Good Day to everyone and Welcome again in my blog,

hope you are all doing great.This is 6th consecutive article on the "Forex learning". I am starting to enjoy to write about this topic. Hope, you guys also find its interesting. For the people, who just got here today, this is my successive article on Forex learning. This one is the "Eighth/8th"one. Here the previous ones-

2.Learning Forex

3.Learning Forex

4.Learning Forex

5.Learning Forex

6.Learning Forex

7.Learning Forex

Today's topic is "Currency Pair". What is it? How it works, major pairs and related information to it. Well, let's start-

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. The first listed currency of a currency pair is called the base currency, and the second currency is called the quote currency.

Image Source

Forex trading is simultaneously the purchasing one currency and the sale of another currency. Currency is traded through a broker or dealer and in a pair. For example: Euro and USA Dollar pair of EUR / USD or British Pound and Japanese Yen's even GBP / JPY. When you do Forex trading, you have to buy / sell through Pair.

Image Source

Imagine, the two countries have economic status on two sides of this rope. Based on the exchange rate rise, when a currency is strong.

Major currency pairs:The following currency pairs are considered as major currency pairs. These currency pairs are traded in USD pair and traded everywhere. These major pairs have the liquidity of most and they are the most traded in the world.

The currency pairs listed below are considered the “majors.”

These pairs all contain the U.S. dollar (USD) on one side and are the most frequently traded.

The majors are the most liquid and widely traded currency pairs in the world.

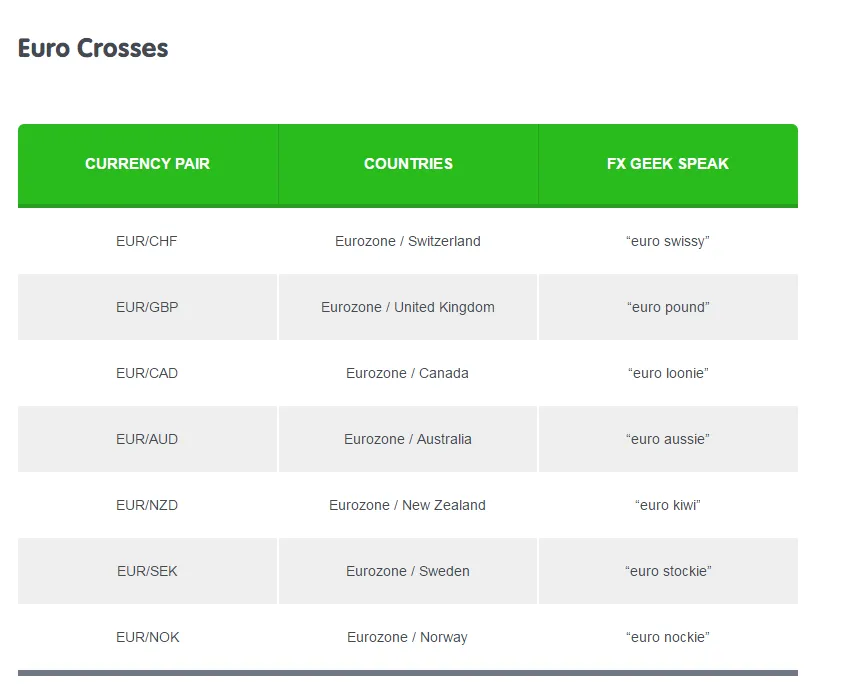

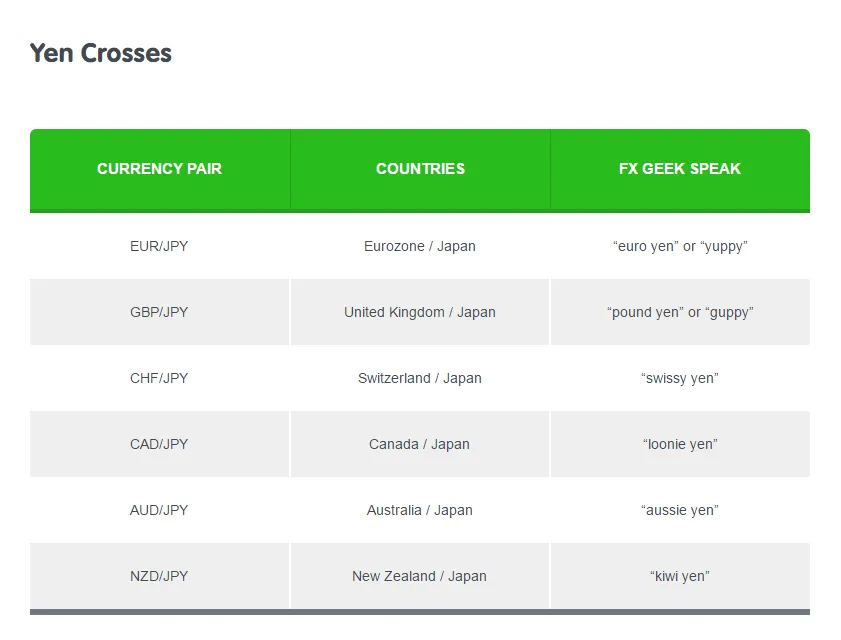

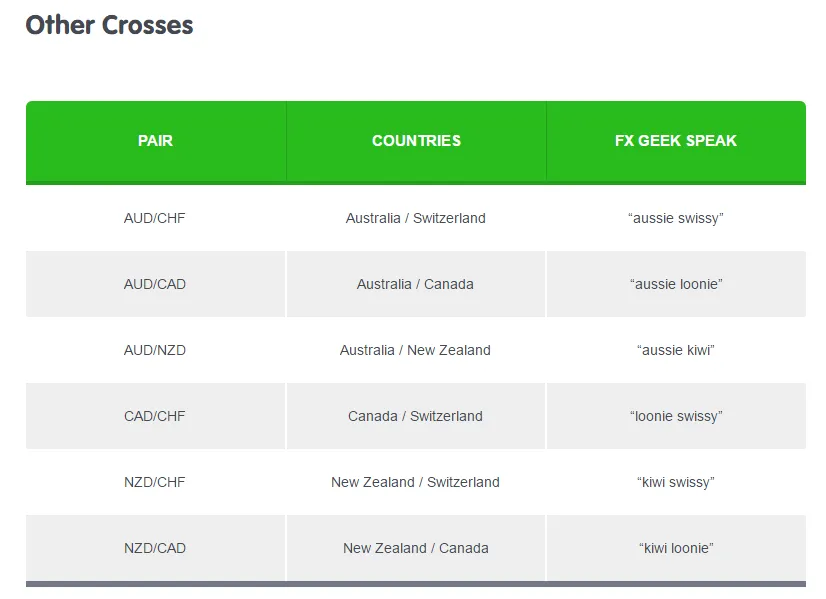

Currency pairs that don’t contain the U.S. dollar (USD) are known as cross-currency pairs or simply as the “crosses.”

Major crosses are also known as “minors.”

The most actively traded crosses are derived from the three major non-USD currencies: EUR, JPY, and GBP.

Exotic Currency Pairs:

No, exotic pairs are not exotic belly dancers who happen to be twins. Exotic currency pairs are made up of one major currency paired with the currency of an emerging economy, such as Brazil, Mexico or Hungary.

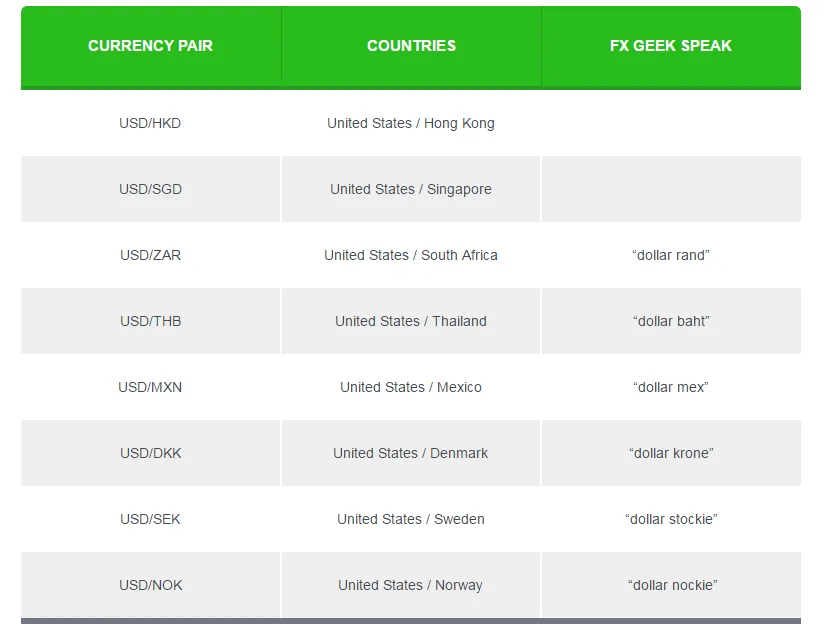

The chart below contains a few examples of exotic currency pairs. Wanna take a shot at guessing what those other currency symbols stand for?

Depending on your Forex broker, you may see the following exotic currency pairs so it’s good to know what they are.

Keep in mind that these pairs aren’t as heavily traded as the “majors” or “crosses,” so the transaction costs associated with trading these pairs are usually bigger.

The complement currency is added to a pair with a major currency, as an exotic pair.

It’s not unusual to see spreads that are two or three times bigger than that of EUR/USD or USD/JPY. So if you want to trade exotics currency pairs, remember to factor this in your decision.

Well this is all for today! I am not going to put any more in it. Let's talk about the later part in the next one. Feel free to leave a comment, if you have any queries. I will try my best to give you the desired answer.