General Electric is the story of two CEOs:

Jack Welch - In his two decades at the helm of General Electric, he grew:

- revenues from $25 billion to $130 billion

- profit from $1.5 billion to $15 billion

- market capitalization ballooned to $400 billion, growing by a multiple of 30.

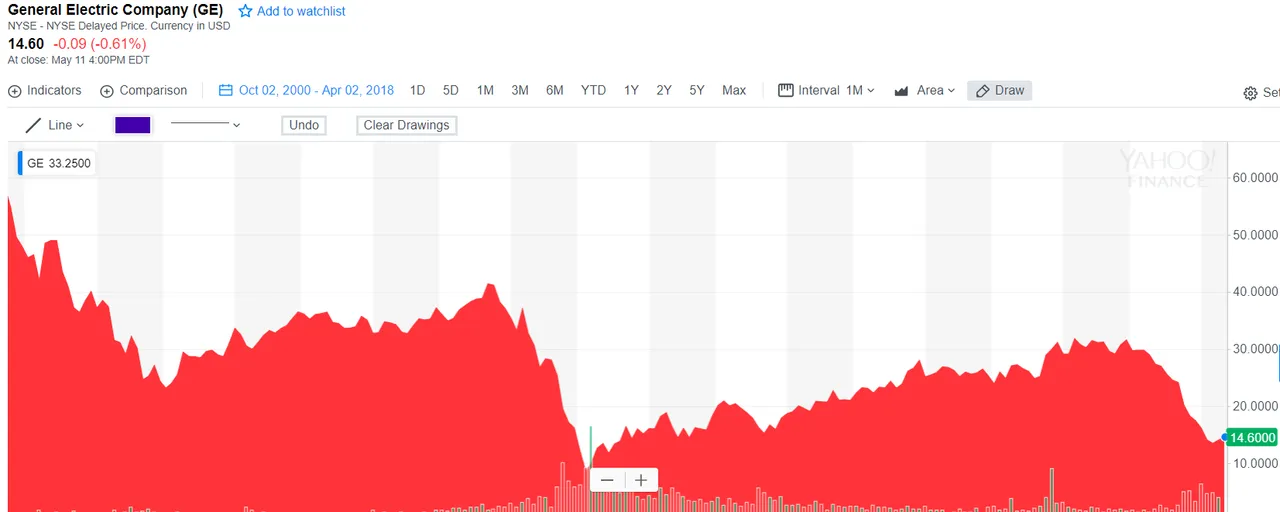

Jeffrey Immelt - a crony capitalist whose actions resulted in the share price falling by more then two thirds in the 17 years since his appointment as CEO of GE was announced:

- participated in every Obama administration boondoggle imaginable

- Obama's council of economic advisers (remember them giggling about "shovel ready" jobs)

- resorted to short term financial engineering when the Democrats lost power

I do not know why it took the GE Board so long to get rid of Jeffery Immelt, but since they did in October last year - the skeletons have been falling out of the closet and the share price has taken a big beating. So much so, it is the worse performing Dow stock over the past year. The doggiest dog of the Dow if you like.

The Dogs of the Dow Theory would suggest that the market has over-corrected for all the bad news that has come out recently including:

- Cash flow problems

- Massive amounts of debt exposed to rising interest rates

I added General Electric Co (GE:NYSE) to our portfolio this week at $14.60. Lets see how it performs over the next 12 months compared to the other Dow stocks