The nakamoto coefficient is a measure of decentralization. It is a combination of the Gini Coefficient and Lorenz Curve. It takes the human element into account. However, it is far from perfect. In this article, we'll explore the calculation and what it means.

Calculating the nakamoto coefficient

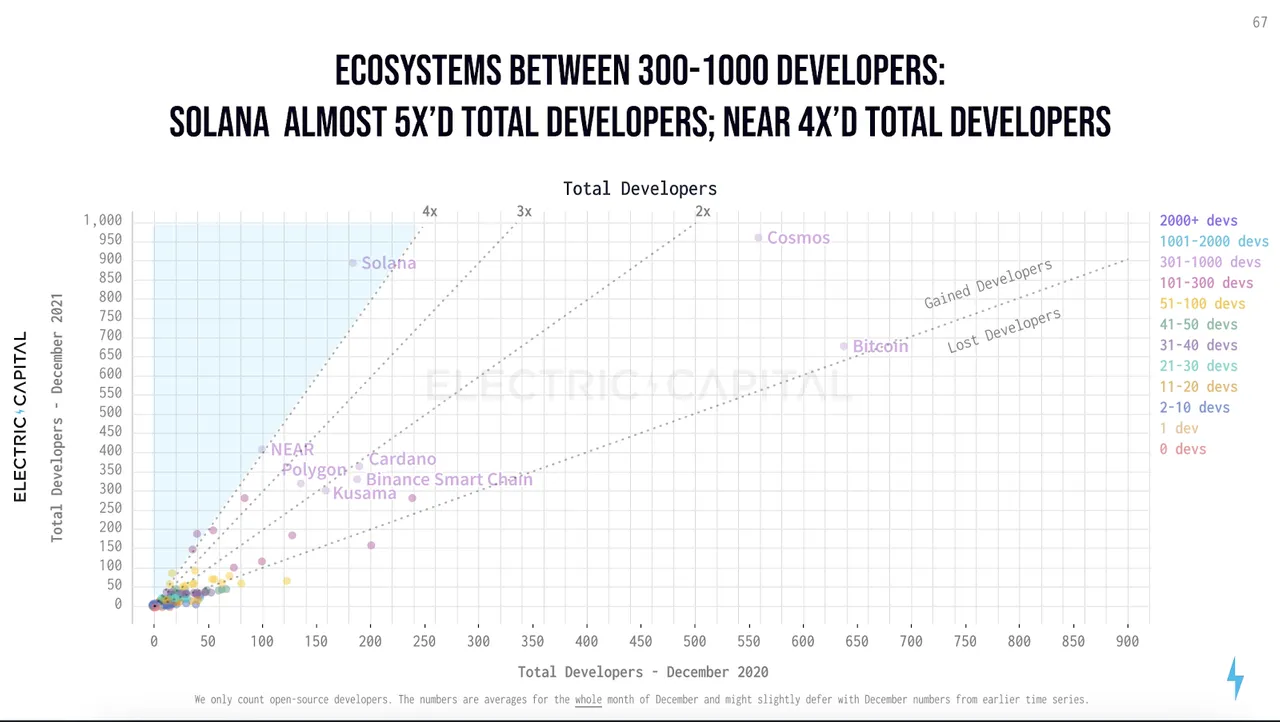

The Nakamoto Coefficient measures the degree of centralization in a cryptocurrency. The coefficient is a number that accounts for network subsystems and measures the centralized nature of the network. It is calculated by the cryptocurrency exchange CrossTower. Bitcoin currently has a coefficient of 7,349. In comparison, Solana has a coefficient of 19. There are approximately 2.3 million active Solana addresses as of December 2021.

To calculate the Nakamoto Coefficient for your investment, use the Lorenz curve and the Gini Coefficient to determine the degree of decentralization in a specific blockchain. In addition to examining the Nakamoto Coefficient for your investment portfolio, you can also use the Nakamoto Coefficient as a key indicator for your portfolio.

The Nakamoto Coefficient is often used to highlight potential risks. For example, you can use it to determine the number of validator nodes required to compromise the blockchain. If your Nakamoto Coefficient is higher than 50 percent, it is likely that the system is more decentralized.

It's a measure of decentralization

A Nakamoto Coefficient is a measurement of the level of decentralization of a project. It essentially measures how many nodes are required to disrupt a blockchain network. These nodes are what run the blockchain software, validate transactions, and store the history of all transactions. The higher the number of nodes, the more decentralisation there is, and therefore, the less chance a bad actor has of gaining control.

The Nakamoto Coefficient was first developed by Balaji Srinivasan, former CTO of Coinbase. He combined the Gini Coefficient with the Lorenz Curve to determine the level of decentralization for blockchains. Since each system is comprised of many subsystems, the Nakamoto Coefficient is a quantitative measure of the degree of decentralization. It can be applied to analyze a variety of blockchains, including Ethereum and Bitcoin.

The Nakamoto coefficient is useful for investors who want to understand how decentralized a blockchain is. A low Gini Coefficient means that a network is decentralized. A high Gini Coefficient can be an attack tool. If the Gini coefficient is too high, it's time to consider an alternative method. Blockchains may be decentralized, but they're not completely free of centralization.

It's based on the Gini Coefficient

The Gini Coefficient is a way to describe inequality by taking a two-dimensional area and reducing it to a single number. The problem with this method is that it obscures the shape of an inequality. It's like describing the contents of a photo by its average brightness value or length along one edge.

The Gini Coefficient is a popular measure of inequality. A score of one indicates that a single entity controls all resources, while a score below one indicates that the distribution is increasing among a group. The Gini Coefficient is a useful measure of inequality and non-uniformity, but it's not ideal for measuring decentralisation in blockchain networks. Because blockchain networks are decentralized, the Gini Coefficient doesn't account for the number of nodes that make up the network.

The Gini index is a measure of income inequality, and the higher the Gini index, the greater the inequality. In other words, high-income people are getting more of the total income, while low-income people are receiving less than half. The Gini index has steadily increased over the last few centuries, but it spiked during the COVID-19 pandemic. However, the Gini Coefficient isn't a panacea, and it's only as reliable as the data it uses.

It doesn't take into account human element

Nakamoto Coefficient is a crucial metric for evaluating blockchain projects, but it fails to capture the human element. Exogenous factors like geopolitics, natural disasters, and corporate interests must be considered, in addition to the network's health. Dissidents, for example, need to be able to access funds without fearing retribution.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.