When to invest in EOS or IOTA or any ICO? Let's look at the story of Steem and Zcash for guidance. More than a year after release, Steem is a proven investment with low risk and high reward today because of the odds of a price increase and the ability to participate on Steemit which has hundreds of thousands of users and makes thousands in payments to authors every day.

When was the best time to buy into Steem? A year ago Steem had potential but no proven results. Today buying Steem is much safer especially for the casual buyer because the odds of a reward just from holding Steem are higher and the risks of a price drop are lower given the data presented later. For the enthusiastic all in buyer, investing steadily over the last year would have been ideal and also would leave little time or energy to invest in anything else! It also might have been tempting during the down times to sell out and jump in with something else only to miss out on the biggest opportunities for growth!

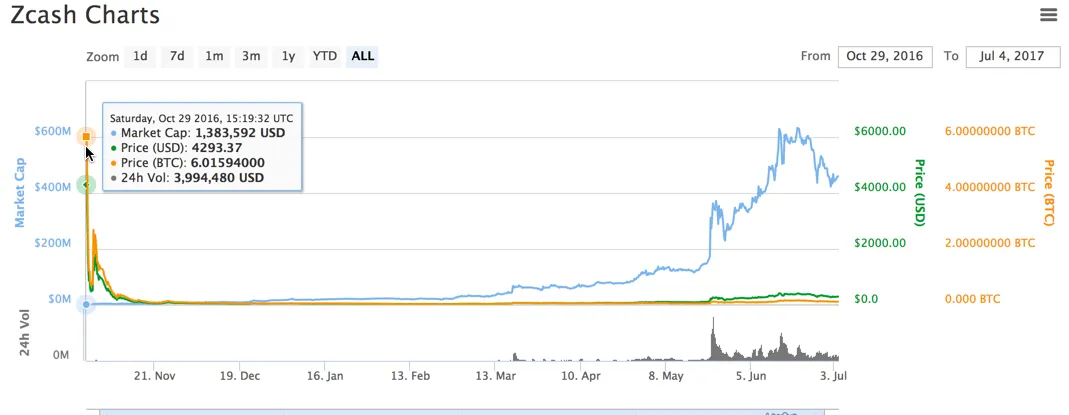

How did Zcash perform after a huge initial release the first year? Zcash came out with a huge initial price spike followed by an epic drop from $4239 for 1 Zcash to as low as under $30 within a year. What a wild ride that would not be fun if the only goal was to make money!

How are Steem and Zcash a mirror for EOS, IOTA, and most any initial coin offering? What journey can a buyer of EOS or IOTA expected based on what those buying Steem and Zcash faced during the first year? Would we take a look together either by continuing to read or watching the video below because it might save us a lot of time and money?

Located in the USA? EOS does not make the tokens available for sale to buyers in the United States because of the following legal terms listed at https://eos.io/faq.html.

"17. Why can’t U.S. citizens, residents or entities purchase EOS Tokens? It was decided that U.S. citizens, residents and entities should be excluded from purchasing EOS Tokens in the token distribution because of some of the logistical challenges associated with differing regulations in the many states of the United States of America. block.one does not believe that the distribution of EOS Tokens or the EOS Tokens themselves are securities, commodities, swaps on either securities or commodities, or similar financial instruments. The EOS Tokens are not designed for investment or speculative purposes and should not be considered as a type of investment. Nevertheless, U.S. citizens, residents and entities should not purchase or attempt to purchase EOS Tokens."

Seeing that EOS was not available in the USA unless I bought on Bitfinex or another exchange made deciding not to invest in EOS simple for me and motivated further research into why I already have been avoiding buying into new cryptocurrency ICOs?

First, will we look at risk because famous investor Warren Buffett's number one rule of investing is "Never lose money"? Does buying into an ICO or a cryptocurrency at least one year after release provide a much lower risk? Yes because with over a year of data on a proven currency, we can easily look back to get an idea of whether the price today is low, high, or about right. When a new digital currency is launched, we have no reference point to see how low the price was when no one wanted to buy and how high it got when the excitement was maximum. Clearly buying in during the initial coin offering is a huge risk because how can we determine if the value is accurate on a cryptocurrency that just launched?

Second, will we look at a comparison with investing in startups because initial coin offerings are a very close comparison to angel investing or venture capital investments in a new startup company? When funding startups with capital, the loss rate is huge with investors expecting to make a profit on small percentage of total investments which hopefully will cover losses. Venture capital firms often are lucky to pick 1 out of 4 winners with 75% companies they invest in not even providing the initial investment back and only maybe 1 out of 200 being a really high return. With initial coin offerings, the rate of success is likely to be similar because like a startup company just beginning to get to work, there is a lot of hope and promise of changing the world with few proven results. In talking to most people, it is easy to see how almost everyone has amazing ideas that change the world while very few of those ideas are actually executed with most failing fast.

Third, will we review the data for our own community here in Steem because the trajectory for EOS is likely to be the same? Here is the first month or so of the price of Steem a year ago now. Naturally if we have just bought Steem the entire time from release until launch and participated in the community the whole way, we might have a fortune by now. If we are so excited about a new cryptocurrency we are ready to commit everything to it right away, then yes buying some to begin with and every day going forward might make sense. However, is this honestly the approach we are looking to take on most ICOs or are we really hoping to use them to make money?

If we were hoping just to make some money on the Steem ICO we might have bought in within the first day or so of release according to CoinMarketCap.com at around $0.89. Over the next month we might have been a bit disappointed at the price consistently dropping and landing at around $0.20 which would have been about a 75% loss depending on exactly when buying and then selling. Many investors at this point would have sold and considered it a loss because we are programmed to buy high when everyone is excited and sell low when fear takes over. What happened next?

Who would have believed then in July 2016 the Steem price would take off to as much as $4 for one Steem? If we had bought in at the very first opportunity and sold at the height of excitement, we might have make 4x our money if we were just purely looking to use Steem to get a return on investment and if we had made it through the price drop of the month before. At the same time, why sell at 4x when it might go to 10x or 20x or 100x? How many of us really would have sold at $4 after seeing the price go up so fast? Wouldn't we have held on for even greater profits?

After hitting $4, the Steem price still a year later has not returned to $4. Now how much fun does it sound to invest in an ICO where the price of Steem today has been a roller coaster since it was first available? If we signed up FOR THE RIDE, we would have had a blast! Here is a review of the Steem ride. At launch the price was close to $1 and over a year later now up about 50% with the high never more than 4 times the initial investment and the low down as much as 90%! That's a ride we might get sick on if signing up just for a nice profit! If we bought in when the hype was the greatest at over $2, our investment still would not even be in the positive yet a year later and would have at one point been nearly a total loss.

The point is that now Steem is an outstanding investment because it has proven itself in good times and bad. Now the risk is much lower to buy some Steem today because we can see that today with the price being $1.80 it is probably a good buy given that it was over $4 at one point, albeit with a lot less Steem available, and with a year of growth since the highest price the true value is likely much higher than ever before. While the price could go down some or even a lot as a part of a bigger market catastrophe, we know here that we have real value because of how much we have contributed in posts and relationships which are visible to everyone. Steem is no longer a startup but rather a self-sustaining business. Most startups never make it to this phase which is why self-sustaining businesses tend to draw the greatest investments.

After considering Steem, how about EOS? So far EOS according to their website has only released about 20% of the supply they are planning to within the next year. That means for every one EOS token available today there will be 4 more given out within the next year which is likely to mean a big price decline. Within the first month of release might be the very worst time to buy in especially on an exchange which is how the prices are determined and where likely a relatively small amount of EOS is available relative to the total. The actual price most have paid for EOS is likely a fraction of what the exchanges say meaning the market cap is almost completely imaginary without actual figures of ETH received by EOS.

What makes buying in worse is that how much given to the buyer each day is relative to how much ETH is sent in. Some days a lot of Ethereum being sent in might mean buying at above market price while on a few days of low demand a great deal might be possible. If we are set on buying EOS, buying in every day is likely to produce the best result because the distributions are based on demand and low demand days make great payouts. The problem is that every day more tokens are given out likely means more sellers trying to cash out on exchanges. Buying on exchange now is almost certain to end up in a loss as the greater profits made initially the more users will try to put more for sale which will drive the price down as the initial euphoria of release wears off and gives way to being one of 500+ cryptocurrencies which needs a lot of contributions to be meaningful.

On top of these existing issues, if the Ethereum price takes a dive, it also will be cheaper to buy more ETH and change it to EOS. Naturally the opposite is true if it goes up although this is likely to be balanced by how much ETH is sent each day to the initial distribution. While today it seems like the safest and smartest option to wait until EOS has delivered proven value to hundreds of thousands of users over the next year, what about other initial coin offerings?

When we review the Zcash ICO, this will get even better!

Yes the number is displaying correctly on the chart above! The initial price for 1 Zcash was $4239 at release with speculative markets pricing at over 2,000 in BTC for 1 Zcash or ZEC. The ZEC market cap at the time was over 1 billion dollars which is more than double what it is today despite many more Zcash available. All of the hype over how amazing EOS is reminds me of the same with Zcash which was supposed to be replacing Bitcoin a year ago. On July 4, 2017 the price for that same exact Zcash less than a year later is $295 even after a recent huge growth in price. At the lowest, ZEC went below $30 just a few months ago. Again, buying in at the beginning would have resulted within a year in a nearly total loss. A year after release Zcash is number 12 on the market capitalization charts and seems unlikely to compete with Ethereum or replace Bitcoin in the foreseeable future. That said, Zcash is in a great position to continue making a meaningful contribution to our financial revolution online going forward and we are grateful it exists!

Our problem tends to be thinking we are smarter than other people. We think we invest better than others. We think we make better love than others. We think we are better bosses and employees than others. We think we lead better lives than others. The truth is that we are all so similar we are practically clones of each other with a few basic different models having small differences similar to Battlestar Galactica. We are all so much smarter than each other we predictably get lured into the same traps over and over again only to be complaining to our same friends over and over again about how the same thing happened to us again and we cannot believe we forgot and it will never happen again.

Initial Coin Offerings are usually a trap like Leia tried to warn Luke Skywalker about in The Empire Strikes back which despite being the second star wars movie released is Episode V. Like Luke, we might lose our right hand financially as the dark lord of the currency reveals himself to be our father. While some humor is attempted here, the message is clear. It is better to wait and let every new cryptocurrency prove itself before making a significant investment.

What about having an ICO like EOS as part of a sexy term like diversified portfolio? One author yesterday explained that not having a diversified portfolio was insane because we could lose everything if that one investment falls through. While this is certainly true, maybe just having one partner and one job is insane also because if we get fired or our partner leaves us, we lose everything for the moment. Then in the next moment we have the opportunity to begin fresh with a new job, partner, or investment.

What experience do I have with buying in early?

I bought into Steem as part of a diversified portfolio on Poloniex for about 0.1 BTC which was around $100 at the top of the hype along with 20 or 30 other altcoins. Over the next several months while many of my altcoin investments went up, Steem took a big dive. When my 0.1 Bitcoin of Steem became worth 0.01 Bitcoin, I bought another 0.1 BTC of Steem figuring it would have to go back up at some point right? When it kept dropping along with the rest of the altcoin market in December 2016, I sold it all and left thinking "Steem is worthless" because for me it had been the way I used it. I then bet everything on Dash based on a lot of hype from my friend @aarellanes when he was working with @robertgenito after I heard about masternodes and Wall of Coins putting Dash as the second currency on their website after Bitcoin. After contributing a massive amount of hype to Dash, I then sold out 4 months after buying in and now here I am all in on Steem so far 2 months in!

After months of passively trading on Poloniex up until December 2016, I discovered the great joy of actually getting something out of my investment in the form of being a member of a community. Up until then, I had simply thought that the point of investing was to use money to make more money. I completely missed out on the point of investing being to do some good in the world by combining the contribution of money with service in the form of participation. Fortunately for Steem, the Dash community was like a pair of underwear that were too tight for me which cut off circulation to things important for me being able to reproduce. Sure it would keep me warm but at what cost?

When I invested in Steem, it was a fairly safe investment because with a year since the initial release, it was easy to see the value of the existing community and to make an assessment of the true price of Steem relative to the actual price. I calculated Steem was undervalued as much as 10 times relative to other currencies and that my service within the Steemit community would be valued above most other places I could go.

Investing in Steem posed little risk because after a year of ups and downs, a lot of real improvement took place while the total value of the combined Steem tokens was lower than it had been before. All of the Steem today a year after the initial hype in July 2016 is worth about the same as it was then. Therefore, this makes for a great investment because the true value of Steem is was higher than it was a year ago because of all the participation and improvements.

Being a courageous soldier willing to run up to the front lines and risk everything looks great in movies and is great if we are willing to contribute that much to our cause. Buying into an ICO without completely participating in the investment by making a significant contribution on an ongoing basis is just like going into a casino and throwing some money down and hoping to win. I have done that enough times to hopefully have learned my lesson that I have no business going into a casino unless I am hoping to give them my money. I even invested as much as $1,000 in a presale once and have no plans to do that again either because I only have so much time and energy to contribute.

An ideal investing experience includes the opportunity to exert some influence on the return of the investment which is why I love Steem. Here each of us can personally make a contribution to the ongoing value of our investment by posting, upvoting, commenting, and sharing Steemit with friends and family. When I read Money Master The Game by Tony Robbins, the one key investing strategy I noticed that Warren Buffet and other top investors in the world seem to do is to invest where they personally can make a difference. If we can personally make a difference in an ICO, then by all means invest and get to work!

The reality is most of us have very limited time and energy while trying to prove to the world the opposite is true by showing how much we can do and telling everyone how busy we are. I have time to do a really good job contributing to one cryptocurrency just as I have time to do what I hope is a really good job of contributing to one family with one wife. While it might put me less at risk of losing everything to find a few more cryptocurrencies to invest in and a few more wives to raise families with, the reality is the more diversified I am, the less I do well.

In dating this was very obvious as I could barely keep the names of the girls I dated straight when it got to more than three at once. After an initial euphoria of feeling like I was a god for having two girls over in one night, the uncomfortable reality set in of confusing who said what and trying to keep everyone happen. Fairly quickly all the girls would find a guy that would give them a better answer for "Where is this going?" than answering their question with another question like "Where is what going?"

For cryptocurrencies this took much longer to learn because I did not ask any of them to marry me. Why not trade 50 different currencies? Would I have bought Steem in the beginning if I knew more about it? Probably not because just to hold it on an exchange was an awful idea before the December 2016 change reducing inflation. Today I am grateful I learned enough to be here and to finally settle down into being of service consistently in one place instead of trying to hop each day from one exciting new crypto partner to another the next day.

Thank you very much for reading all the way to the end of this post* which took me two hours to type this morning after I woke up at 5:30 am and felt compelled to write about this to help us avoid both the losses and the fear of missing out! I write these in depth posts because this gives us the best chance to build a deeper relationship and because this format provides the very best opportunity to rank high in Google. Organic search traffic from Google gives this post the chance to reach the most people that need this exact information. More Google visitors to Steemit means more readers for all of us here which means a higher return on our investments in Steem which means more to give back to others.

If you read all the way to the end of this post or scrolled down here to view the comments, would you please upvote this post because that will tell me to keep writing for us here on Steemit each day?

Love,

Jerry Banfield