What is Ethereum?

According to the official website, Ethereum is a decentralized blockchain platform that runs smart contracts: applications that run exactly as programmed without any possibility of censorship, fraud or third-party interference. Using Ethereum you can build unstoppable applications running on computers all over the world without any downtime. Ethereum currently uses Proof of Work for consensus with plans to move to Proof of Stake in near future. Users contributing resources to the network are rewarded with Ether, the native cryptocurrency of the Ethereum blockchain.

Ethereum conceptualized as the “world computer”, consists of the Ethereum Virtual Machine (EVM), a native Turing complete scripting language — Solidity and Ether the cryptocurrency, used as fuel to run smart contracts. A suite of decentralized technologies like Swarm, Whisper etc together will make the dream of building infrastructure for Web 3 a reality.

History

Vitalik Buterin, creator of Ethereum first heard about Bitcoin from his father when he was 17. Fascinated with this new technology he co-founded Bitcoin Magazine. He then worked with Mastercoin for a while before announcing Ethereum in late 2013. He attended the University of Waterloo but later dropped out after receiving Thiel Fellowship to work full time on Ethereum.

Soon other people started contributing to the Ethereum Project. Gavin Wood started working on the protocol and wrote the yellow paper while Jeffrey Wilcke contributed to the Go client. Many others like Joseph Lubin, Charles Hoskinson, Anthony Di Iorio played a major role in the development of Ethereum in the early days. Around July 2014, they launched a presale, where 1 BTC could fetch you anywhere around 1000–2000 ETH. It turned out to be very successful and raised around $18 million, the highest for any project that time. The funds were managed by the Ethereum Foundation based in Switzerland.

There were four major releases decided for Ethereum: Frontier, Homestead, Metropolis and Serenity. The network went live with the Frontier release in July 2015. Homestead — the stable version, was released next year in March. One of the major events that brought a lot of interest to Ethereum was the release of DAO. The DAO (decentralized autonomous organization) was supposed to be a fund that financially supports projects building on Ethereum. It went on to raise $150 million. The DAO was later exploited and as there was a significant portion of ETH stuck in there. They decided to hard fork and a new Ethereum chain was created. The old chain was now known as Ethereum Classic while the new chain continued as Ethereum.

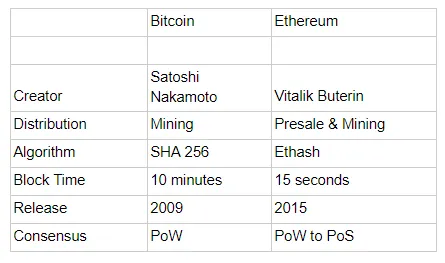

Difference between Ethereum and Bitcoin

Bitcoin and Ethereum are very different. While one aims to become the “internet of money” the other is more focused on being the “world computer”.

Distribution

Bitcoin’s only way of distribution was through mining. Anyone could have provided resources to the network and get rewarded in Bitcoins. Ethereum had a presale. 12 million ETH was held for the dev fund and around 60 million ETH was generated from the crowdfunding event totaling the Genesis to around 72 million. The final total supply after the move to Proof of Stake is still unclear.

Speed and Fees

The average block time of Ethereum has always hovered around 15 seconds for most of the time. During heavy usage by popular ICOs and DApps the block time increases significantly.

Ethereum fees comparatively is lower than other currencies while sometimes during high usage it gets costlier to use Ether compared to Bitcoin. Mostly on average it ranges around $0.1 to $0.3.

Verification and Validation

Bitcoin uses Proof of Work to secure its network. Miners provide resources and get rewarded in Bitcoin for their contribution. Ethereum follows the same model for now. 5 ETH as a reward is given to miners every 15 seconds using the same PoW model as Bitcoin. The algorithm used for mining ETH is different from that of Bitcoin. Ethereum uses Ethash. Ethereum plans to move to a Proof of Stake model where there is no hardware mining involved as blocks will be created randomly by people who stake their coins to secure the network. Before moving on to PoS, there will be a hybrid stage where new ETH will be generated using both Pow and PoS at the same time.

Smart Contracts

The main thing that differentiates Ethereum from other cryptocurrencies is its ability to run complex smart contracts on its platform at large scale. The term “Smart Contracts” was coined by Nick Szabo in his paper where he explains “The basic idea of smart contracts is that many kinds of contractual clauses (such as liens, bonding, delineation of property rights, etc.) can be embedded in the hardware and software we deal with, in such a way as to make breach of contract expensive (if desired, sometimes prohibitively so) for the breacher.” Smart contracts on Ethereum help facilitate, verify and enforce the terms of the contracts without involvement of any third party.

Let’s understand it with an example: You are in a conversation about Bitcoin on a chat group. The discussion is about what the price of Bitcoin will be by the end of the year. You post your predictions and some random guy challenges you for a bet. You both agree and set a date, time and price. You don’t know him so how can you be sure that he’ll keep his word and pay you when he loses? This is where smart contracts come in.

You decide that you’ll take this bet only if its facilitated by a smart contract. You both agree and the smart contract code is audited publicly. This is how it’ll work — You both will send same amount of ether into this smart contract. You set a date, time and price. If the price is below X on 31st December then he wins. If it is above X then you win. You both provide your wallet addresses. When this date finally arrives, the smart contract will check the price of Bitcoin with the help of an oracle and conduct a check.

If you’re the winner, the smart contract will send you the prize money. This way you got your money without having to trust your opponent or go through any third party.

Similarly using smart contracts any complex business logic can be ported to the blockchain. Crowdfunding, Elections, Stock Trading etc is now possible using smart contracts.

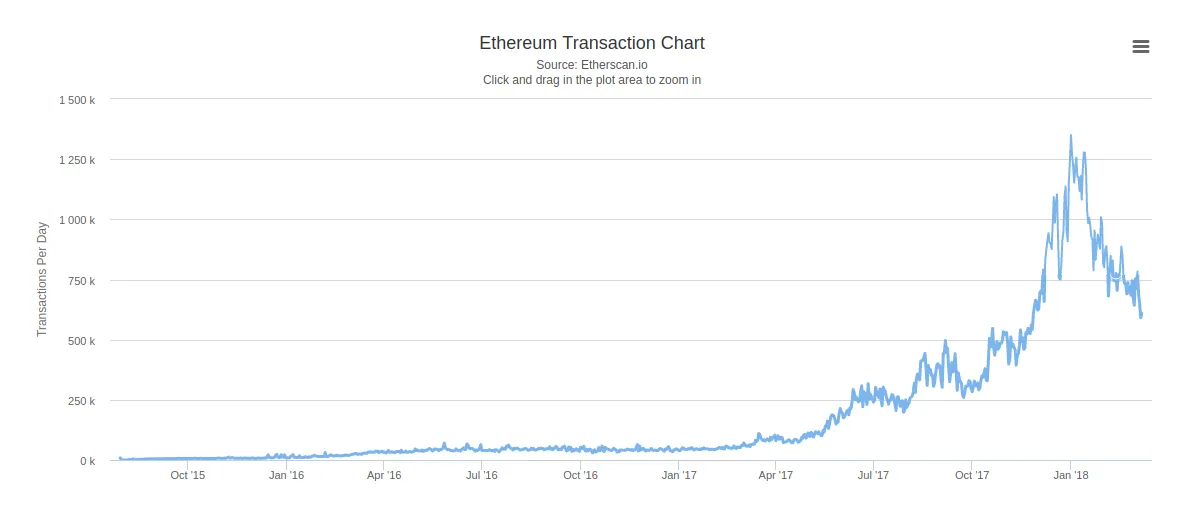

Price

ETH price in 2014 at it’s presale was around 35 to 45 cents. After the sale period was over, it’s in the January 2016 that it reached $1. ETH has always maintained its position in the top 3 on coinmarketcap since 2016. The first major spike we saw in 2016 was during the beginning of the year where it went from < $ 1 to $ 3 by the end of the month, reaching $200 million in market cap. It reached an all time high market cap of $1 billion for the first time in March 2016 when the priced reached ~ $15.

Later in 2016 after a small dip, it reached an all time high of $20 and $1.5 billion in market cap by June. During this period the DAO debacle happened where a hacker siphoned off

Around $50 million dollar worth of ETH which caused the price to halve and drop further almost reaching $5 on some exchanges. The price later got back up and stayed below $20 for the rest of the year.

In 2017, the bulls were back. With partnerships with banks and other financial institutions the sentiment had changed and people had now started paying attention again. The price went from being < $10 in February to $50 by March end. The market cap also went from $1 billion to $5 billion for the first time.

This trend continued over the year with Bitcoin going to new highs and more and more people jumping on the bandwagon it had a good effect on the price of Ether too. The same trend has continued over the year and is same with 2018 where it reached new highs of $1000+ and a market cap of highest ever $120 Billion.

Future

There’s a lot in store from Ethereum this year. The second stage of Metropolis should release this year moving towards a complete Proof of Stake system. Sharding and Plasma are also in the works, with the help of which even million transactions per second would be possible on Ethereum. Even though Ethereum is moving at a great pace, decentralization in Ethereum is still a hot topic after the DAO hard fork. WFP recently mentioned how they’re saving millions of dollars by using Ethereum instead of banks. Some projects have come together and formed Ethereum Community Fund to further support the development of basic infrastructure for the ecosystem. More than 1000 different decentralized applications have been now built and even NASA is said to have started their research on applications of such blockchains.

All in all, it is clear that people have started experimenting with public blockchains and think it could help them reduce their costs and bring more transparency. Which blockchain will ultimately win or maybe many of them will coexist? Nobody knows, but we can argue that Ethereum would be a good contender. To learn more about Ethereum, visit the official site. To check market price, supply and other other stats, visit coinmarketcap.

Recent Articles

How does Bitcoin Transactions works?

How to Secure your Cryptocurrencies | Types of Cryptocurrency Wallets

Regulation will bring down price of cryptocurrency in 10 year's Harvard Economist Says