Economical analysis of the recent masternode proposal. Gridcoin network development discussion.

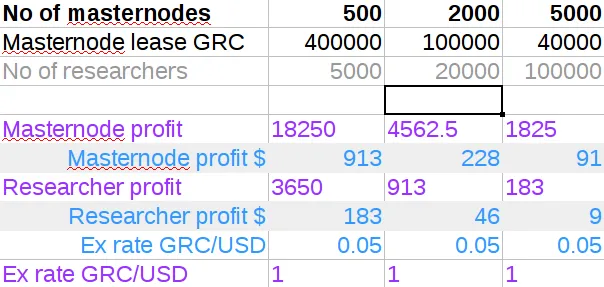

Proposed payout structure (approximate):

- 18.25 mln GRC to workers / researchers

- 9.125 mln GRC to masternodes

- 0.4 mln GRC masternode lease

Other assumption:

- cost of VPS server with static IP = up to $500 per annum

- 50% of all GRC will be locked in / used to lease masternodes*

- 400 mln GRC supply

*Currently there are ~4500 masternodes in Dash network. At 1000 lease cost for each total cost is equal to 58% of circulating supply.

With the above assumptions Gridcoin network would consist of 500 masternodes.

At exchange rate of 1 GRC = 0.05 USD each masternode income would equal $912.5, what would easily cover server costs.

At exchange rate of 1 GRC = 1 USD each masternode income would be equal to $18 250, what would easily cover server cost and bring substantial profit close to 5% of the initial investment.

A whale holding 10 mln GRC would need to set up 25 servers/masternodes.

Assuming there are 10 thousand workers (researchers), each would have, in average, an income of respectively $91.25 (1GRC=$0.05) or $1825 (1GRC=$1) per year. For 100 thousand researchers payouts would drop sharply, respectively to $9 or $183.

We can estimate, that to achieve a number of masternodes similar to the number present in Dash network, cost of the masternode lease should be 40 000 GRC. However, currently this would hardly cover server costs or not (expected profit of $91 per capita for 5 000 masternodes). At exchange rate of 1 GRC = 1 USD expected profit would be $1825 and would allow to cover server costs and bring some profit. A whale holding 10 mln GRC would have to set up 250 servers, what is a drawback for big holders.

Seller – Buyer Trap

If someone already holds 10 mln GRC it is fairly easy to set up 25 servers, but difficult to cash out the whole sum due to low liquidity – exchange rate would dive. On the other hand, buying high amount of GRC would put pressure upwards. Thus whales cannot sell at nominal prices, while buyers cannot buy at nominal prices.

Conclusions

Due to expected earnings of owning a masternode, high cost of 400 thousand per masternode and seller–buyer trap, we can expect that just a few people would own almost all masternodes and concentration would rather grow than fall. While technically we could consider the network to be decentralised, as it would be mostly owned by just a few entities - structure would resemble oligarchy.

At 40 000 GRC lease cost of the masternode, would Gridcoin become successful (1GRC = 1USD or better), would become prohibitive for an average researcher. The part solution would be shared masternodes.

Payout system rewarding researchers based only on in-built inflation leaves little room for organic growth.