”They will come to a bad ending”

The Oracle of Omaha recently prognosticated the demise of Bitcoin, despite admitting a complete lack of knowledge on the inner workings and market dynamics of Bitcoin in particular, and cryptocurrencies in general.

Neither did he bother providing any factual basis for his predictions. In fact, he failed to even define some very basic terms.

Admittedly, market conditions over past couple of weeks have been pretty brutal. We breached the psychologically-important line of defense at $10,000, and the general mood isn't a celebratory one. More so than ever today, with the market crashing to levels not seen since before Thanksgiving.

Still, what people like Mr. Buffet and other armchair pundits on CNBC fail to realize is that Bitcoin could crash 99%, that even a price decline of that magnitude wouldn't mean the end of the network.

To be sure, extreme draw-down volatility as shown in the example above would absolutely decimate the hashrate, creating a ridiculous amount of transaction backlog and raising fees for everyone.

Still, after two weeks, the difficulty would adjust, blocks would start being found at regular intervals, and fees would go down.

In other words, Bitcoin doesn't 'end' just because it is now valued at an arbitrary fraction of an arbitrary valuation at its ATH. Life continues on the blockchain whether the price is $100 or $100,000.

This is my first point of contention with Mr. Buffet's argument, but it isn't the last.

In the latter section of an interview with Fortune magazine, the billionaire founder of Berkshire Hathaway stated he'd 'gladly' acquire a position in five-year put options on ”everyone of the cryptocurrencies.”

But would he really? A put option is the right (not the obligation) to sell a predetermined quantity of the underlying asset at a price (called the 'strike') agreed upon by both the buyer and the seller, at any point in time up the put's expiry date.

The terms outlined above constitute the basic properties of an American style put option. European style options allow less flexibility and can only be exercised at the expiration date, but the dynamics are similar.

In simple terms, put options are essentially insurance against a price decline of the underlying asset.

Option pricing is generally done by running a series of variables -- like the implied volatility of the underlying and time until expiration -- through the Black-Scholes equation.

This equation makes an interesting assumption, though, in that it assumes the log returns are normally distributed.

Which of course, you don't need to be a mathematician to know that the log returns for Bitcoin are not normally distributed. Bitcoin price movements are extreme. But just how extreme, you might ask?

Nassim Taleb -- author of 'The Black Swan' -- ran the numbers and found out Bitcoin follows a Levy-Stable distribution, which, contrary to what one might expect from the name, is pretty wild.

In fact, the volatility for Bitcoin is mathematically undefined. A year from now the price could just as well be $10, as it could be $100,000 per coin.

What price would you charge someone for fire insurance when the probability of the very house you're insuring against burning down to the ground is essentially unknowable?

Personally, I'd never be an option seller. When things go wrong, losses accumulate exponentially, often leading to spectacular blowups like in the 1987 crash, or the Sub-prime market meltdown of 2007/2008.

If I were ever to sell insurance, you can bet I'd charge a massive premium to compensate for the risk I'd be taking.

This a verbose way of saying that Mr. Buffet would be paying through the nose to short Bitcoin through an instrument like options.

Ethereum, Ripple and Bitcoin Cash are more volatile, so the premiums for these would be even steeper.

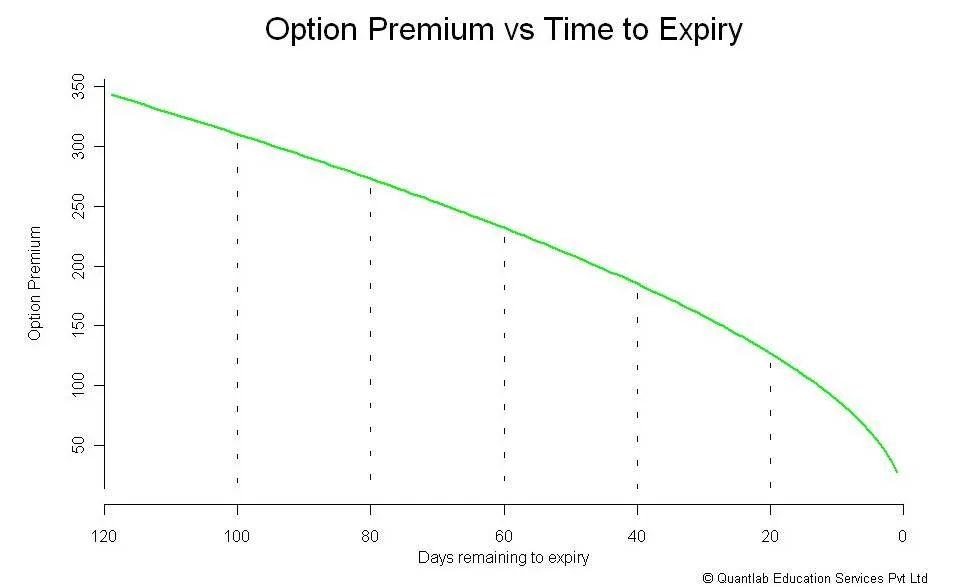

And then there's this little thing called Theta decay, which dictates an option loses value as it approaches the expiration date.

Sure, Bitcoin could be in a bubble, but how do you know when it's going to pop? You could be right about the general direction of the market, and still lose money if your timing isn't precise enough!

In summation, Warren Buffet talks the talk, but I highly doubt he'd be willing to put his money where his mouth is when it comes to crypto. The devil is in the details, and the factors I just outlined would make Mr. Buffet's gamble anything but a sure bet.

Maybe I'll start listening when he gets a little skin in the game. Until then, he's just another guy with an opinion.