypto News, September, 6th💰

- 🗞 Daily Crypto News, September, 5th💰

- 🗞 Daily Crypto News, September, 4th💰

- 🗞 Daily Crypto News, September, 3rd💰

- 🗞 Daily Crypto News, September, 2nd💰

- 🗞 Daily Crypto News, September, 1st💰

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Youtube

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ UpTrennd

➡️ Read.cash

➡️ LBRY

Helps us by delegating to @hodlcommunity