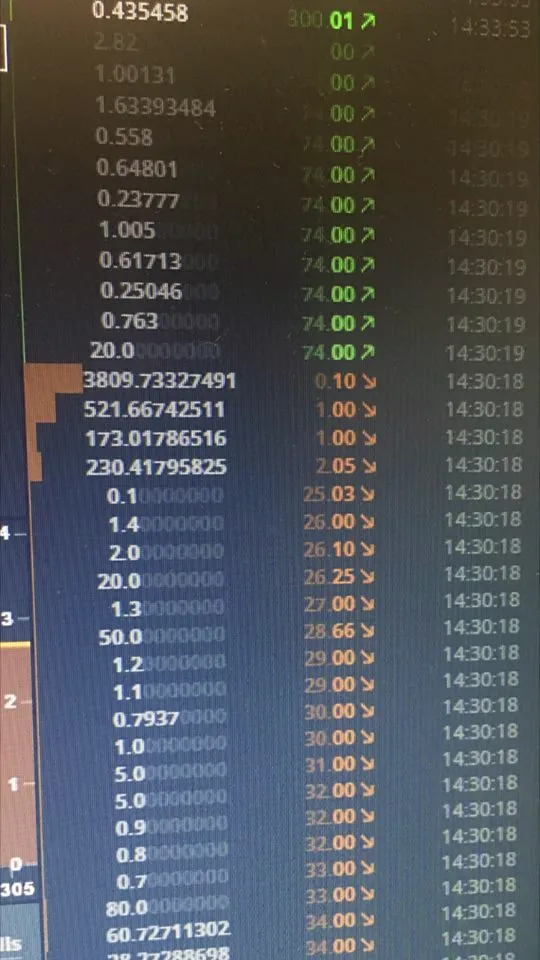

For the TLDR readers the flash crash was the outcome of an unregulated market paired with a multi-million dollar sell, which triggered an avalanche of Stop Loss Orders (not to be confused with Stop Limit Orders) and in return caused a quick recession of price down to $0.10 USD.

It quickly returned back to 300 like a good puppy should. The spark of this ticking time bomb was due multi-million dollar trade. Which i believed to be an OTC trade in the amount of [38000 Ether @ $0.60 USD]

A similar incident like this happened in 2008 please use your keyboard chopsticks to look up OTC Derivatives pre-regulation.

Now what makes the big difference between the NYSE or JPX is that blockchain transactions are seen by EVERYONE. We all know what blockchains are by now or you wouldn't be on a website like this.

When a large sell like that is performed price will guarantee a drop. Which can induce a large slippage in the exchanges. Now many people on GDAX were utilizing margin trading and others were utilizing stop loss orders to exit the market in case of a large dip. Problem is when slippage occurs past a hefty portfolios stop trigger it can cause a domino effect of stop loss orders to trigger and then all convert to market orders (best available price).

The main problem behind this is that the hype is all "To The Moon" with ethereum which results in very few limit orders that exist in the $250 and below prices when there isn't enough shares to fulfill a market order it takes what it can and moves to a better price AKA lower price. rinse and repeat till eels at the bottom of the chart gets a nibble.

In my conclusion all this talk about class actions and boycotting GDAX are groundless. Trading on an exchange in an unregulated market and a volatile industry is risky enough. Why add risky orders. Learn from your own mistakes but first learn from others mistakes and chug along. Ride this train to lambos and fucking HODL.