About ExoLover’s Pre-Initial Token Distribution Event

Startups in the Blockchain space have embraced initial coin offerings as early capital raising vehicles and it is fair to say that cryptocurrencies and ICOs have been providing momentum for further blockchain development. Each company's technological vision calls for a token with unique uses and properties therefore; the ICO boom has garnered a lot of interest over the last few years. ExoLover's new business model which leverages token demand and the needs of millions of people around the world makes this opportunity worth exploring

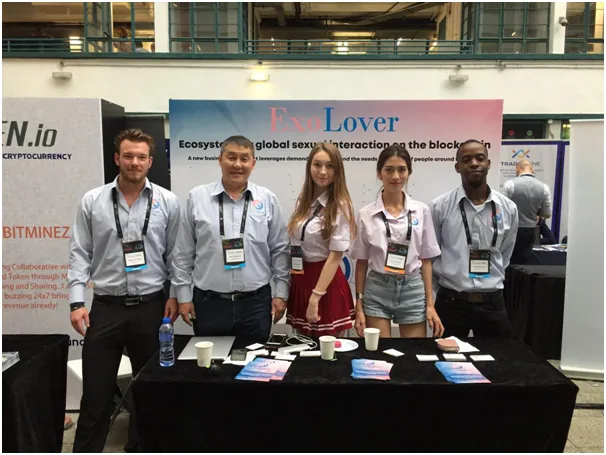

ExoLover’s Pre-Initial Token Distribution Event is current live. Aside from the fact that no one in the blockchain space is bringing the kind of industry game changing proposition to the fore quite like the Australian headquartered startup is, ExoLover’s patented wearable adult novelty devices which will only be usable on the Exo blockchain platform are set to transform the sex toy industry in a major way.

In the Token Distribution Event 1,000,000,000 EXO Tokens will be produced. 700,000,000 of those EXO Tokens are to be sent for exchange on pre-initial and initial token distribution. The pre-initial token distribution started on 29/05/2018 and in the first week 1st week 1EXO will be $0.050, 2nd week 1EXO will be $0.060, 3rd week 1EXO will be $0.070, and 4th week 1EXO will be $0.080.

More About ICOs in General

ICOs are also used as a way to fund the development of new cryptocurrencies which can then be sold and traded on cryptocurrency exchanges depending on the demand. The first such cryptocurrency to be distributed by an ICO was Ripple. Ripple Labs started to develop the Ripple payment system in 2013 creating billions of XRP tokens which the company then sold to fund the development of the platform.

Around the same time Mastercoin, later renamed Omni, and more significantly Ethereum, had some of the largest crypto crowdsales of all time which provided particularly the latter, capital needed to enable features such as smart contracts which also ultimately gave further impetus to the rise in ICOs powered by ERC20 tokens - the Ethereum token standard, which is a technical standard used for smart contracts on the Ethereum blockchain. If developments in the space swing in favour of most crypto enthusiasts’ sentiment, then we could see these tokens become the future shares and securities once proper regulation is in place.

Facts & Figures

According to Strategy&, the global strategy consulting team at PwC: “In 2017, a total of US$4.6 billion was raised through ICOs, up from US$200 million in 2016” making initial coin offerings a very popular form of capital raising activity by blockchain startups.

The general consensus currently is that by revealing key aspects of consumer demand, crypto tokens could boost entrepreneurial returns beyond what can be achieved through conventional equity financing. ICOs present a challenge to the traditional venture capital model by providing a third option for startups to raise finance, after taking on debt or selling equity. According to Paul Mitchell, Fintech & Blockchain Lead, at PwC: “The ICO is the second big disruptive model to come from the blockchain after Bitcoin, enabling decentralised fund raising.”

In October and November 2017 alone, five ICOs were reported to have totalled over $494 million which clearly signals the high levels of interest in this space. According to Goldman Sachs: “More money was raised by internet startups through ICOs in the summer of 2017 compared to the funding raised from venture capital firms and angel investors.”

How ICOs work

It’s important for a company promoting an ICO to have their product directly associated with blockchain technology. Ideally, the technology shouldn’t be replaceable by a traditional database system since the value of ICO issued tokens is largely based on the strength of the immutability of blockchains and decentralized applications. The utility of coins is generally correlated to their value because if coins are created simply to be traded on exchanges, they are doomed to fail, that is if there are no real worthwhile use cases for the token assets.

Digital tokens issued during ICOs tend to come under enormous speculative pressure especially upon launch on the markets and exchanges so providing real utility is the primary way in which to counteract such market forces and stabilize the token economies.

10 crucial steps when launching an ICO:

- Spreading the word about the project to attract potential investors;

- Making announcements to various blockchain forums such as Bitcointalk, Reddit, etc;

- Releasing a detailed White Paper to the public to get feedback on the strengths and weaknesses of the project proposal;

- Outlining the project mission, goals, value proposition, technical and business case, and analysis through channels such as Steemit blog posts and social media updates via Twitter, Facebook or LinkedIn;

- Highlighting the problems to be solved, the size of the market to be serviced, available markets and areas of potential growth and risk factors to potential investors by conducting FAQs through channels such as Telegram, Slack, Discord, or GitHub;

- Publicizing the core team members of a given project including their relevant experience and track records as this is essential to convincing the crypto investment crowd;

- Adjusting the business model and addressing the concerns given in feedback received from the communities potentially interested in backing the project;

- Making the terms of the ICO public including all project specifics, targeted investment figures as well as the token sale offer which should consider all the rights that the token possesses, etc.

- Kick-starting the marketing initiatives for example, running targeted PR campaigns to cater to both institutional and individual investors;

- Launching the ICO and making the tokens available for public sale.

Investment in ICOs has increased tremendously over the last year, with structures and accepted industry standards for running these crowdfunding activities also getting firmly established. Development teams now utilize social media platforms to raise awareness for their projects, communicate roadmaps and provide investors with insights into the progress of the projects in a direct and transparent way. Since the beginning of this year; over a billion dollars has been raised through ICOs that issued altcoins to participants and many credible projects have been coming up with new use cases for their blockchain technologies.