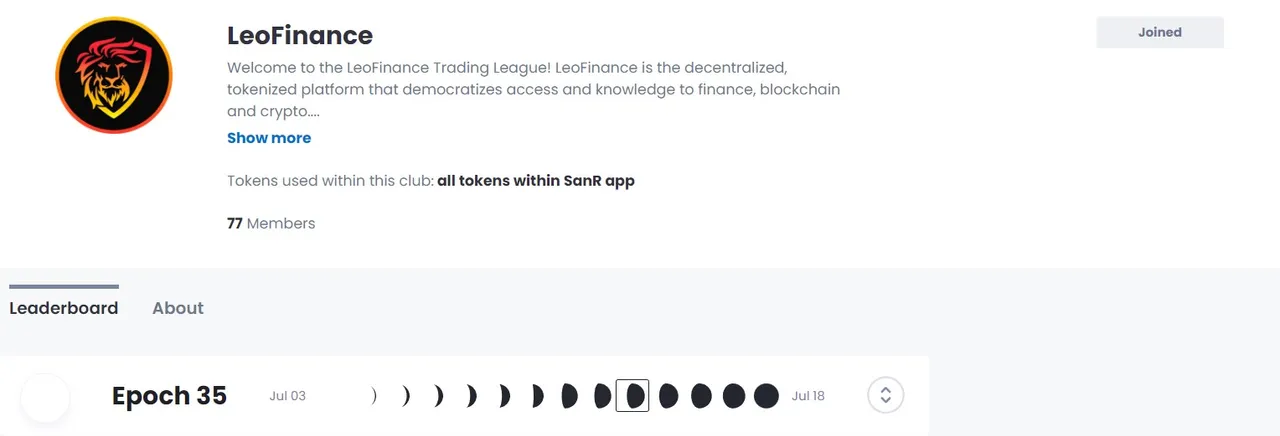

The LeoFinance-SanR partnership has opened a way for us to practice crypto trading without risking real crpto assets. If you are open to learning, I invite you to come aboard, join us on the club (the LeoFinance Trading League) and let's learn along with the others. It's never too late. The truth is, although I joined the club last month, I haven't had the chance to explore the platform, let alone read through.

A few days ago, I decided to give it time and visited the platform, explored first and tried to familiarize myself with the menus and the tools by navigating through. The UI is actually neat and user-friendly.

Anyhow, after exploring, I opened my first signal choosing the BCH/USDT pair, ticking the "Rise" (SanRise) button because I believed the price of Bitcoin Cash will go higher than its current value when I was creating the signal. The price then was $266.07 and I set to take 5% profit and a Stop Loss at 5% too, with 2x leverage.

After setting my forecast (signal), I went on with my day and only visited my dashboard some hours later and found out my order had been closed with a net imaginary profit of 10.95%. Easy-peasy yeah? Kind of. Well only because there isn't any real crypto involved.

And if you are thinking it is difficult to open signals on SanR (that was my initial thought to be honest), it is actually pretty simple.

On the tokens drop down menu (HIVE is included in the list by the way (HIVE/BTC and HIVE/USDT). And I read that other Hive assets like LEO and SPS will get listed soon), you just select the token pair that you want to buy and tick "Rise" (SanRise) if you think the coin or token's price will increase or "Fall" (SanSet) if you believe the opposite will happen.

You can either set the "Take Profit" and "Stop Loss" price or not at all. When these two are set, your order will automatically close when any of the prices are reached. When you don't set any price, you will have to manually close the order at some point.

Likewise, you can set the "Trigger Price" for your buy order. Not setting it will treat the current price of the token as your default buy.

You can open a maximum of 10 signals at any given time. If you want to add new ones, you will have to close some of your previous signals. Each signal stay open for 14 days before they automatically close, unless you manually close them yourself. The signal closes anytime when your Take Profit (TP) and Stop Loss (SL) prices are reached.

And not to forget that I found out while exploring further that if you ever change your mind on the prices that you set for your "Take Profit" and "Stop Loss," you can edit them by going to your dashboard and clicking on the signal that you wish edited.

It will open up the pair's details and there, you can edit the price accordingly. Fast and easy. Takes literally just a few seconds to do. No sweat!

I recommend reading this comprehensive guide by Eric for a more detailed walkthrough on how to sign up to SanR and create your first signal. He also teased that something big is coming.

For further reading about the SanR, do check the following articles:

- How SanR is Helping Users Become Better Crypto Traders

- Learn and Enhance Your Crypto Trading Skills with SanR

- Quick Start Guide

And better yet, join the SanR community page and share your thoughts and experience as you test the app.

What Else Can You Do on the SanR Platform

Practice trading skills for free.

We can learn basic trading and enhance our analytical skills without risking any real crypto asset. While we connect a wallet use the application, there isn't any gas fees to be paid on any of the trading transactions. But for security purposes, do note to use a wallet that doesn't hold any funds.

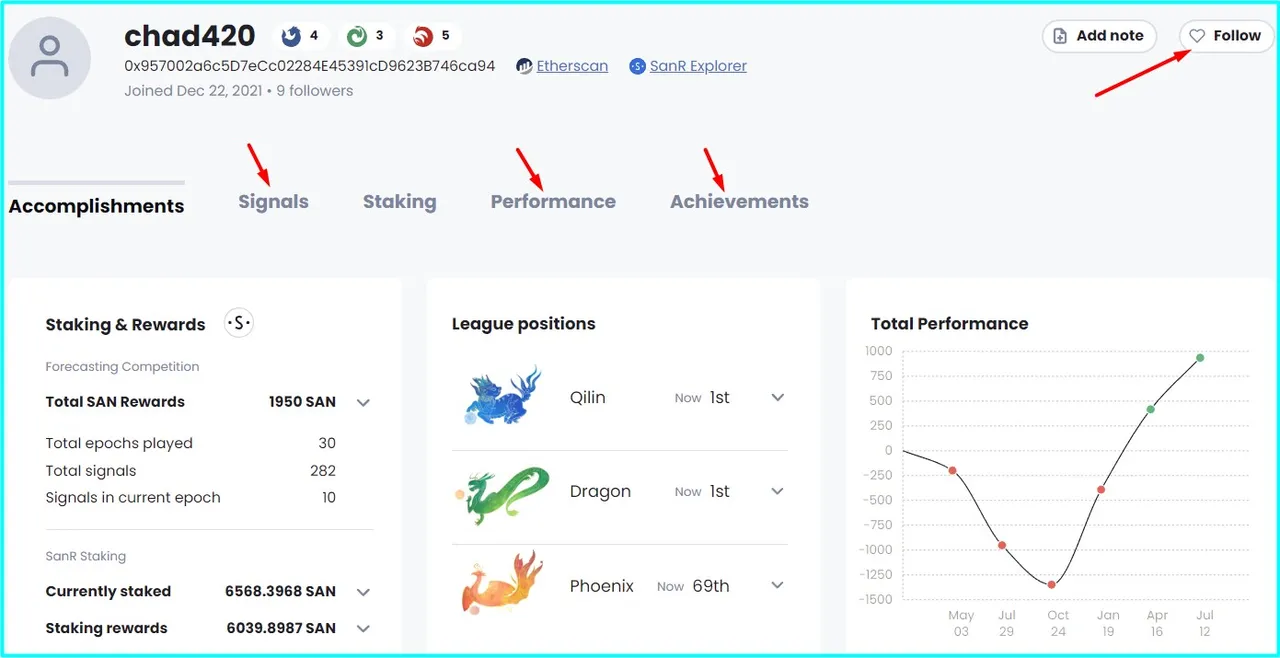

Watch the signals of others

Since users can view the trading signals of others within the SanR app, they have the opportunity to learn from more experienced traders. Users can "follow" others as well.

Participate in a crypto market forecasting competition

Users can join trading leagues (like that of the LeoFinance Club) and compete with others to predict market movements, enhance their analytical and forecasting skills, and potentially earn rewards (SAN tokens and others).

Likewise, crypto communities can create their own club and conduct trading and/or forecasting competitions. LeoFinance has an ongoing competition with a prize pot of $300 (2000 LEO and 2500 SAN). The current epoch will end on July 18th.

Stake SAN tokens and earn rewards.

Users can stake SAN (Santiment token) and get a share from the SAN rewards fund. This is done through Intelligence Staking.

Personal Conclusion

Trading is never easy and SanR is giving people the opportunity to learn basic trading, practice and hone their analytical skills without the fear and risk of losing any real funds or crypto. The concept behind the application is very interesting and the platform being decentralized and basically free to use is simply amazing.

I'm a rookie and I personally believe this adventure is going to be fun and hope to give my emotional quotient a good workout while creating signals and learn to make better trading decisions.

Lead image created on Canva. All screenshots from SanR dashboard. No copyright infringement intended. 13072023/09:37ph