I’ve just started rewatching the entertaining TV show called I Zombie. Currently showing on Netflix.

(Spoiler alert) It’s revealed in the show that the zombies have been created by the combination of recreational drug Utopia and energy drink Max Rager. Aware his company has produced this psychotic effect on people causing them to desire eating brains, the CEO tries to sell his company to the military-industrial complex. Meanwhile, a zombie outbreak is imminent due to the entrepreneurial activities of villain Blaine. He makes rich people zombies so he can supply them with brains, at a cost.

This may sound like complete fiction, but what if I was to tell you we really do have a zombie problem. However, it lies in our corporations and in particular in our banks.

Zombie Companies

These have been created by over a decade of ultra low borrowing costs.

Technically a zombie company is one that has to issue new debt just to pay interest due on existing debt. According to a Bloomberg study 32% of the Russell 3000 don’t actually make any money! A lot of these are found concentrated in the tech sector.

It’s evidence of a zombie outbreak brought on by an addiction to cheap money and gambling.

Currently this outbreak is being contained – barely. However, as we head into an economic slow down these companies will have no where to hide. Interest rate rises mean the brains have become harder and more expensive to obtain. These zombies are at high risk of losing the plot because they simply can’t afford to pay that kind of interest on their debt.

Zero to 5% in less than a year. That’s a rapid increase in interest rates.

To keep control of a zombie outbreak we will see more and more fiscal control. Unfortunately, the zombies are addicted to the cheap money. What will governments and central banks do to keep them from going full out zombie mode?

Credit Suisse

The company on everyone’s lips.

The question is – is Credit Suisse a zombie bank and does it have the potential to bring all the other zombie banks and companies down with it?

The big news here is that on Sunday the former top shareholder of Credit Suisse, Harris Associates, sold all it’s holdings in the Swiss bank.

Credit Suisse has been in the business of lending money for 167 years and was seen previously as being one of the more conservative banking outlets. Yet in the spirit of the new casino conditions it made some very bad decisions.

It assisted US hedge fund Archegos to take “catastrophic” risks and lost billions when it collapsed. An independent review found it was Credit Suisse’s bad management to be at fault.

Further bad news for the bank was the failure of Australian bank Greensill and the ongoing litigation, which also has as it’s focus the bad management decisions by Credit Suisse.

Then the icing on the cake, the scandal that ensued when it was discovered that they had been spying on their own employees and which forced the resignation of it’s CEO Tidjane Thiam.

In total last year the bank lost 1.63 bn Swiss Francs. (Swiss Francs are roughly on a par with the dollar now). It’s share value has fallen enormously and now stands along side (if not worse) than Deutsche bank.

We don’t know if these banks are zombies however, because of the fiscal control. If there’s a hint of a crisis central banks throw everything they can at it to keep it contained. Like keeping a bunch of zombies chained up and throwing them brains? Not solving the problem, just keeping a lid on it.

On paper Credit Suisse is worth about 45 bn in total equity, whilst it’s market cap is only 11 bn. Which might look like a bargain to some. However, this is only paper assets.

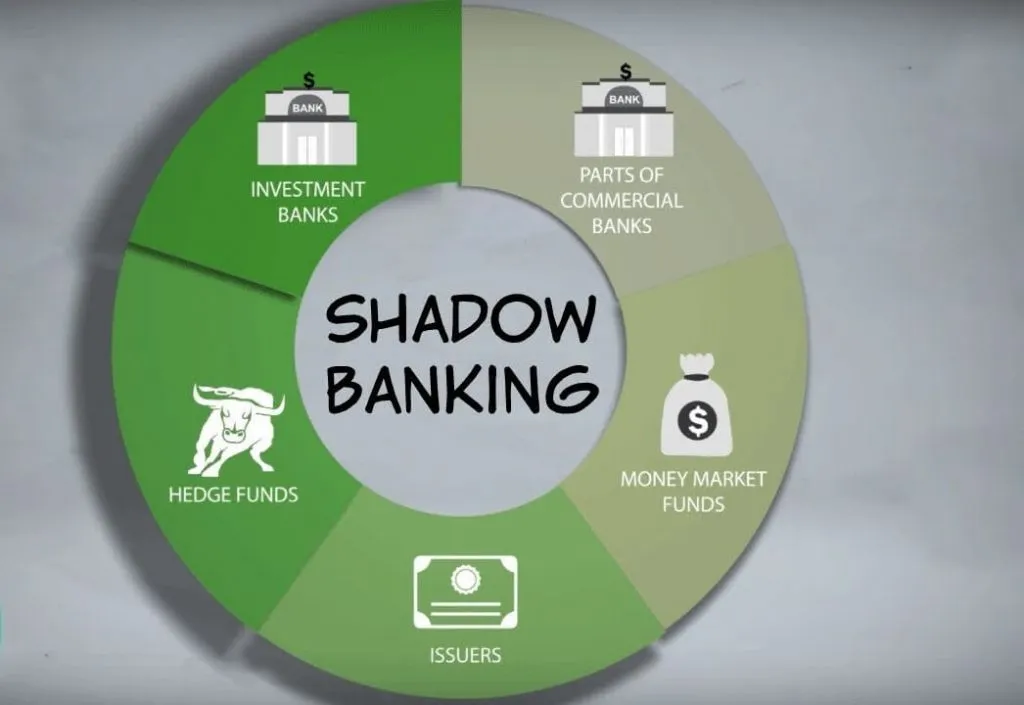

Just as zombies exist in the shadows we know there is more to the banking system – we call it the shadow banking world.

Just like the zombies who hide away the true nature of their being, so behind the scenes we need to take into account the massive fraud that exists in the banking sector.

Harris Associates have sold their entire holdings in the bank which must mean something is wrong that we don’t know about. What we do know is that starting in October 2022 there was a mass client exodus. There were large outflows from their wealth management department and 111 bn withdrawn by Credit Suisse customers in the final three months of 2022.

What we don’t know is to what extent the bank was involved in money laundering in Ukraine and how many of those clients were NATO generals and the like. [Just as an aside – Switzerland’s neutrality in World War Two allowed it to be the banking centre for the Nazis and all of their stolen gold. Therefore, it’s no stretch of the imagination to opine that they have been deeply involved in money laundering in Ukraine.]

Cartoon by Pryor, Geoff, 1944. Click link for a clearer image

Rumours abound on social media sites about the health of the bank.

Credit Suisse is right up there on the Basel III list as a bank of systemic importance and too big too fail. [Another note that the Bank of International Settlement is also based in Switzerland.] In other words it’s the type of zombie that’s very dangerous and could cause a contagious reaction setting free all the other zombie banks and companies.

European Sovereign Debt Crisis

You may remember back in 2011 a sovereign debt problem emerged in Europe.

The Swiss central bank was forced to unpeg it’s currency from the Euro. This was due to the problems the so-called PIGS were having and the Swiss Franc was regarded as a safe haven. Keeping to the peg was hurting Swiss exports so they were forced to break it.

Behind the scenes the Swiss National bank had to go to the US for help. In collusion with Wall Street the Swiss bank was given dollar swaps with which it bought first the FANG stocks (Facebook, Amazon, Netflix and Google), and then a further tranche with which they purchased the MATs (Microsoft, Apple, Tesla).

Basically, zombie banks invested in zombie companies to keep the whole charade going and to hide the general zombie outbreak, which they’ve been containing ever since – well perhaps since 1997 and the Long Term Capital implosion, according to Jim Rickards.

What is referred to as “working capital” [brains], comes to us in part from the enormous slush fund that is the CIA/Narco money.

So in 2019 the Swiss National bank announced it had a 1.5trn US stock portfolio. However, with rising interest rates they are looking at ways to unwind this and there’s only one option open to them and that is to sell the stocks and buy gold. Not that the US Federal Reserve would be happy for that. It threatens decontainmant and an all out zombie apocalypse.

Obviously I have stretched my metaphor for the purpose of the article, but the salient point is that there are zombie companies out there whose very existence relies on the ultra cheap money provided by low interest rates. A situation we currently no longer have.

Due to the high risk of the containment breaking and systemically important banks who are heavily invested in these zombie companies, we should expect to see anything and everything being done to contain an outbreak.

I don’t remember how I Zombie ends but if there’s a cure for our real world zombies it lies in bankruptcy and the reintroduction of real food (gold) for the brains that are currently the food of choice.

Cartoon

Or is this the brain of our ruling class?