In the ever-evolving world of decentralized finance (DeFi), innovation is the key to staying ahead. Raydium, a leading automated market maker (AMM) on the Solana blockchain, has just unveiled a feature that could reshape how we think about liquidity provision and project trustworthiness. Enter "Burn & Earn" – a clever mechanism that allows token teams to lock their liquidity permanently while still reaping the rewards of trading fees.

Burn and Lock Liquidity from Raydium

Burn and Lock Liquidity from Raydium

The Trust Paradox in DeFi

For years, the DeFi space has grappled with a fundamental issue: how can projects prove their long-term commitment to investors? The specter of "rug pulls" – where developers abandon a project after draining its liquidity – has haunted the crypto community, eroding trust and deterring potential investors.

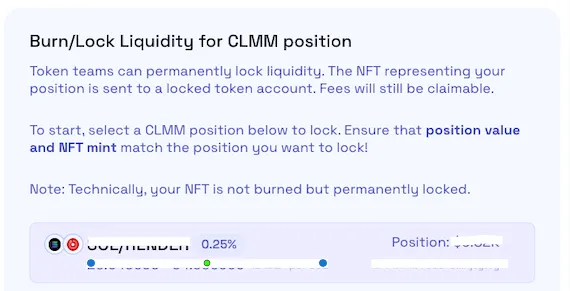

Raydium's Burn & Earn feature aims to tackle this problem head-on. By allowing teams to permanently lock their Concentrated Liquidity Market Maker (CLMM) positions, it provides a tangible demonstration of commitment. This isn't just about locking liquidity for a set period; it's about making an irreversible decision to support the project's longevity.

How Burn & Earn Works

At its core, Burn & Earn is elegantly simple. Token teams can choose to "burn" their liquidity position, rendering it permanently inaccessible. However, unlike traditional burning mechanisms, this doesn't mean sacrificing all benefits. The genius of the system lies in its ability to allow teams to continue claiming trading fees generated by their now-locked position.

This approach strikes a delicate balance. It offers the security and trust-building of permanent liquidity locking while maintaining an incentive structure that encourages ongoing project support and development. It's particularly recommended for full-range positions on top of Concentrated Liquidity pools, maximizing its effectiveness.

The Ripple Effects

The implications of Burn & Earn extend far beyond just Raydium or even the Solana ecosystem. This feature has the potential to set a new standard for trust and commitment in the DeFi space.

For Solana, it's another feather in its cap. The blockchain has been making strides in the DeFi sector, and innovations like this only strengthen its position. It could attract more projects to the platform, drawn by the ability to definitively prove their commitment to investors.

In the broader crypto landscape, Burn & Earn might just be the start of a new trend. If successful, we could see similar mechanisms implemented across various DeFi protocols and blockchains. This could lead to a general uplift in trust across the sector, potentially attracting more mainstream investors who have been wary of DeFi's perceived risks.

Challenges and Considerations

However, it's important to approach this innovation with a balanced perspective. The permanence of the liquidity lock, while a strong trust signal, also introduces inflexibility. Market conditions change, and projects that have burned their liquidity might find themselves unable to adapt as needed.

Moreover, the irreversibility of the process means teams need to be absolutely certain before committing. There's no going back once the liquidity is burned, which could be problematic if unforeseen circumstances arise.

Looking Ahead

As with any new feature in the fast-paced world of DeFi, the true test of Burn & Earn will be in its adoption and long-term impact. Will it become the new gold standard for project commitment, or will teams be hesitant to lock themselves in so permanently?

What's clear is that Raydium has taken a bold step in addressing one of DeFi's most persistent issues. By providing a mechanism for projects to put their money where their mouth is, they've opened up new possibilities for building trust in the crypto ecosystem.

For investors, this feature offers a new metric to consider when evaluating projects. A team willing to permanently lock their liquidity sends a strong signal about their confidence and long-term vision.

As the DeFi landscape continues to mature, innovations like Burn & Earn remind us of the sector's potential to solve its own challenges creatively. It's a testament to the ongoing evolution of crypto finance, always pushing boundaries and exploring new ways to build trust in a trustless system.

Whether Burn & Earn becomes the new norm or simply inspires further innovations, it's certainly a development worth watching closely. In the ever-changing world of crypto, it might just be the spark that ignites the next phase of DeFi's evolution.