Today I would like to touch one of the topics I always raise when talking about investing in cryptocurrencies with my close friends, buddies and family. If you studied economics you must be familiar with boom and bust cycles. Yes, that is first thing I talk about with people who want to invest. It is crucial to understand that it is impossible to experience never ending growth in any economic sphere. At some point, growth ends and what’s next? Economic downturn. And when we touch the topic of cryptocurrencies, there is extreme volatility. It is not American stock market where 1% price change is considered to be significant movement, cryptocurrency sphere is absolutely new financial market where 10–40% change is considered to be “normal thing”.

I understand human nature, I understand why people want to invest when market has already experienced 10000% growth. They simply want a little piece of the possible super profit. But. We all know how it ends. When the huge inflow of newcomers ends, the market crashes. A lot of people get disappointed in cryptocurrencies and pack their bags to leave cryptomarkets as they did before during the past market bubbles. And that is exactly the time when you should invest. Waiting is hard, but it always pays off. Like it paid off for many initial Ethereum investors who are already dollar millionaires.

So, I will try to make you understand why I withdrew a large portion of my portfolio from the market. Why I do not like to invest into shitcoins or just overvalued coins. Why I believe there is going to be from 50% to 95% correction across a lot of coins that are traded on digital exchanges. What decisions you will make is up to you. But remember just one thing, it is better to be the minority than majority when we talk about financial and cryptocurrency markets.

Shall we begin?

Here I showed my thoughts on valuation in general.

What is overvaluation and why you should understand this term.

Overvaluation in cryptocurrency market is the situation when current price greatly exceeds true market value of cryptocurrency. How do we find true value of cryptocurrency? That’s $ 1 000 000 question for some of my readers and viewers! = )

First of all, it is almost impossible to find true value of particular cryptocurrency, but it is still possible to compare crypto with existing financial instruments. How do we understand which financial instruments to use while comparing cryptocurrencies? Here is the answer.

Bitcoin, ethers and other cryptos (such as LTC, DOGE, etc) are considered as currencies now, while other cryptocurrencies (especially the ones which went through ICOs recently) are centered around making profits for its holders ( I shouldn’t name them because I feel like Securities and Exchange commission is watching and reading my blog). So, bitcoins, litecoins, and ethers (even though the creators of Ethereum refuse to acknowledge ether as a currency) can be compared to national currencies. It is hard to digest now but give it another 3 years and you will understand why. Basically, those coins have a huge road ahead in terms of growth but I still expect them to go through ups and downs. And downs are much more near than ups in my humble opinion.

From the other side, we have ICO projects which are much more interested in making money for its holders. They use very strange ways to benefit coin holders, but it is all done to avoid SEC actions. For example, Ethereum casinos send all profits to wallets, which can be accessed by coinholders to withdraw profits. By not directly sending money to wallets, they try to overcome the oversight… Weill, all I can say that it will not work but OK. Let’s go with that. So, we should compare those coins’ capitalizations to existing working companies’ capitalizations.

This is where it gets really interesting, because many cryptocurrencies have insane valuations in comparison to real world profit making companies. We’ll get to that.

Overvaluation is a part of boom cycle, but it always ends. As I mentioned above, it is never ending cycle of ups and downs, this is why I chose UROBOROS image to illustrate this mechanism vividly. Does this image make you feel uneasy? It surely makes me.

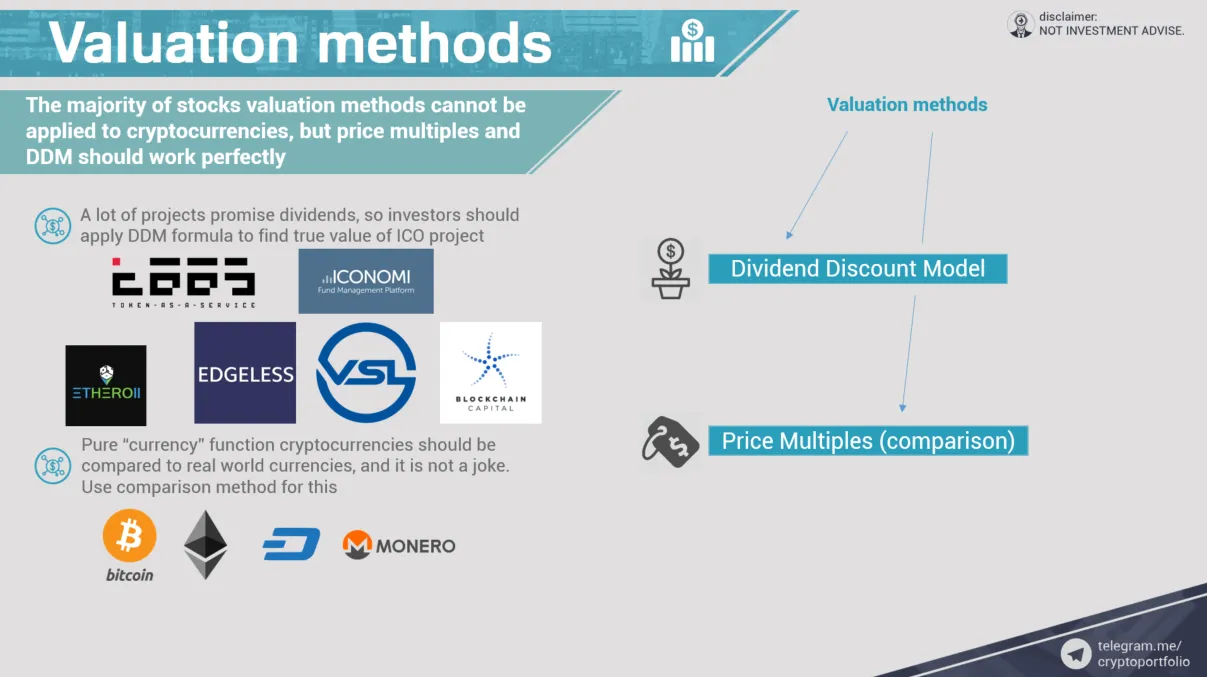

What valuation methods can we use to try to find true value of existing or appearing cryptocurrencies? In reality, the methods I am about to show you are mostly useless right now. And many cryptocurrencies, especially with pure “money” function, have much more variables that should be taken into account. But let’s assume that projects already pay dividends and pure “currency” function cryptos are really successful.

The first method is dividend discount model. By using the payout numbers, we find approximate market valuation with the DDM formula. Right now almost no project returns money, but in future you will be able to evaluate projects when they start to pay dividends. What examples can I give you where you can try to evaluate cryptocurrency?

TAAS, the Ukrainian cryptofund, ICONOMI, Ethereum Casinos ( Etheroll, Edgeless, Vslice), Blockchain capital. If I missed something, please, give me other names in the comment section.

Another method is price multiples. In other words, comparison method. We simply try to find true value of certain cryptocurrency by comparing it to something. In the case of pure currency cryptos, we should compare them to real world currencies. No joke, set up a timer in your gmail account to send you a letter in 2020, you can thank me later. Hodl bitcoins and ethers, man. What examples can I give you here?

Of course, bitcoins, dash, monero. What about ethers? As I mentioned a million times before, ether is a currency and will be used as a currency. And I know that Vitalik and other members of Ethereum Foundation strongly disagree. Low inflation after POS, wide adoption, and actual usage equals to strong currency.

If you are a subscriber to my telegram channel. You already know what’s on this slide. If not, subscribe, right now!

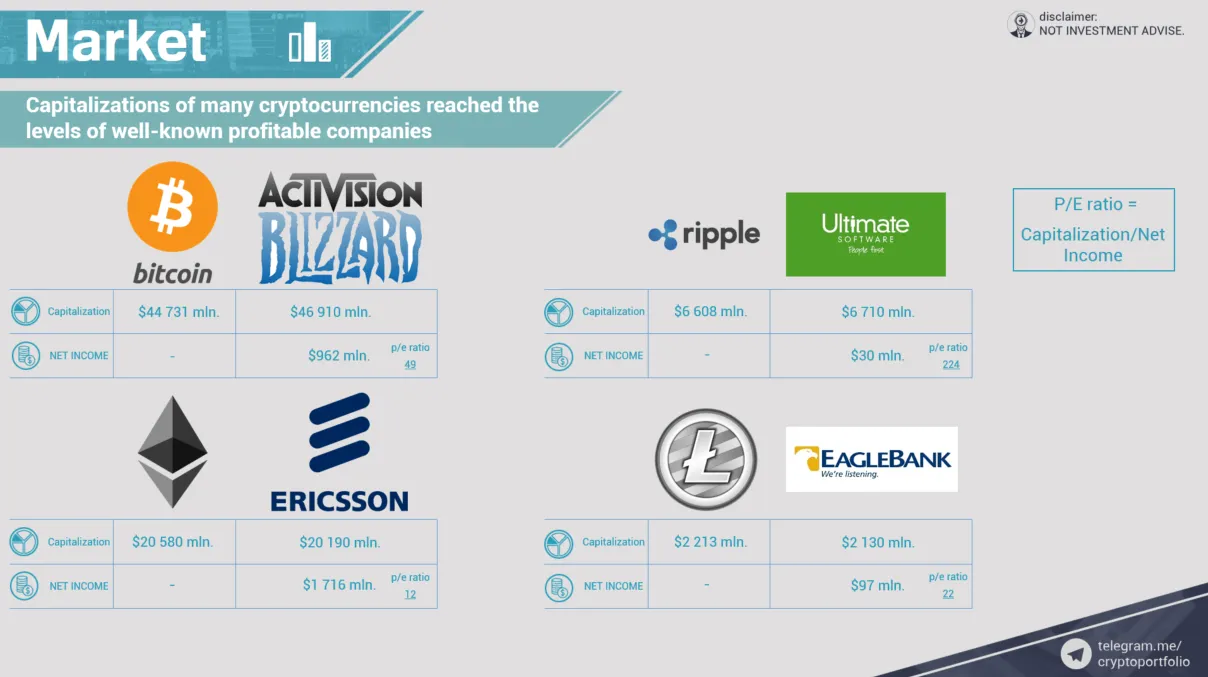

Let’s compare the biggest cryptocurrencies with the real-world companies. We will take a look at annual earnings of companies that have close capitalizations to cryptos. And we will start with…

Bitcoin vs Activision Blizzard Inc.

Net Income of Activision for 2016 was almost $1bln. P to E ratio is 49. By the way, the bigger P to E ratio ( It is capitalization divided by Net Income) the bigger hopes of investors about their investment. If you want a benchmark, average P/E ratio of American Stock Market is about 27. So Activision is a highly valuated investment.

Ethereum vs Ericsson. Ericsson had almost $2bln. in earnings in 2016. P/E ratio is 12. Yep, let’s buy some undervalued Ericsson shares =)

Ripple vs Ultimate software. $30 mln in net income. P/E is 224, wow.

Litecoin vs EagleBank. $97 mln in net income. P/E is 22. And I know that right now capitalizations of cryptocurrencies may be different, they change each hour quite dramatically for God’s sake.

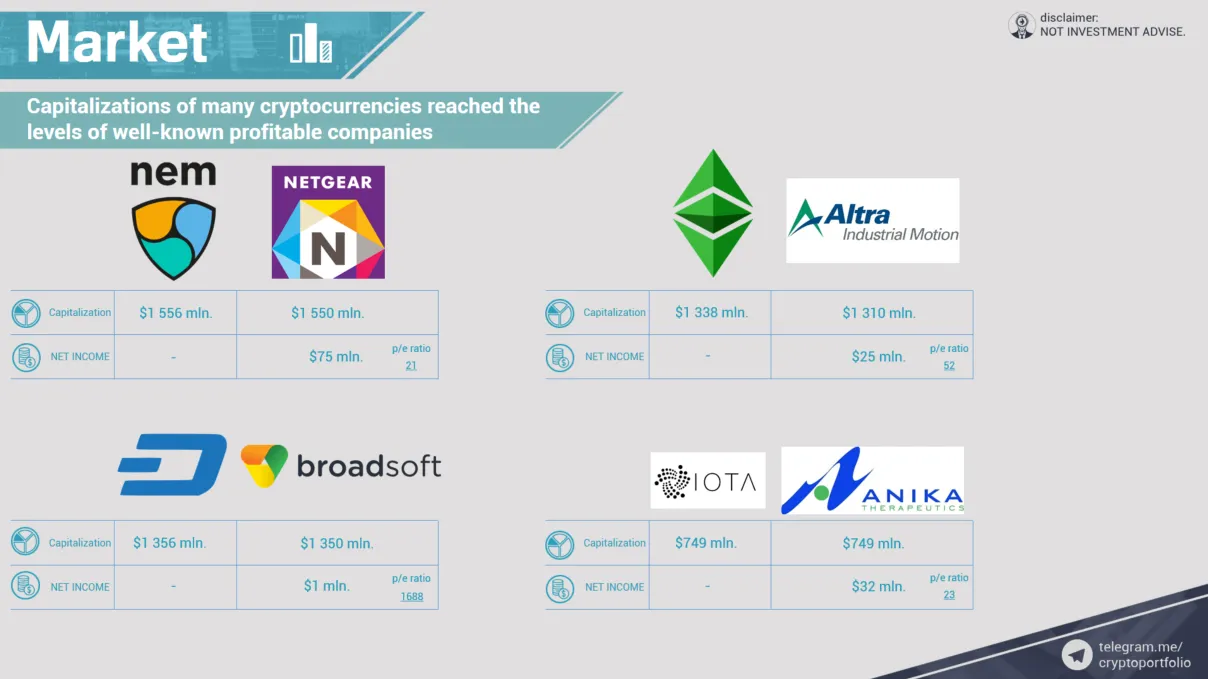

Yep, it wasn’t the end. Let’s continue =)

NEM vs NetGear. Net income is $75 mln. P/E is 21.

DASH vs Broadsoft. Net income is $1mln, P/E is 1688. Quite high hopes about this investment.

ETH Classic vs Altra. Net income is $25mln. P/E is 52.

IOTA (is it blockchain =)?) vs Anika. Net income is $32 mln. P/E is slightly less than the average, 23.

Well.

Monero vs Parksterling Bank. Net income for 2016 is $19mln. P/E ratio is 33.

Stratis vs Student transportation Inc. Net Income is $6mln. P/E ratio is 93.

EOS vs Financial institutions INC. Net income is $31mln. P/E ratio is 14.

Verita…SHITCOIN vs Mitek. Net income is $2mln. P/E ratio is 159.

What are the conclusions?

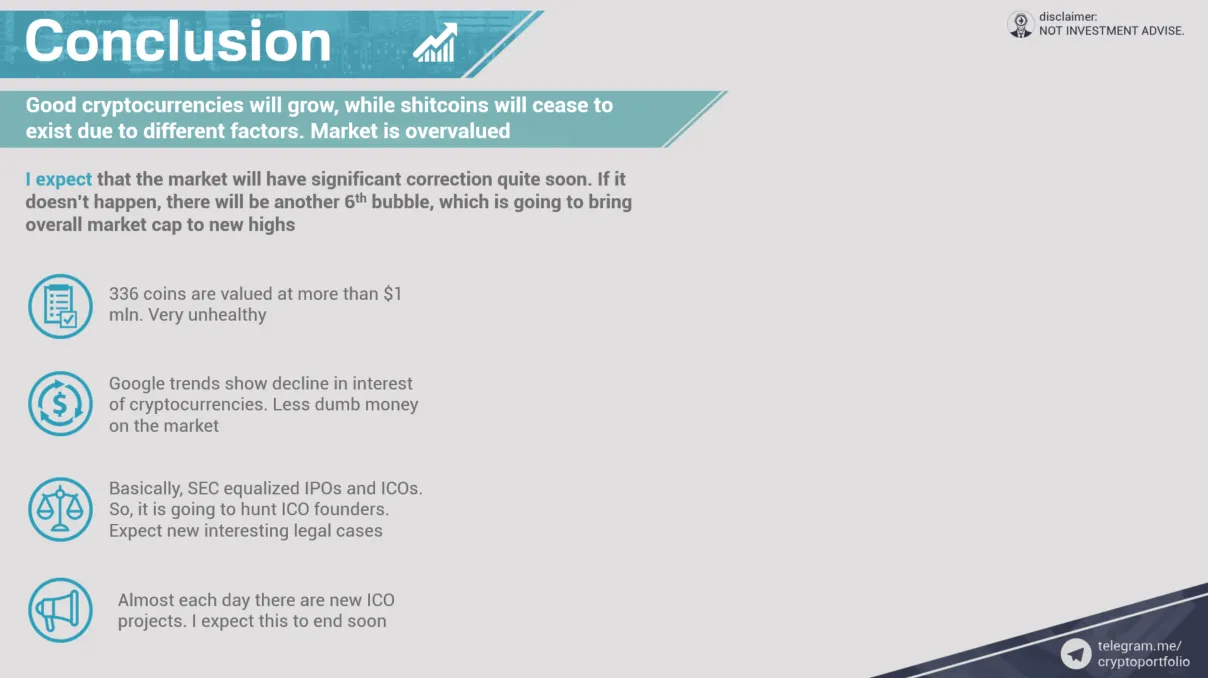

Good cryptocurrencies will grow, while shitcoins will cease to exist due to different factors. Market is overvalued as of now.

I expect that the market will have significant correction quite soon. If it doesn’t happen, there will be another 6th bubble, which is going to bring overall market cap to new highs. Maybe financial apocalypse will happen tomorrow, and BTC will cost $1mln each, but let’s just assume normal scenario.

So. There are 336 shitcoins that are valued at $1 mln. minimum. Is it normal? Answer this question yourself. If you cannot answer this question, buy some putincoins (yes, there is a currency called putincoin, no joke),

Google trends show decline in interest of cryptocurrencies. Less dumb money on the market. Ending stream of newcomers who can put some new money into the market.

Basically, SEC equalized IPOs and ICOs. So, it is going to hunt ICO founders. Expect new interesting legal cases. Be careful, because investors also could be held accountable.

Almost each day there are new ICO projects. I expect this to end soon. If it doesn’t end, then I do not understand something very important.