By now you should've read a good amount of stuff about EOS and thinking if you should get some. I'm getting some for sure since one of the engineers behind EOS is none other than Dan Larimer. This is his third major project since BitShares and Steem, so it's a no-brainer for me especially after finding out that EOS is a blockchain operating system. It's something that could be massively scalable and easy for developers to build stuff on it.

So I've spent the past couple of weeks figuring out my approach to get the most cheap EOS tokens as possible, quickly realising there's no way to determine if the price is okay from one day to the next with its pro-rated distribution mechanism. That means the number of EOS tokens that you will get is determined by:-

(Your ether contribution) x (Total tokens available) / (Total ether contributed)

*in a specific time window

In this case, there's just no way for anyone to set a price to purchase EOS tokens during the year-long crowdsale. For example, if I think that a fair price for EOS token is at $1.00 per token, how do I even begin to do this since the distribution mechanism is based on the total contribution made by other people that I have no control of? There is just no way to specify an acceptable price, even with something like buyWithLimit() or some other max price mechanism - please correct me if I'm wrong about this. The only real way to do this is to contribute in the last minute in any of the time windows after knowing how much others have contributed throughout the time window. We all know that may not work very well, especially if the network is congested, or if some other whales contribute around the same time, blowing my fair price out of the water.

In addition, the only currency to get EOS tokens is by contributing ether, and I do not have much of it left. This would mean that in order to maximise my chances of acquiring "cheap" EOS tokens, I would need to consider spending as little as possible to acquire more ether from my diversified stash of cryptocurrencies. So in this case, which currencies do I expect to perform way better than ether in the near future, or more pedantically, before the yearlong crowdsale ends? This is a matter of speculation and patience then.

For one, I think Steem's price will outperform most tokens in the market towards the end of the year, which is why my broad-stroked strategy is simply to keep building on Steem to improve its value just so I can purchase as many ethers as possible with as little Steem as possible. Another maturing technology that might outperform ether this year is Lisk (basically a Javascript couterpart). Maybe BitShares too, since centralised exchanges are getting pretty frustrating to use these days. There are plenty of other tokens that may provide anyone of us with the leverage throughout the yearlong crowdsale, so instead of jumping into the hype now, it's probably best to just chill out at the moment. But of course, FOMO can still be a good thing, so my approach is to buy with whatever ethers I have left in the first 5 days, and then just be patient throughout the rest of the year, buying more only when I can leverage off my other cryptocurrency holdings if they end up outperforming ether by a long mile.

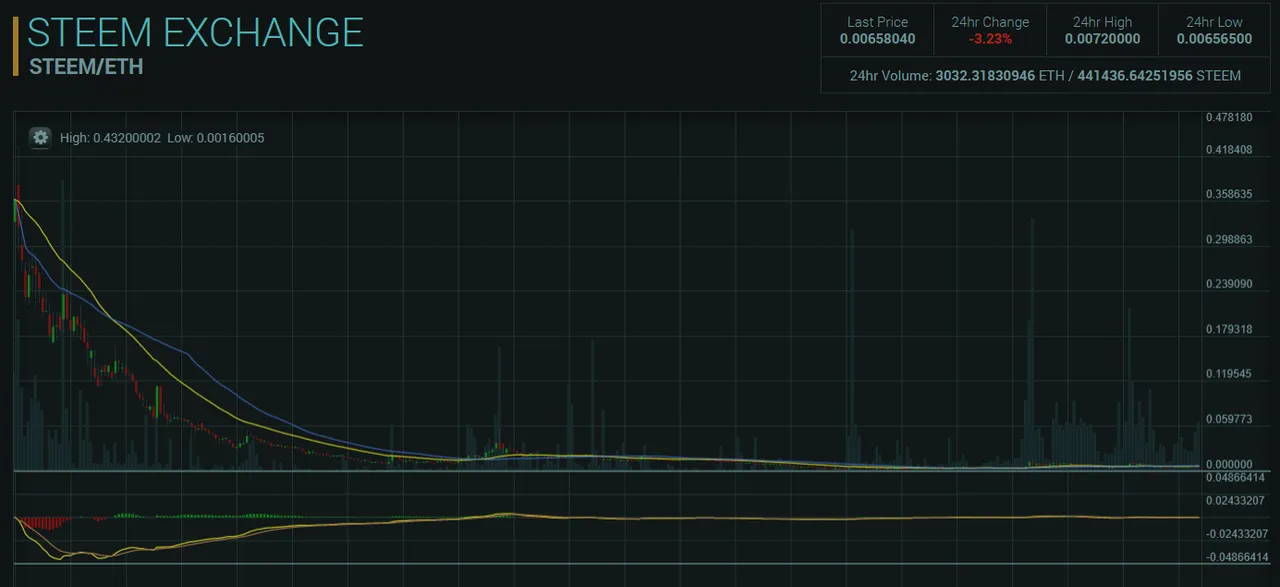

See for yourself - Steem / Eth and Lisk / Eth long-term charts:-

I really can't believe it for myself whenever I see this chart. Don't get me wrong, I'm a huge Ethereum fanboy, but this kind of graph just does not justify my frequent activity on the Steem network. I don't even find myself using any Ethereum apps except for the ICOs. I think many of us can relate to this observation. Plus if you consider the more elusive stuff like chart logic and market correction, it would seem like Steem is due for a massive uptake, finding a market retracement from the huge downtrend.

Lisk is like a Javascript-based Ethereum, so it may attract plenty of mainstream developers. Plenty of stuff can happen just from this little fact alone, barring core developer competency and all of that. Some have said this could be the dark horse of the year, so it would be great to be able to leverage off its massive uptake for EOS when that happens.

Conclusion

Please don't take any of these as serious advice because I'm just explaining my approach here. We all have our own different preferences, and what works for someone may not work for anyone else at all. So far, the only thing that has worked extremely well for me is patience. All the best in getting your EOS tokens!