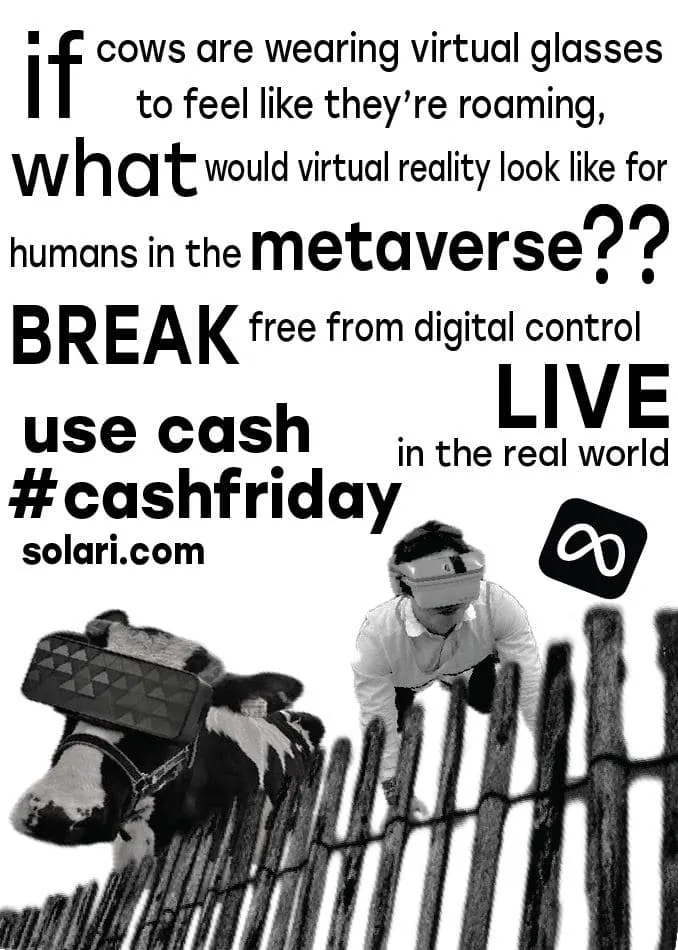

Today being Friday I went to the ATM and withdrew cash to spend in my locale. If we want to keep cash as part of our economies we need to continue using it. I know it’s super convenient to swipe that card, and they’ve just raised the limit again, but we need to make a conscious effort to do this. People have been talking about the war on cash for some time now. During the early stages of the plandemic we got to amaze at businesses refusing cash in case of catching the virus! The epitome of dirty cash.

Behind the war on cash though is the move towards Central Bank Digital Currencies (CBDC). These currencies, unlike the cryptocurrencies we all know and love (well sometimes), will be issued and controlled by each countries central bank. A virtual fiat currency, backed by faith and credit. In other words by the ability of the country’s workers to pay down the interest on the debt in perpetual slavery to the world’s central banks. You will own nothing and be happy – you will be earning the company’s dime to spend in the company store.

Well, they have been experimenting with this brainchild for a while. Different countries are at different points of planning and preparing for a roll out. Learning and sharing practice globally naturally. For the powers that be, a CBDC will allow cost cutting and make it far easier to implement policies. Especially the draconian economic polices that will be required in the future to satisfy the demands of the money lenders.

Jamaica

As of December 2021 91 countries were in various stages of development. One such country is Jamaica. It began its pilot in March 2021 with vendor eCurrencyMint Inc. eCurrency purports to be the world’s only true CBDC solution to securely issue and distribute digital fiat currency by central banks. On their website they state they have been working with central banks and international bodies like the IMF since 2011. I think this shows us how long they have been working on this, however, it is clear that the project has really taken off in 2020-2021.

In May, Jamaica began their 8 month pilot which ended 31 December 2021. One of the main concerns was the attendant technology needed, with a focus on wallets. On the 9 August the Bank of Jamaica (BOJ) minted $230 million worth of digital currency. This was issued first to institutions and authorised payment service holders. The next day they issued $1m worth to be distributed to staff already set up with wallets. With everything in place eCurrencyMint concluded their latest funding round on 5 October and attracted investment from Ray Dallio and Vikram Pandit, former CEO of Citigroup, among others.

On 6 October an amendment is approved in parliament allowing BOJ to be the sole issuer of CBDC. On the 29 October the BOJ issues $5m to the National Commercial Bank. They get 57 customers onboard including four small businesses. In December they hold a “Market on the Lawn” to promote use of the CBDC.

In November they participate in a webinar to share insights etc. Other panelists include Peter Karstens of the European Central Bank (ECB) and Ian Vitek of the Swedish Riksbank. Sweden being another country that has been working on this CDBC for some time now and is currently running a pilot.

Considered a successful pilot the BOJ is now rolling out CBDC in Q1 of 2022. Plus two additional wallet providers are in the works. CBDCs have also been launched in all seven islands of the East Caribbean, the Bahamas, and Nigeria (as of end 2021). Most countries are still in the research phase including the US, UK and Europe. A further 14 are at some point in the piloting stage including Australia, Canada, Brazil and Russia.

A sign indicating e-CNY (the name for the digital Yuan)

Unsurprisingly China is well ahead of the US in developing their CBDC having set up a task force back in 2014. In April 2020 they piloted in four cities and this was extended to 28 in August. In July 2021 the People’s Bank of China issued a report on the pilot. In it they describe their three objectives; to satisfy the people’s demand for digitised cash, to support efficiency and safety of retail payments, and improve cross border payments.

The paper concludes to advance, in a “prudent and orderly manner”, as part of China’s 14th Five Year plan. However, as of January 2022 the PBOC have begun ramping up efforts to roll out a digital Yuan launching an app this month to allow users in 10 areas including Shanghai and Beijing to sign up for the digital currency. Recently Alibaba and Tencent (WeChat) have jumped onboard. They have also been running digital currency lotteries to distribute tens of millions of digital Yuan.

The pressure for countries to adopt a digitised fiat currency is intimately related to the economic/financial crash of 2008, the debt burden, and the rise of decentralised cryptocurrencies. For some countries like China and Russia it relates to de-dollarisation as US debt has ballooned and QE is a way to cheat your creditors.

A centralised digitised currency has the benefit of cheapness and unlimited control. If we think government's are bad now – once the currency is digitised they might believe they have really invented the magic money tree. If they are able to roll this out successfully in the next period we will have witnessed what some are calling a financial coup d'état.

At the G7 summit meeting at Jackson Hole, Wyoming, in August 2019, a much needed bailout plan was orchestrated. In September the Fed began its emergency repo loan bailout programme. This shows that the financial problems pre-date Covid 19. Indeed the plandemic is now being used as the cover story and what was termed Going Direct now falls under the catch-all Great Reset of Klaus Schwab and the WEF.

Of course the CBDCs are a form of control and their advocates are keen to talk about financial inclusion. This coming from giant corporations like Blackstone who are aggressively acquiring property in the US to rent to the future neo-feudal peasants! Combine this CBDC with your digitised passport and you can start to appreciate the level of control they are seeking to exert over us.

The plandemic has not only been a cover story it has been used to actively pursue agendas like ID2020 (digital IDs), and putting into place emergency legal frameworks to create support for centralised control. A Great Reset must include a reset of asset prices. In just three months (March-June 2020) the FED increased its balance sheet by $2.8 trillion or 60-70%. A staggering wealth transfer. It will probably pale into comparison with what they will attempt to do with these CBDCs.

Well I think just like cryptos, CBDCs are here to stay. We are just ready now to be herded into the pen. Not only that, they will play an important role in the coming financial crisis and yet another temporary fix, which will undoubtedly only pave the way for an even bigger crisis. So, for now I will continue using cash on Friday - keeping it in the system, making it harder for them to implement their plans of control.