Our good friends at SilverDoctors.com just gave us an insider peek into Russia's gold vaults.

We all know that Russia's Central Bank has been importing tonnage of gold in the past several years, as they recognized its true value in contrast with the vastly depreciating fiat (read printed or digitally-created-per-computer-key-strokes) currencies.

While Russia is showing theirs, other BRICS nations such as China are a little more shy and timid.

Apart from cultural reasons, there are undoubtedly strategic ones as well. If they were to show the size of their real reserves (as opposed to their stated reserves of 1,842 tons), it could easily create a catastrophic impact on the US dollar and consequently the value of their trillions in holdings of US Treasurys.

Another reason can be a military one. They always have this Ace-in-the-hole Gold card that they can use at any time should the American neocons stir trouble on the Korean peninsula or in the South China Sea.

The Chinese are very smart, calculating, and shrewd; I should know, as I've been living in this country since 2008. They don't like to make big moves to rock the boat, but rather prefer to take things in the manner of death-by-a-thousand-cuts, as can clearly be demonstrated by this weeks' reference to their possibly slowing or halting their purchase of US Treasurys.

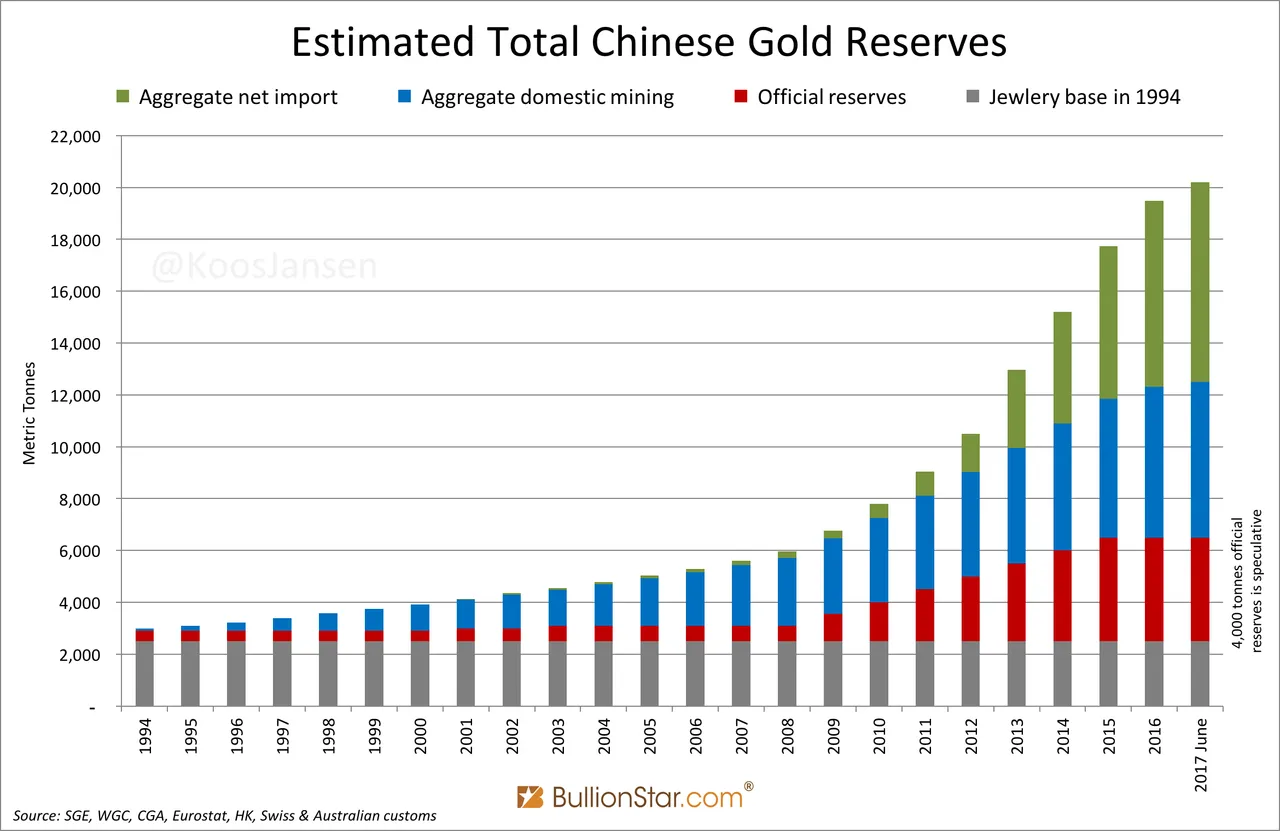

But how much gold does China really have?

According to Koos Janson, an expert in the field, China's estimated gold reserves surpass 20,000 tons!

What about Uncle Sam?

Official stated reserves (between the vaults of the Fed + Fort Knox), claim to be in excess of 8,000 tons.

Yet there hasn't been an official audit of either of those vaults in decades. While the current US Treasury Secretary Steve Mnuchin assures us that the gold is "safe", the general consensus amongst experts is that the gold is gone. If it were there why not show it to us?

I wonder if President Trump would tout his "gold button" as being really bigger than Russia's or China's?

While most of us know that the current price of gold is being (and has for a very long time) suppressed and manipulated in London and New York, most likely to keep the illusion of a "strong" dollar, it is only a matter of time before the East (read China, Russia) takes firm control of its pricing through honest and fully-backed bullion on the Shanghai Gold Exchange, this is not to mention the new Petro-Yuan, or yuan-denominated oil contracts backed by gold bullion; this will be a game changer.